why is the social Security tax and Medicare tax wrong?

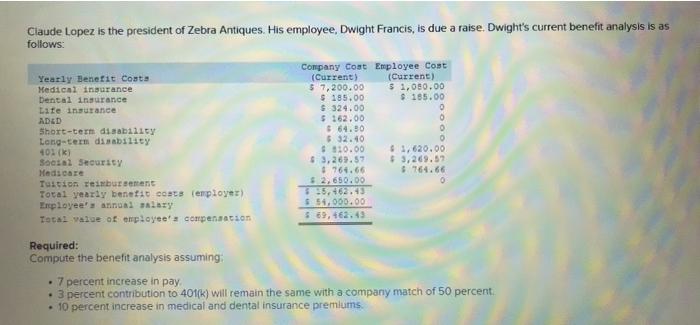

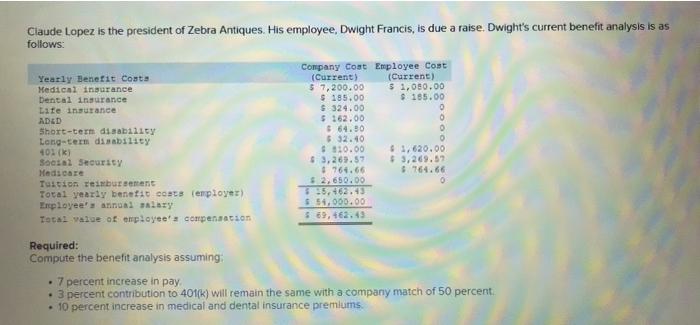

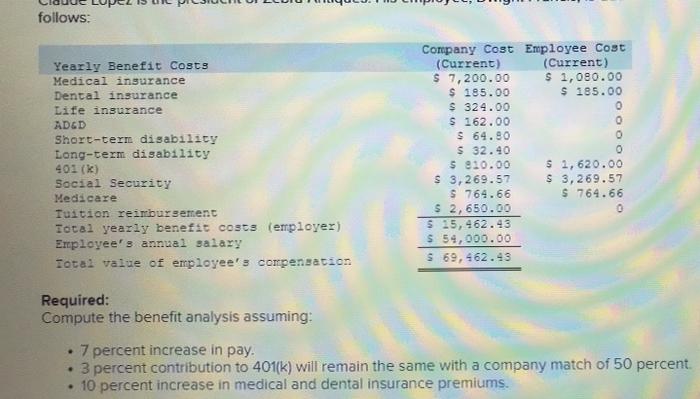

Claude Lopez is the president of Zebra Antiques. His employee, Dwight Francis, is due a raise. Dwight's current benefit analysis is as follows: Yearly Benefit Costs Medical insurance Dental insurance Life insurance ADED Short-term disability Long-term disability 401(k) Social Security Medicare Tuition reimbursement Total yearly benefit costs employer) Employee's annual salary Total value of employees compensation Company Cost Employee Cost (Current) (Current) 5 7,200.00 $ 1,080.00 $185.00 $185.00 $324.00 0 $ 162.00 O $64.30 0 $32.40 0 $10.00 $ 3,620.00 63,269.57 $3,269.57 1764.66 $764.66 $ 2,650.00 0 $ 54,000.00 $ 89, 462.43 Required: Compute the benefit analysis assuming 7 percent increase in pay 3 percent contribution to 401(k) will remain the same with a company match of 50 percent . 10 percent increase in medical and dental insurance premiums X Answer is complete but not entirely correct. Yearly Benefit Costs Employee Cost (New) 1,188.00 203.50 0 0 0 Medical insurance Dental insurance Life insurance AD&D Short-term disability Long-term disability 401(k) Social Security Medicare Tuition reimbursement Total yearly benefit costs (employer) Employee's annual salary Total value of employee's compensation Company Cost (New) $ 7.920.00 $ $ 203.50 $ $ 324.00 $ 162.00 $ 64 80 $ 32 40 866.70 $ $ 3.582.36X $ $ 837 81 X $ $ 2 650.00 16 643.57 X S 57 780.00 $ 74 423 57 0 en 1,733.40 3.582.36 X 837 81 X 0 CA follows: Yearly Benefit Costs Medical insurance Dental insurance Life insurance ADGD Short-term disability Long-term disability 401(k) Social Security Medicare Tuition reimbursement Total yearly benefit costs (employer) Employee's annual salary Total value of employee's compensation Company Cost Employee Cost (Current) (Current) $ 7,200.00 $ 1,080.00 $ 185.00 $ 185.00 $ 324.00 0 S 162.00 $64.80 S 32.40 $ 810.00 $ 2, 620.00 S 3,269.57 $ 3,269.57 $ 764.66 $ 764.66 $ 2,650.00 $ 25, 462.43 $ 54,000.00 $ 69, 462.43 OOOO Required: Compute the benefit analysis assuming: 7 percent increase in pay. 3 percent contribution to 401(k) will remain the same with a company match of 50 percent. 10 percent increase in medical and dental insurance premiums