Why should Change in Accounting for Income Tax (#3) be removed to normalize the financial statements? Which statement should it be removed from and what will the impact be?

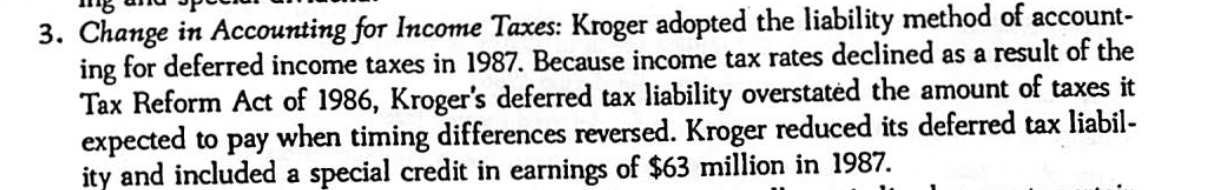

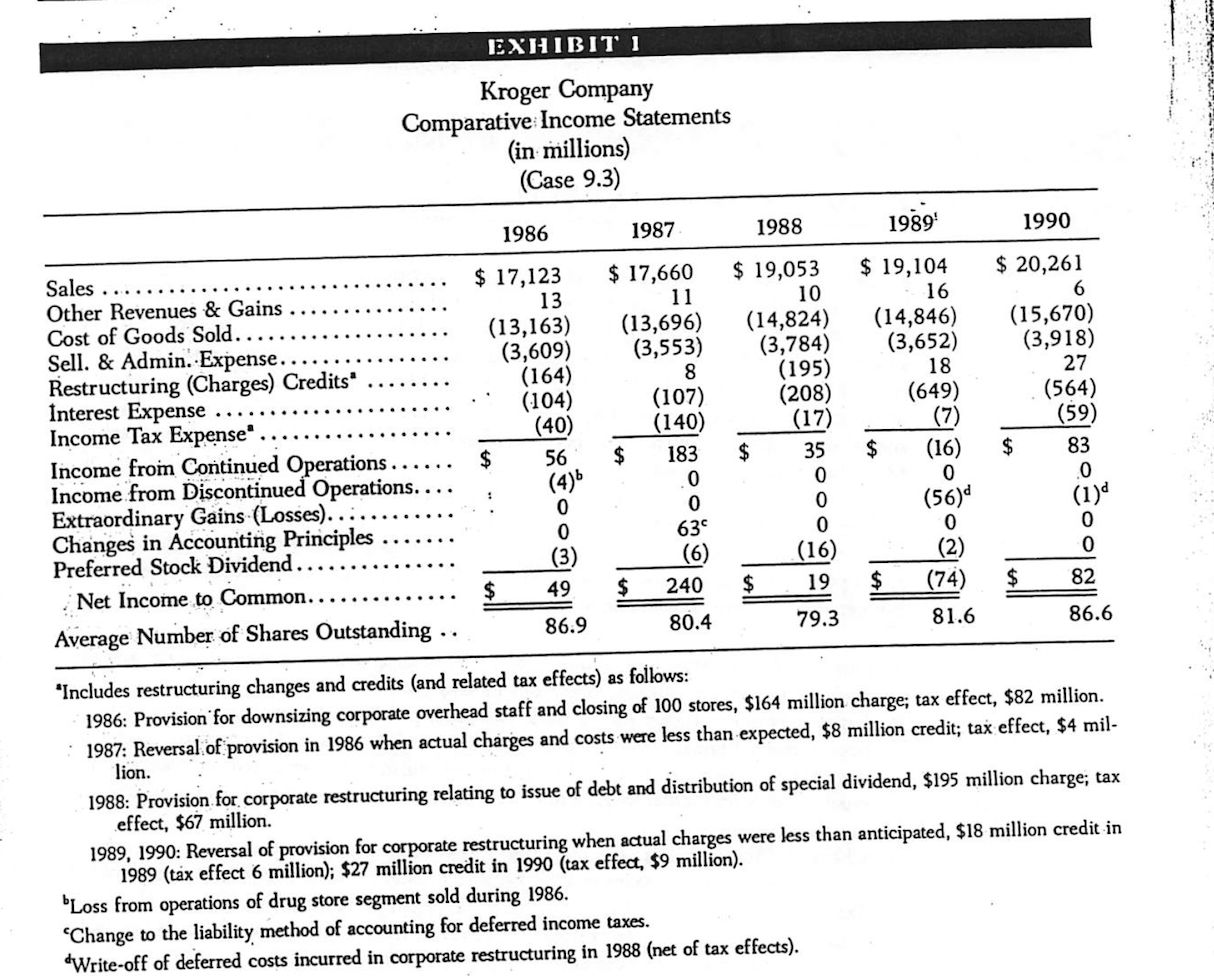

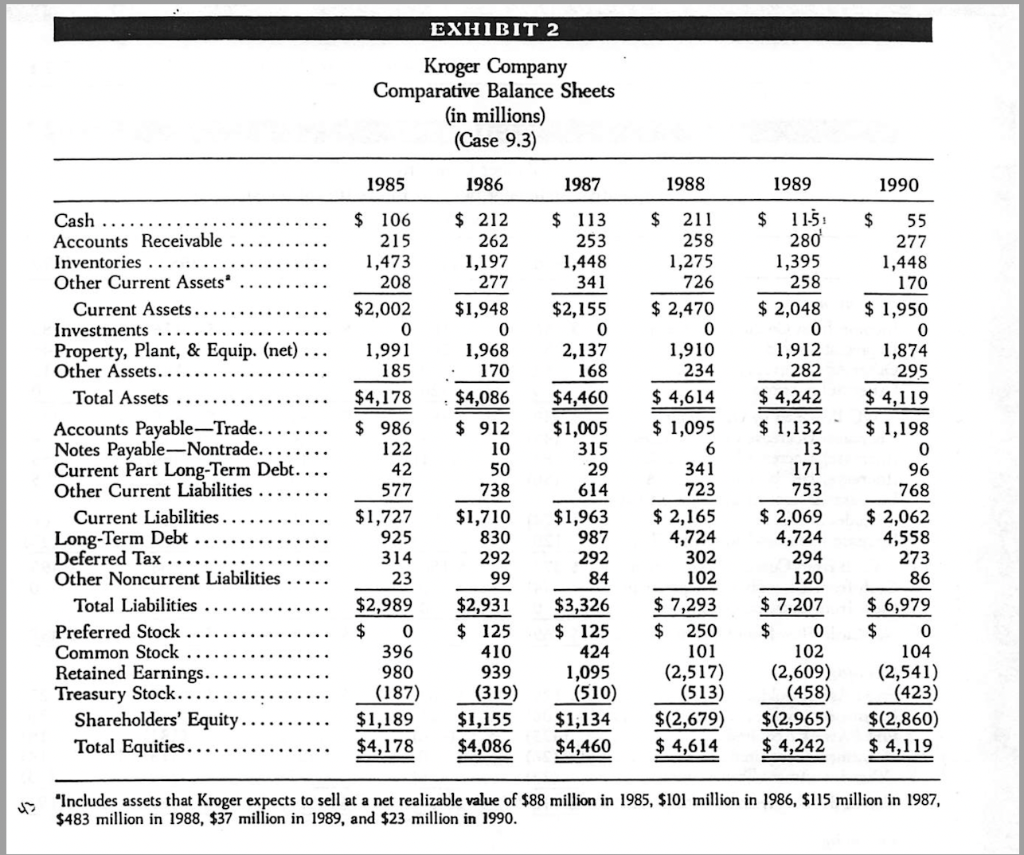

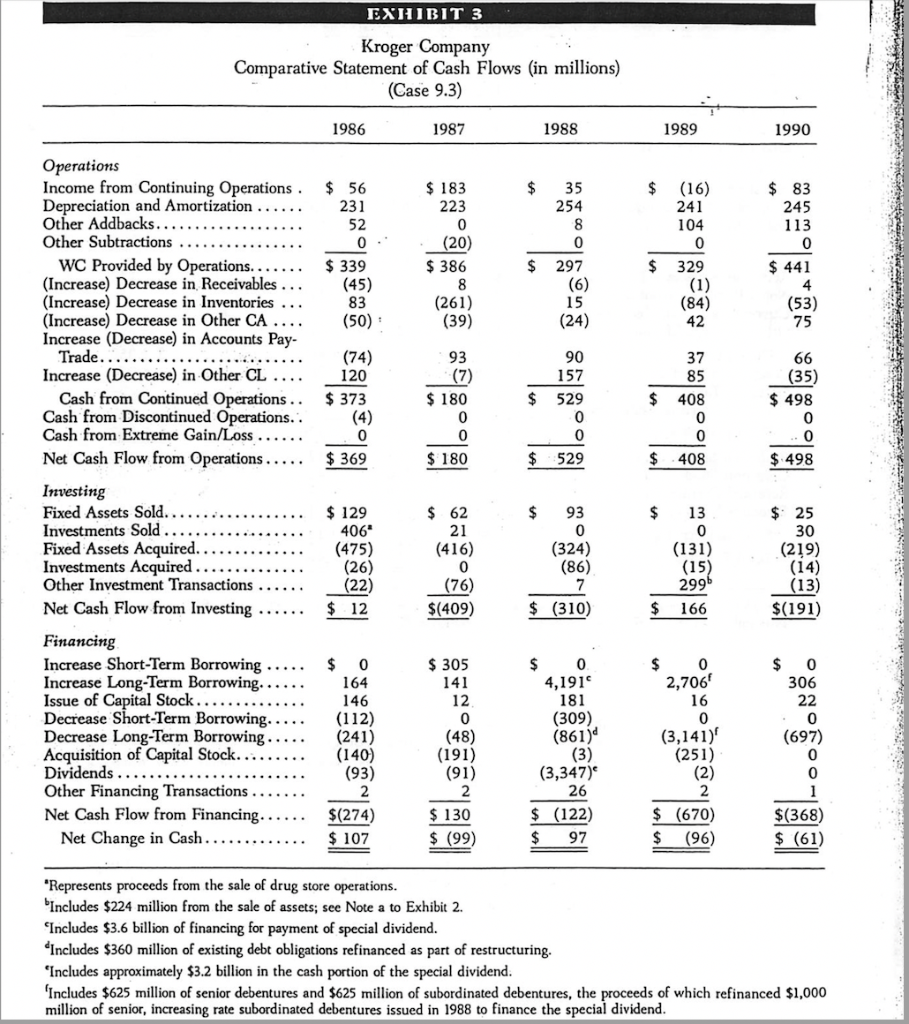

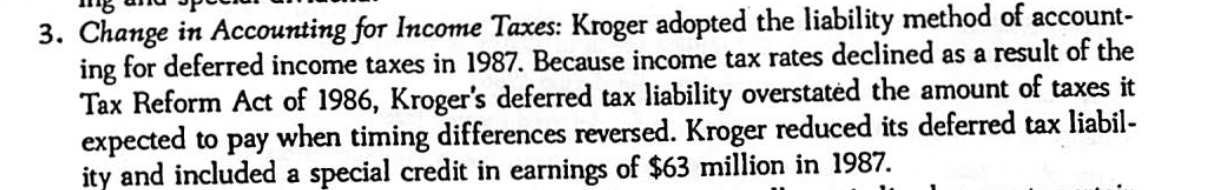

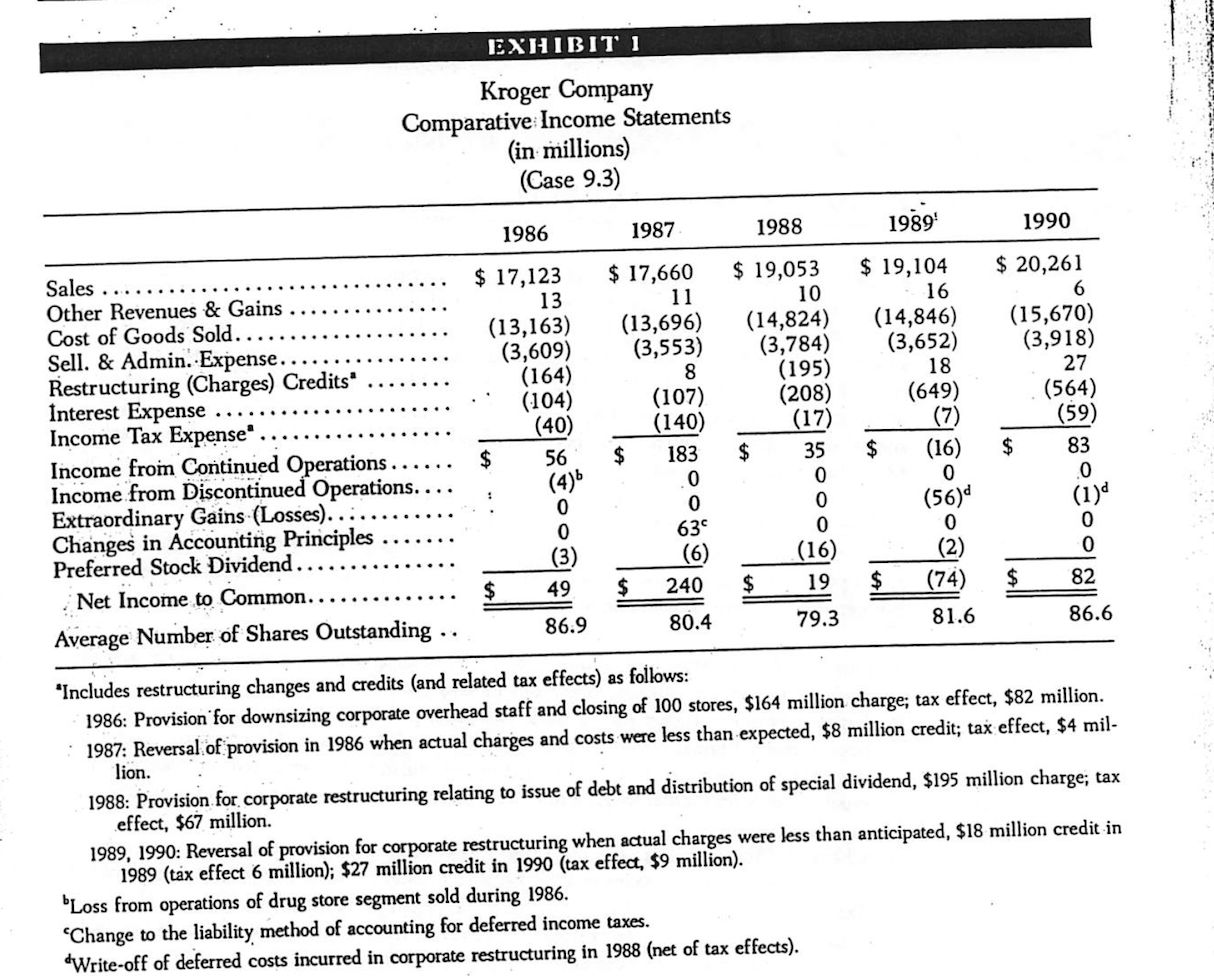

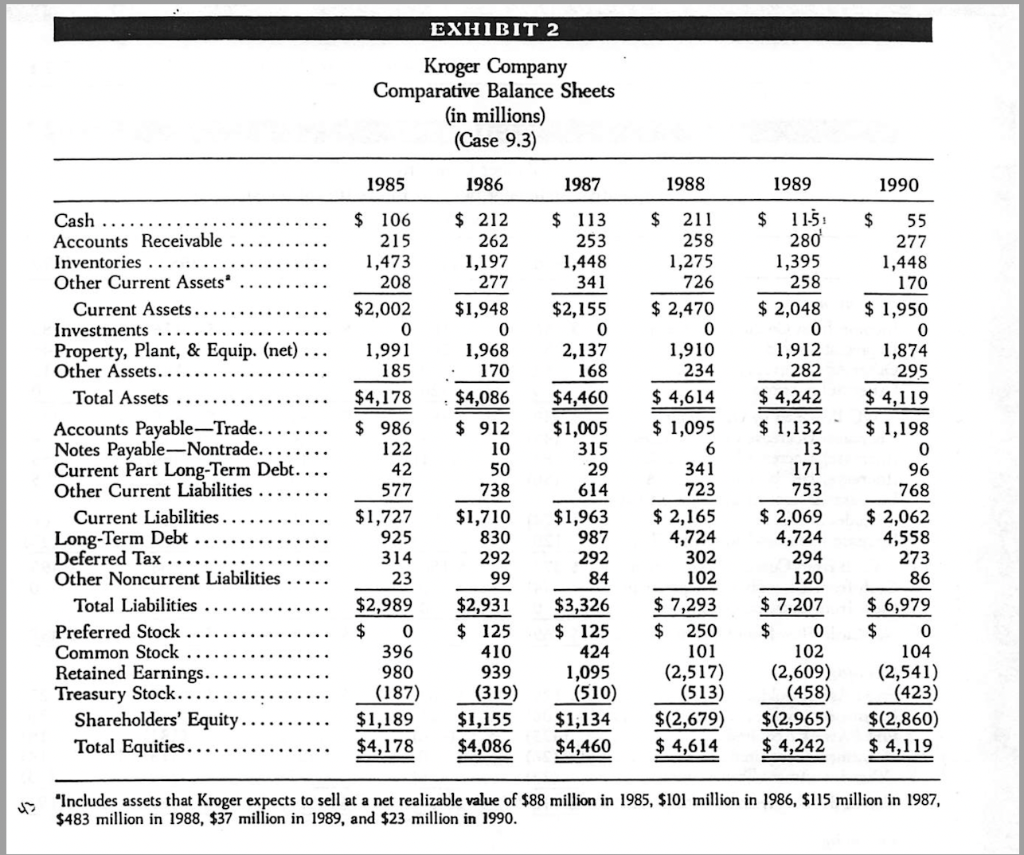

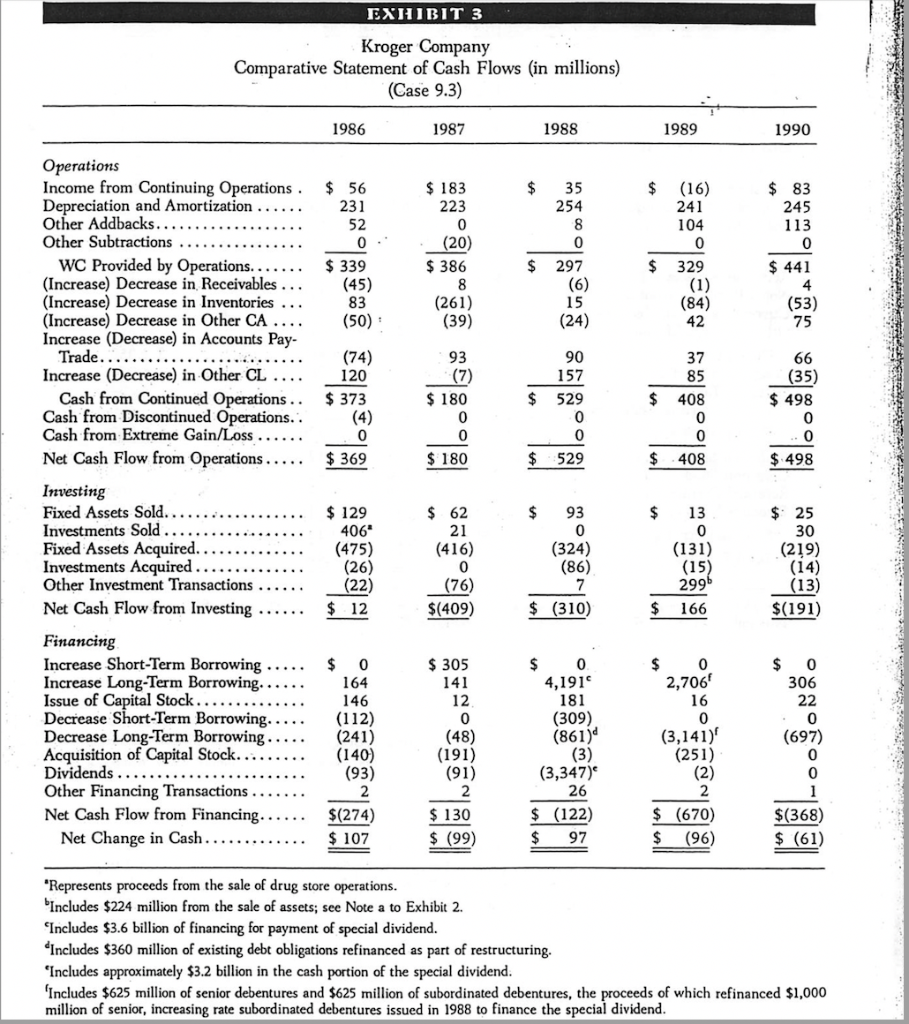

3. Change in Accounting for Income Taxes: Kroger adopted the liability method of account- ing for deferred income taxes in 1987. Because income tax rates declined as a result of the Tax Reform Act of 1986, Kroger's deferred tax liability overstated the amount of taxes it expected to pay when timing differences reversed. Kroger reduced its deferred tax liabil- ity and included a special credit in earnings of $63 million in 1987. EXHIBITI Kroger Company Comparative Income Statements (in millions) (Case 9.3) 1989 1986 1987 1988 1990 Sales Other Revenues & Gains Cost of Goods Sold.. Sell. & Admin. Expense. Restructuring (Charges) Credits Interest Expense Income Tax Expense" Income from Continued Operations. Income from Discontinued Operations.. Extraordinary Gains (Losses). Changes in Accounting Principles Preferred Stock Dividend.. Net Income to Common.. Average Number of Shares Outstanding .. $ 17,123 13 (13,163) (3,609) (164) (104) (40) $ 56 $ 17,660 11 (13,696) (3,553) 8 (107) (140) $ 183 0 0 630 (6) $ 240 $ 19,053 10 (14,824) (3,784) (195) (208) (17) $ 35 0 0 0 (16) $ 19 $ 19,104 16 (14,846) (3,652) 18 (649) (7) $ (16) 0 (56) 0 (2) (74) $ 20,261 6 (15,670) (3,918) 27 (564) (59) $ 83 0 (1) 0 0 $ 82 (4) 0 0 (3 49 $ 80.4 86.9 79.3 81.6 86.6 'Includes restructuring changes and credits (and related tax effects) as follows: 1986: Provision for downsizing corporate overhead staff and closing of 100 stores, $164 million charge; tax effect, $82 million. 1987: Reversal of provision in 1986 when actual charges and costs were less than expected, $8 million credit; tax effect, $4 mil- lion. 1988: Provision for corporate restructuring relating to issue of debt and distribution of special dividend, $195 million charge; tax effect, $67 million. 1989, 1990: Reversal of provision for corporate restructuring when actual charges were less than anticipated, $18 million credit in 1989 (tax effect 6 million); $27 million credit in 1990 (tax effect, $9 million). Loss from operations of drug store segment sold during 1986. "Change to the liability method of accounting for deferred income taxes. Write-off of deferred costs incurred in corporate restructuring in 1988 (net of tax effects). EXHIBIT 2 Kroger Company Comparative Balance Sheets (in millions) (Case 9.3) 1985 1986 1987 1988 1989 1990 Cash Accounts Receivable Inventories Other Current Assets Current Assets .. Investments Property, Plant, & Equip. (net) Other Assets.. Total Assets Accounts Payable-Trade... Notes PayableNontrade.. Current Part Long-Term Debt. Other Current Liabilities Current Liabilities Long-Term Debt Deferred Tax Other Noncurrent Liabilities Total Liabilities Preferred Stock Common Stock Retained Earnings. Treasury Stock Shareholders' Equity. Total Equities.. $ 106 215 1,473 208 $2,002 0 1,991 185 $4,178 $ 986 122 42 577 $1,727 925 314 23 $2,989 $ 0 396 980 (187) $1,189 $4,178 $ 212 262 1,197 277 $1,948 0 1,968 170 $4,086 $ 912 10 50 738 $1,710 830 292 99 $2,931 $ 125 410 939 (319) $1,155 $4,086 $ 113 253 1,448 341 $2,155 0 2,137 168 $4,460 $1,005 315 29 614 $1,963 987 292 84 $3,326 $ 125 424 1,095 (510) $1,134 $4,460 $ 211 258 1,275 726 $ 2,470 0 1,910 234 $ 4,614 $ 1,095 6 341 723 $ 2,165 4,724 302 102 $ 7,293 $ 250 101 (2,517) (513) $(2,679) $ 4,614 $ 11.5 280 1,395 258 $ 2,048 0 1,912 282 $ 4,242 $ 1,132 13 171 753 $ 2,069 4,724 294 120 $ 7,207 $ 0 102 (2,609) (458) $(2,965) $ 4,242 $ 55 277 1,448 170 $ 1,950 0 1,874 295 $ 4,119 $ 1,198 0 96 768 $ 2,062 4,558 273 86 $ 6,979 $ 0 104 (2,541) (423) $(2,860) $ 4,119 "Includes assets that Kroger expects to sell at a net realizable value of $88 million in 1985, $101 million in 1986, $115 million in 1987, $483 million in 1988, $37 million in 1989, and $23 million in 1990. EXHIBIT3 Kroger Company Comparative Statement of Cash Flows (in millions) (Case 9.3) 1986 1987 1988 1989 1990 $ $ 56 231 52 0 $ 339 (45) 83 (50) $ 183 223 0 (20) $ 386 35 254 8 0 297 (6) 15 (24) $ (16) 241 104 0 $ 329 (1) (84) 42 $ 83 245 113 0 $ 441 4 (53) 75 $ (261) (39) Operations Income from Continuing Operations Depreciation and Amortization Other Addbacks. Other Subtractions WC Provided by Operations... (Increase) Decrease in Receivables ... (Increase) Decrease in Inventories (Increase) Decrease in Other CA Increase (Decrease) in Accounts Pay- Trade. Increase (Decrease) in Other CL Cash from Continued Operations .. Cash from Discontinued Operations. Cash from Extreme Gain/Loss Net Cash Flow from Operations.... Investing Fixed Assets Sold. Investments Sold. Fixed Assets Acquired.. Investments Acquired Other Investment Transactions Net Cash Flow from Investing (74) 120 $ 373 93 (7) $ 180 90 157 $ 529 0 0 $ 529 37 85 $ 408 0 0 $ 408 66 (35) $ 498 0 0 $ 498 0 $ 369 0 $ 180 $ $ 129 406 (475) (26) (22) $ 12 $ 62 21 (416) 0 (76) $(409) 93 0 (324) (86) $ 13 0 (131) (15) 2996 $ 166 $ 25 30 (219) (14) (13) $(191) $ (310) $ 0 164 146 Financing Increase Short-Term Borrowing Increase Long-Term Borrowing. Issue of Capital Stock.. Decrease Short-Term Borrowing. Decrease Long-Term Borrowing Acquisition of Capital Stock. Dividends Other Financing Transactions Net Cash Flow from Financing.. Net Change in Cash.. $ 305 141 12 0 (48) (191) (91) 2 $ 130 $ (99) (112) (241) (140) (93) 2 $(274) $ 107 $ 0 4,1914 181 (309) (861) (3) (3,347) 26 $ (122) $ 97 $ 0 2,706 16 0 (3,141) (251) (2) 2 $ (670) $ (96) $ 0 306 22 0 (697) 0 1 $(368) $ (61) "Represents proceeds from the sale of drug store operations. Includes $224 million from the sale of assets; see Note a to Exhibit 2. Includes $3.6 billion of financing for payment of special dividend. dincludes $360 million of existing debt obligations refinanced as part of restructuring. 'Includes approximately $3.2 billion in the cash portion of the special dividend. 'Includes $625 million of senior debentures and $625 million of subordinated debentures, the proceeds of which refinanced $1,000 million of senior, increasing rate subordinated debentures issued in 1988 to finance the special dividend. 3. Change in Accounting for Income Taxes: Kroger adopted the liability method of account- ing for deferred income taxes in 1987. Because income tax rates declined as a result of the Tax Reform Act of 1986, Kroger's deferred tax liability overstated the amount of taxes it expected to pay when timing differences reversed. Kroger reduced its deferred tax liabil- ity and included a special credit in earnings of $63 million in 1987. EXHIBITI Kroger Company Comparative Income Statements (in millions) (Case 9.3) 1989 1986 1987 1988 1990 Sales Other Revenues & Gains Cost of Goods Sold.. Sell. & Admin. Expense. Restructuring (Charges) Credits Interest Expense Income Tax Expense" Income from Continued Operations. Income from Discontinued Operations.. Extraordinary Gains (Losses). Changes in Accounting Principles Preferred Stock Dividend.. Net Income to Common.. Average Number of Shares Outstanding .. $ 17,123 13 (13,163) (3,609) (164) (104) (40) $ 56 $ 17,660 11 (13,696) (3,553) 8 (107) (140) $ 183 0 0 630 (6) $ 240 $ 19,053 10 (14,824) (3,784) (195) (208) (17) $ 35 0 0 0 (16) $ 19 $ 19,104 16 (14,846) (3,652) 18 (649) (7) $ (16) 0 (56) 0 (2) (74) $ 20,261 6 (15,670) (3,918) 27 (564) (59) $ 83 0 (1) 0 0 $ 82 (4) 0 0 (3 49 $ 80.4 86.9 79.3 81.6 86.6 'Includes restructuring changes and credits (and related tax effects) as follows: 1986: Provision for downsizing corporate overhead staff and closing of 100 stores, $164 million charge; tax effect, $82 million. 1987: Reversal of provision in 1986 when actual charges and costs were less than expected, $8 million credit; tax effect, $4 mil- lion. 1988: Provision for corporate restructuring relating to issue of debt and distribution of special dividend, $195 million charge; tax effect, $67 million. 1989, 1990: Reversal of provision for corporate restructuring when actual charges were less than anticipated, $18 million credit in 1989 (tax effect 6 million); $27 million credit in 1990 (tax effect, $9 million). Loss from operations of drug store segment sold during 1986. "Change to the liability method of accounting for deferred income taxes. Write-off of deferred costs incurred in corporate restructuring in 1988 (net of tax effects). EXHIBIT 2 Kroger Company Comparative Balance Sheets (in millions) (Case 9.3) 1985 1986 1987 1988 1989 1990 Cash Accounts Receivable Inventories Other Current Assets Current Assets .. Investments Property, Plant, & Equip. (net) Other Assets.. Total Assets Accounts Payable-Trade... Notes PayableNontrade.. Current Part Long-Term Debt. Other Current Liabilities Current Liabilities Long-Term Debt Deferred Tax Other Noncurrent Liabilities Total Liabilities Preferred Stock Common Stock Retained Earnings. Treasury Stock Shareholders' Equity. Total Equities.. $ 106 215 1,473 208 $2,002 0 1,991 185 $4,178 $ 986 122 42 577 $1,727 925 314 23 $2,989 $ 0 396 980 (187) $1,189 $4,178 $ 212 262 1,197 277 $1,948 0 1,968 170 $4,086 $ 912 10 50 738 $1,710 830 292 99 $2,931 $ 125 410 939 (319) $1,155 $4,086 $ 113 253 1,448 341 $2,155 0 2,137 168 $4,460 $1,005 315 29 614 $1,963 987 292 84 $3,326 $ 125 424 1,095 (510) $1,134 $4,460 $ 211 258 1,275 726 $ 2,470 0 1,910 234 $ 4,614 $ 1,095 6 341 723 $ 2,165 4,724 302 102 $ 7,293 $ 250 101 (2,517) (513) $(2,679) $ 4,614 $ 11.5 280 1,395 258 $ 2,048 0 1,912 282 $ 4,242 $ 1,132 13 171 753 $ 2,069 4,724 294 120 $ 7,207 $ 0 102 (2,609) (458) $(2,965) $ 4,242 $ 55 277 1,448 170 $ 1,950 0 1,874 295 $ 4,119 $ 1,198 0 96 768 $ 2,062 4,558 273 86 $ 6,979 $ 0 104 (2,541) (423) $(2,860) $ 4,119 "Includes assets that Kroger expects to sell at a net realizable value of $88 million in 1985, $101 million in 1986, $115 million in 1987, $483 million in 1988, $37 million in 1989, and $23 million in 1990. EXHIBIT3 Kroger Company Comparative Statement of Cash Flows (in millions) (Case 9.3) 1986 1987 1988 1989 1990 $ $ 56 231 52 0 $ 339 (45) 83 (50) $ 183 223 0 (20) $ 386 35 254 8 0 297 (6) 15 (24) $ (16) 241 104 0 $ 329 (1) (84) 42 $ 83 245 113 0 $ 441 4 (53) 75 $ (261) (39) Operations Income from Continuing Operations Depreciation and Amortization Other Addbacks. Other Subtractions WC Provided by Operations... (Increase) Decrease in Receivables ... (Increase) Decrease in Inventories (Increase) Decrease in Other CA Increase (Decrease) in Accounts Pay- Trade. Increase (Decrease) in Other CL Cash from Continued Operations .. Cash from Discontinued Operations. Cash from Extreme Gain/Loss Net Cash Flow from Operations.... Investing Fixed Assets Sold. Investments Sold. Fixed Assets Acquired.. Investments Acquired Other Investment Transactions Net Cash Flow from Investing (74) 120 $ 373 93 (7) $ 180 90 157 $ 529 0 0 $ 529 37 85 $ 408 0 0 $ 408 66 (35) $ 498 0 0 $ 498 0 $ 369 0 $ 180 $ $ 129 406 (475) (26) (22) $ 12 $ 62 21 (416) 0 (76) $(409) 93 0 (324) (86) $ 13 0 (131) (15) 2996 $ 166 $ 25 30 (219) (14) (13) $(191) $ (310) $ 0 164 146 Financing Increase Short-Term Borrowing Increase Long-Term Borrowing. Issue of Capital Stock.. Decrease Short-Term Borrowing. Decrease Long-Term Borrowing Acquisition of Capital Stock. Dividends Other Financing Transactions Net Cash Flow from Financing.. Net Change in Cash.. $ 305 141 12 0 (48) (191) (91) 2 $ 130 $ (99) (112) (241) (140) (93) 2 $(274) $ 107 $ 0 4,1914 181 (309) (861) (3) (3,347) 26 $ (122) $ 97 $ 0 2,706 16 0 (3,141) (251) (2) 2 $ (670) $ (96) $ 0 306 22 0 (697) 0 1 $(368) $ (61) "Represents proceeds from the sale of drug store operations. Includes $224 million from the sale of assets; see Note a to Exhibit 2. Includes $3.6 billion of financing for payment of special dividend. dincludes $360 million of existing debt obligations refinanced as part of restructuring. 'Includes approximately $3.2 billion in the cash portion of the special dividend. 'Includes $625 million of senior debentures and $625 million of subordinated debentures, the proceeds of which refinanced $1,000 million of senior, increasing rate subordinated debentures issued in 1988 to finance the special dividend