Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is my answer wrong? How should it be done? EDIT: I think I understand where I went wrong, but I still want to make

Why is my answer wrong? How should it be done?

Why is my answer wrong? How should it be done?

EDIT: I think I understand where I went wrong, but I still want to make sure I'm correct.

For the remaining income, I get a total of $102,360. I missed the ratio and thought it was divided equally, so should it be:

Conyers $34,120 ($102,360 x 1/3)

Bernard $68,240 (102,360 x 2/3)

Are the calculations above correct?

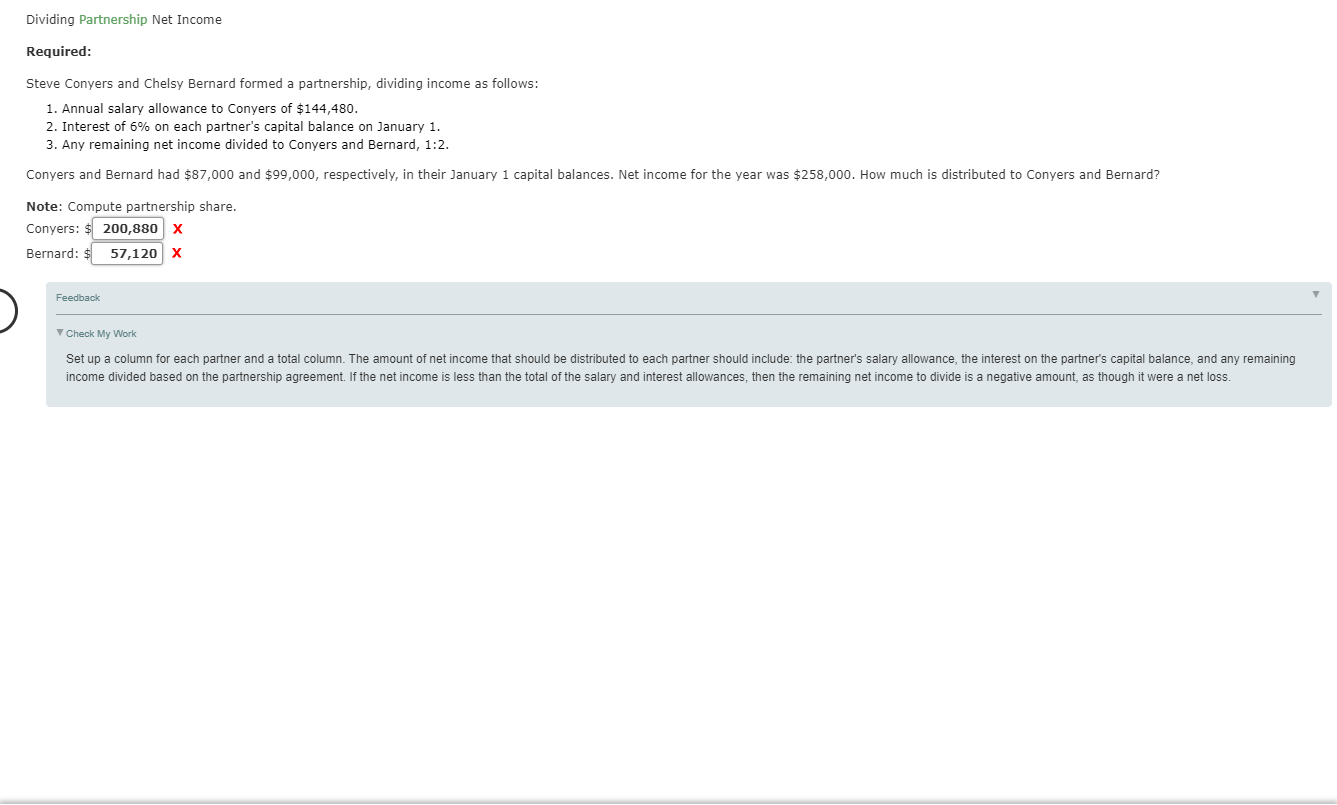

Dividing Partnership Net Income Required: Steve Conyers and Chelsy Bernard formed a partnership, dividing income as follows: 1. Annual salary allowance to Conyers of $144,480. 2. Interest of 6% on each partner's capital balance on January 1. 3. Any remaining net income divided to Conyers and Bernard, 1:2. Conyers and Bernard had $87,000 and $99,000, respectively, in their January 1 capital balances. Net income for the year was $258,000. How much is distributed to Conyers and Bernard? Note: Compute partnership share. Conyers: $ 200,880 X Bernard: $ 57,120 X Feedback Check My Work Set up a column for each partner and a total column. The amount of net income that should be distributed to each partner should include: the partner's salary allowance, the interest on the partner's capital balance, and any remaining income divided based on the partnership agreement. If the net income is less than the total of the salary and interest allowances, then the remaining net income to divide is a negative amount, as though it were a net lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started