Answered step by step

Verified Expert Solution

Question

1 Approved Answer

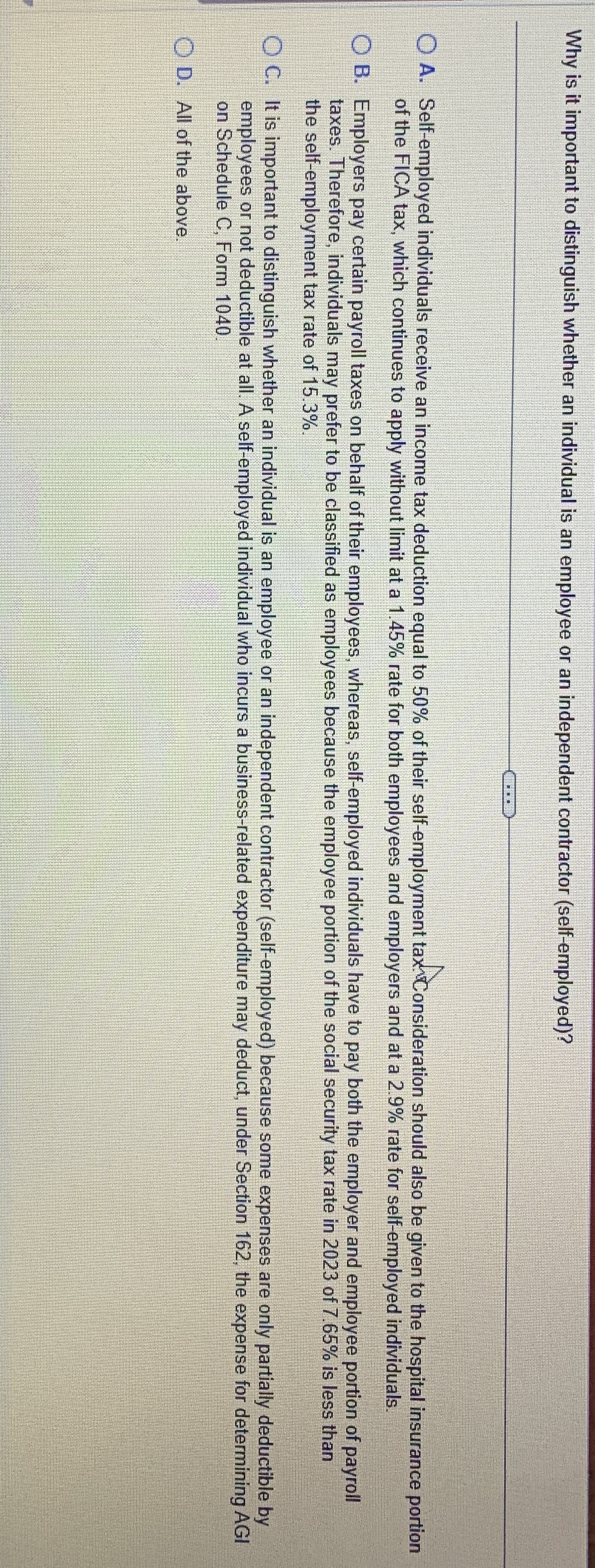

Why is it important to distinguish whether an individual is an employee or an independent contractor ( self - employed ) ? of the FICA

Why is it important to distinguish whether an individual is an employee or an independent contractor selfemployed

of the FICA tax, which continues to apply without limit at a rate for both employees and employers and at a rate for selfemployed individuals.

B Employers pay certain payroll taxes on behalf of their employees, whereas, selfemployed individuals have to pay both the employer and employee portion of payroll

taxes. Therefore, individuals may prefer to be classified as employees because the employee portion of the social security tax rate in of is less than

the selfemployment tax rate of

employees or not deductible at all. A selfemployed individual who incurs a businessrelated expenditure may deduct, under Section the expense for determining AGI

on Schedule C Form

D All of the above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started