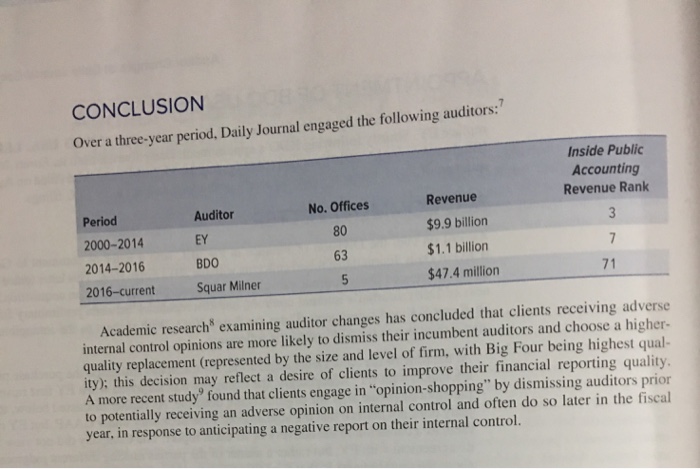

Why might adverse opinions on internal control over financial reporting prompt Daily Journal to change auditors? Are Daily Journals auditor change activities consistent with the results of the academic studies summarized in the case? Why or why not?

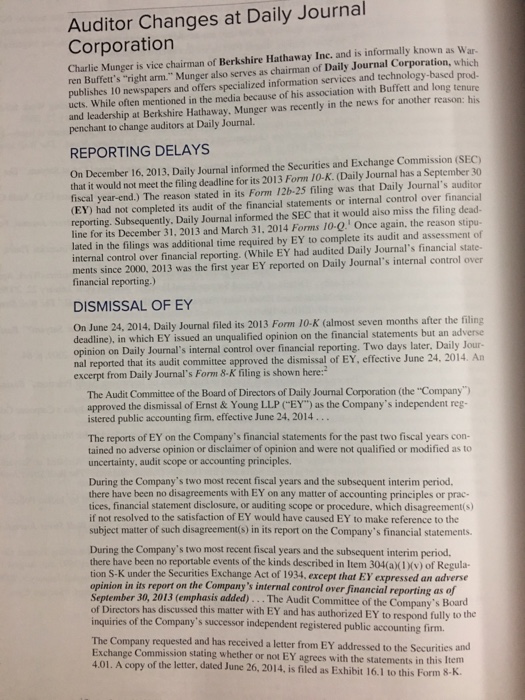

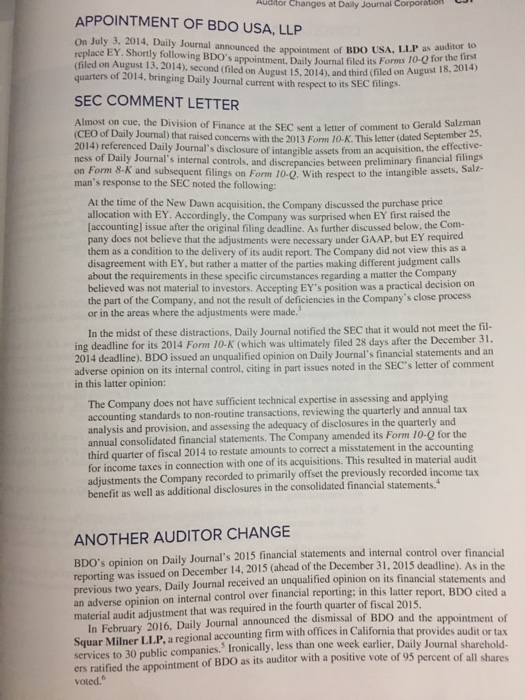

Auditor Changes at Daily Journal Corporation Charlie Munger is vice chairman of Berkshire Hathaway Inc. and is informally known as Wa ren Buffett's "right arm."Munger also serves as chairman of Daily Journal Corporation, whic publishes 10 newspapers and offers specialized information services and technology-based prod- ucts. While often mentioned in the media because of his association with Buffett and long tenure and leadership at Berkshire Hathaway. Munger was recently in the news for another reason: his penchant to change auditors at Daily Journal. REPORTING DELAYS On December 16, 2013, Daily Journal informed the Securities and Exchange Commission (SEC) that it would not meet the filing deadline for its 2013 Form 10-K. (Daily Journal has a September 30 fiscal year-end.) The reason stated in its Form 12b-25 filing was that Daily Journal's auditor (EY) had not completed its audit of the financial statements or internal control over financial reporting. Subsequently, Daily Journal informed the SEC that it would also miss the filing dead line for its December 31, 2013 and March 31, 2014 Forms 10-Q. Once again, the reason stipu lated in the filings was additional time required by EY to complete its audit and assessment internal control over financial reporting. (While EY had audited Daily Jourmal's financial state- ments since 2000, 2013 was the first year EY reported on Daily Journal's internal control financial reporting.) DISMISSAL OF EY On June 24, 2014, Daily Journal filed its 2013 Form 10-K (almost seven months after the fili deadline), in which EY issued an unqualified opinion on the financial statements but an adverse opinion on Daily Journal's internal control over financial reporting. Two days later, Daily Jour- nal reported that its audit committee approved the dismissal of EY, effective June 24. 2014. An excerpt from Daily Journal's Form 8-K filing is shown here: The Audit Committee of the Board of Directors of Daily Journal Corporation (the "Company") approved the dismissal of Ernst &Young LLP ("EY") as the Company's independent reg istered public accounting firm, effective June 24, 2014 The reports of EY on the Company's financial statements for the past two fiscal years con- tained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles During the Company's two most recent fiscal years and the subsequent interim period. there have been no disagreements with EY on any matter of accounting principles or prac tices, financial statement disclosure, or auditing scope or procedure, which disagreement(s) if not resolved to the satisfaction of EY would have caused EY to make reference to the subject matter of such disagreement(s) in its report on the Company's financial statements During the Company's two most recent fiscal years and the subsequent interim period. there have been no reportable events of the kinds described in Item 304(a)(IX) of Regula tion S-K under the Securities Exchange Act of 1934, except that EY expressed an adverse opinion in its report on the Company's internal control over financial reporting as of September 30, 2013 (emphasis added) The Audit Committee of the Company of Directors has discussed this matter with EY and has authorized EY to respond fully to the inquiries of the Company's successor independent registered public accounting firm The Compan y requested and has received a letter from EY addressed to the Securities and Exchange Commission stating whether or not EY agrees with the statements in this It 4.01. A copy of the letter, dated June 26, 2014, is filed as Exhibit 16.1 to this Form 8-K