Question

Why is there a cost associated with retained earnings? b. What is Aces cost of retained earnings, based on the CAPM approach and the analysts

Why is there a cost associated with retained earnings?

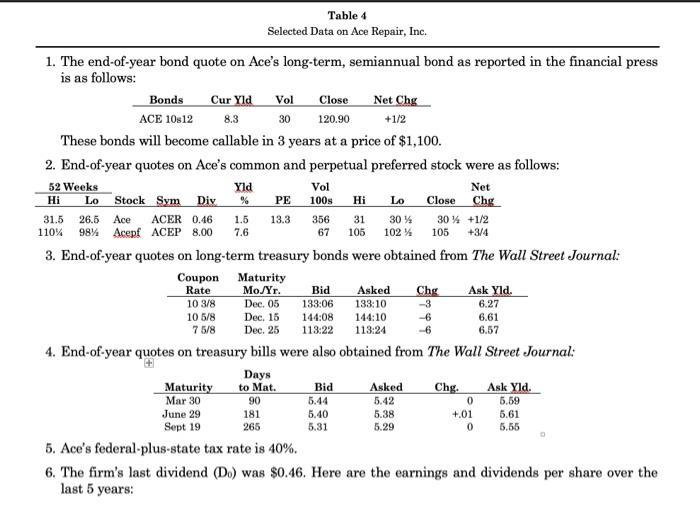

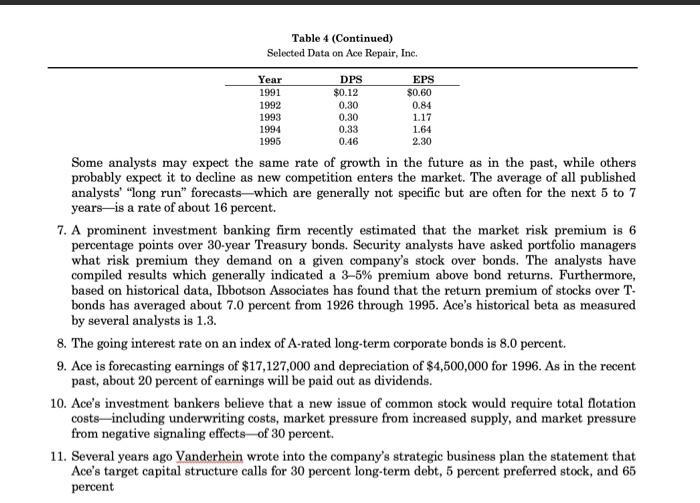

b. What is Ace’s cost of retained earnings, based on the CAPM approach and the analysts’ long run forecast rate of growth?

c. Why might one consider the T-bond rate to be a better estimate of the risk-free rate than the T-bill rate? Why might one argue for the use of the T-bill rate?

d. How do historical betas, adjusted historical betas, and fundamental betas differ? Would Ace’s historical beta be a better or a worse measure of its future market risk than the historical beta for a portfolio would be for the portfolio’s future market risk? Explain.

e. What are some alternative ways to obtain a market risk premium for use in a CAPM cost-of-equity calculation? Discuss both the possibility of obtaining estimates from outside organizations and also ways which Ace could calculate a market risk premium itself.

6. a. What is Ace’s discounted cash flow (DCF) cost of retained earnings?

b. Suppose Ace, over the last few years, has had an 18 percent average return on equity (ROE) and has paid out 20 percent of its net income as dividends. Under what conditions could this information be used to help estimate the firm’s expected future growth rate, g? Estimate ks using this procedure for determining g.

c. What was the firm’s historical dividend growth rate using the point-to-point method? Using the linear regression method?

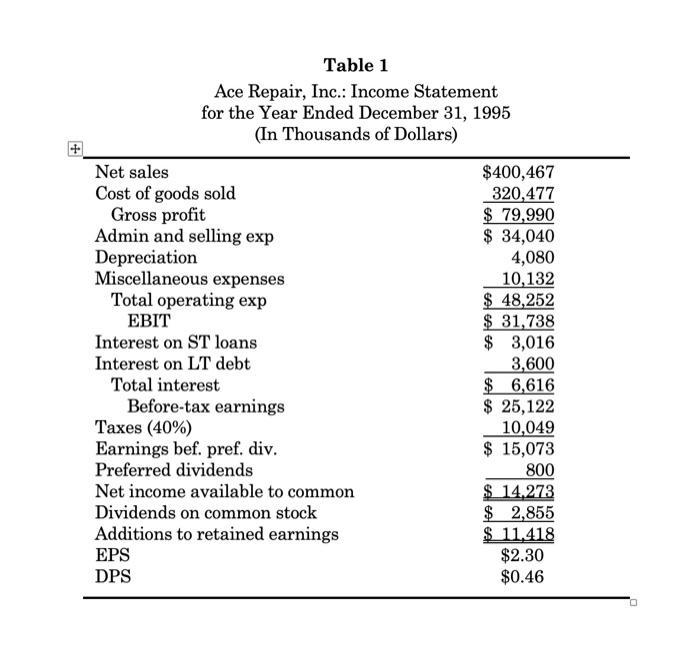

Table 1 Ace Repair, Inc.: Income Statement for the Year Ended December 31, 1995 (In Thousands of Dollars) Net sales Cost of goods sold Gross profit Admin and selling exp Depreciation Miscellaneous expenses Total operating exp EBIT Interest on ST loans Interest on LT debt Total interest Before-tax earnings Taxes (40%) Earnings bef. pref. div. Preferred dividends Net income available to common Dividends on common stock Additions to retained earnings EPS DPS $400,467 320,477 $ 79,990 $ 34,040 4,080 10,132 $ 48,252 $31,738 $ 3,016 3,600 $6,616 $ 25,122 10,049 $ 15,073 800 $14,273 $2,855 $ 11,418 $2.30 $0.46 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a There is a cost associated with retained earnings because of the opportunity cost of not reinvesti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started