Answered step by step

Verified Expert Solution

Question

1 Approved Answer

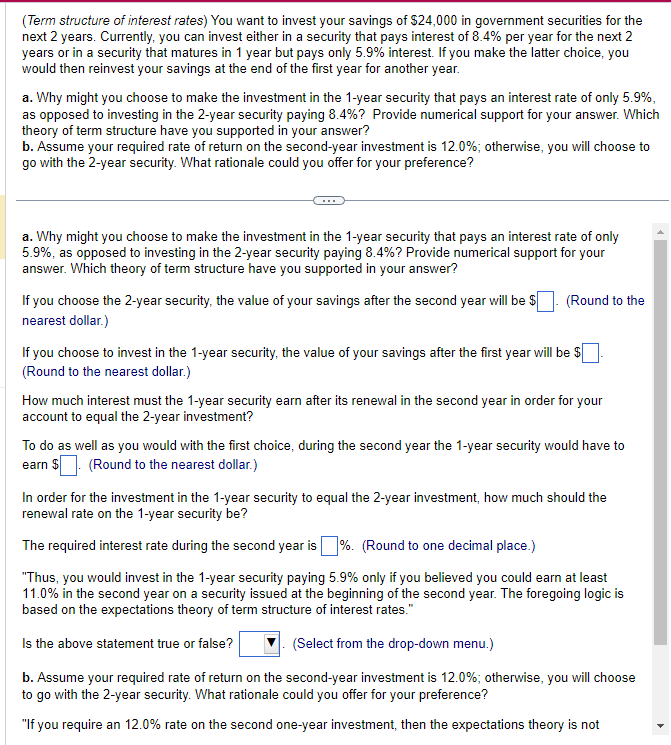

Why might you choose to make the investment in the 1 - year security that pays an interest rate of only 5 . 9 %

Why might you choose to make the investment in the year security that pays an interest rate of only as opposed to investing in the year security paying Provide numerical support for your answer. Which theory of term structure have you supported in your answer?

If you choose the year security the value of your savings after the second year will be $

enter your response here. Round to the nearest dollar.

Part

If you choose to invest in the year security the value of your savings after the first year will be $

enter your response here. Round to the nearest dollar.

Part

How much interest must the year security earn after its renewal in the second year in order for your account to equal the year investment

To do as well as you would with the first choice, during the second year the year security would have to earn $

enter your response here. Round to the nearest dollar.

Part

In order for the investment in the year security to equal the year investment how much should the renewal rate on the year security be

The required interest rate during the second year is

enter your response here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started