Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why should there be no reward for bearing stock-specific (or idiosyncratic) risk? Choose ONE BEST answer. Idiosyncratic risk is only a small slice of total

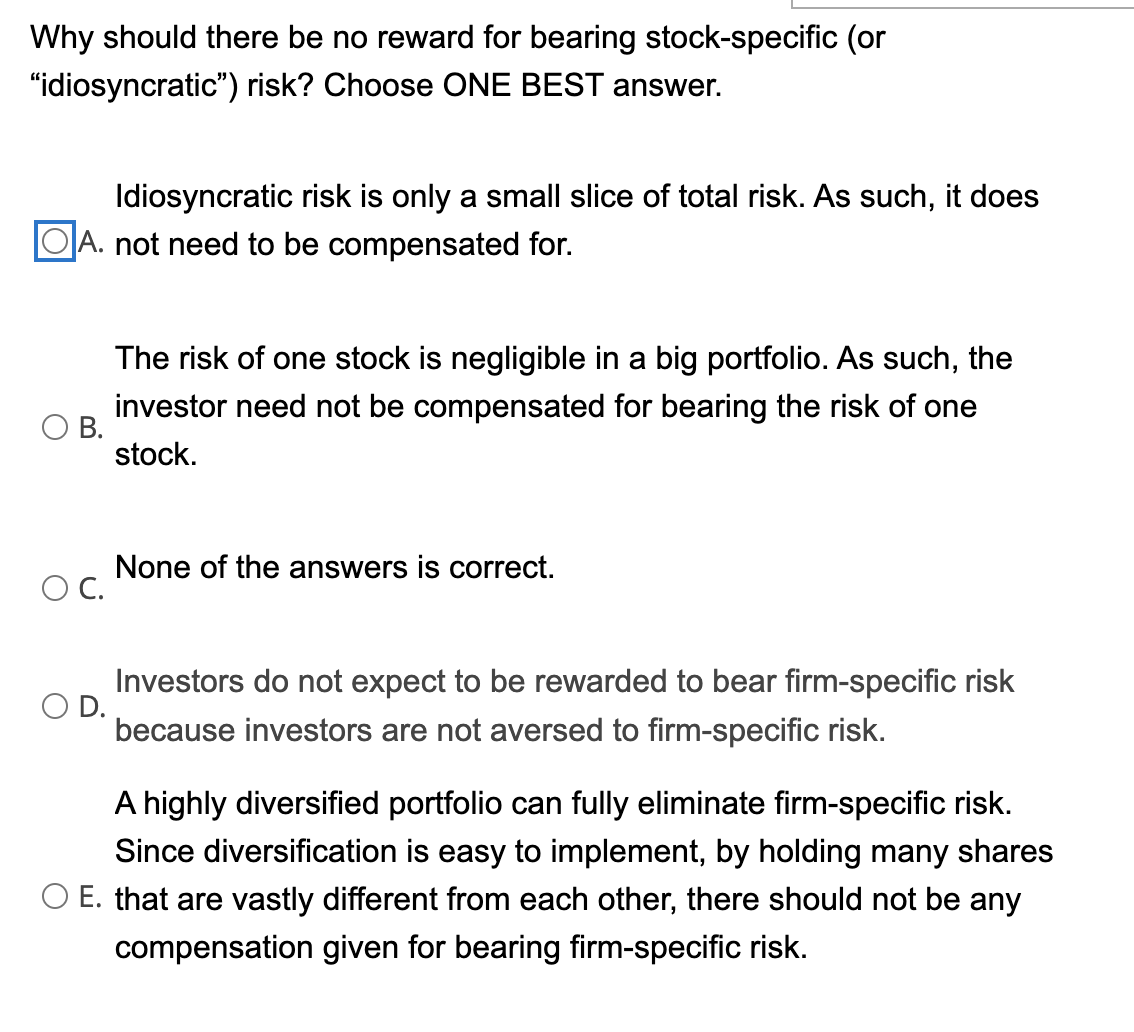

Why should there be no reward for bearing stock-specific (or "idiosyncratic") risk? Choose ONE BEST answer. Idiosyncratic risk is only a small slice of total risk. As such, it does A. not need to be compensated for. The risk of one stock is negligible in a big portfolio. As such, the B. investor need not be compensated for bearing the risk of one stock. C. None of the answers is correct. D. Investors do not expect to be rewarded to bear firm-specific risk because investors are not aversed to firm-specific risk. A highly diversified portfolio can fully eliminate firm-specific risk. Since diversification is easy to implement, by holding many shares E. that are vastly different from each other, there should not be any compensation given for bearing firm-specific risk

Why should there be no reward for bearing stock-specific (or "idiosyncratic") risk? Choose ONE BEST answer. Idiosyncratic risk is only a small slice of total risk. As such, it does A. not need to be compensated for. The risk of one stock is negligible in a big portfolio. As such, the B. investor need not be compensated for bearing the risk of one stock. C. None of the answers is correct. D. Investors do not expect to be rewarded to bear firm-specific risk because investors are not aversed to firm-specific risk. A highly diversified portfolio can fully eliminate firm-specific risk. Since diversification is easy to implement, by holding many shares E. that are vastly different from each other, there should not be any compensation given for bearing firm-specific risk Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started