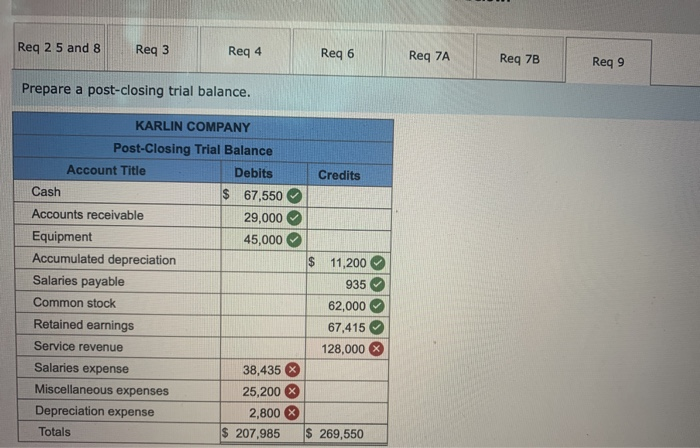

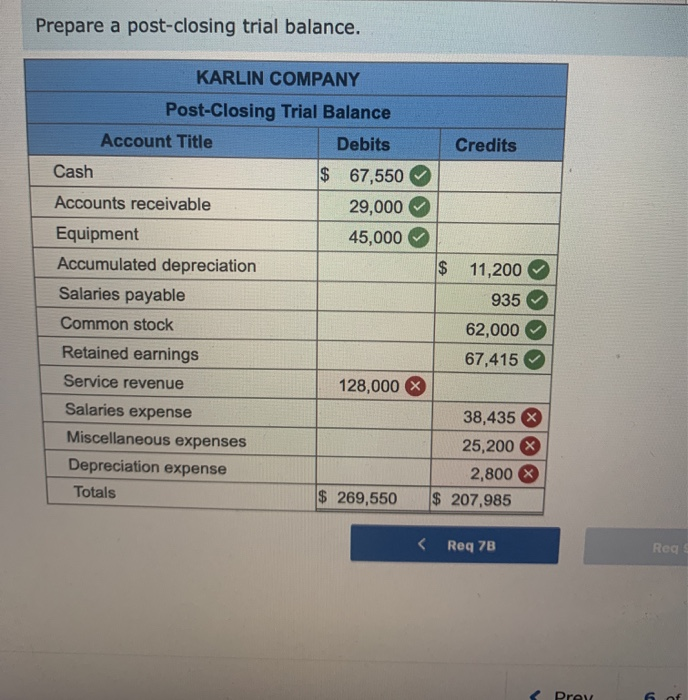

why this keep showing errorWhat is the right number

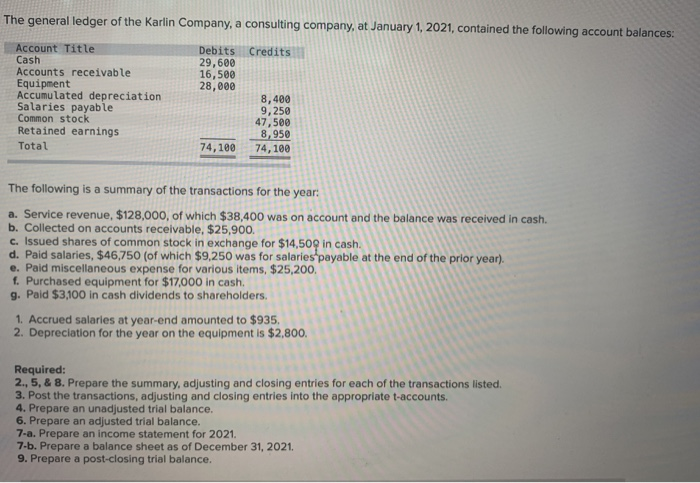

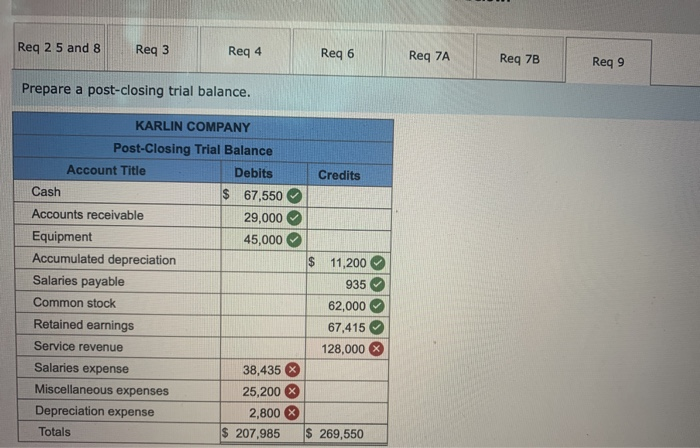

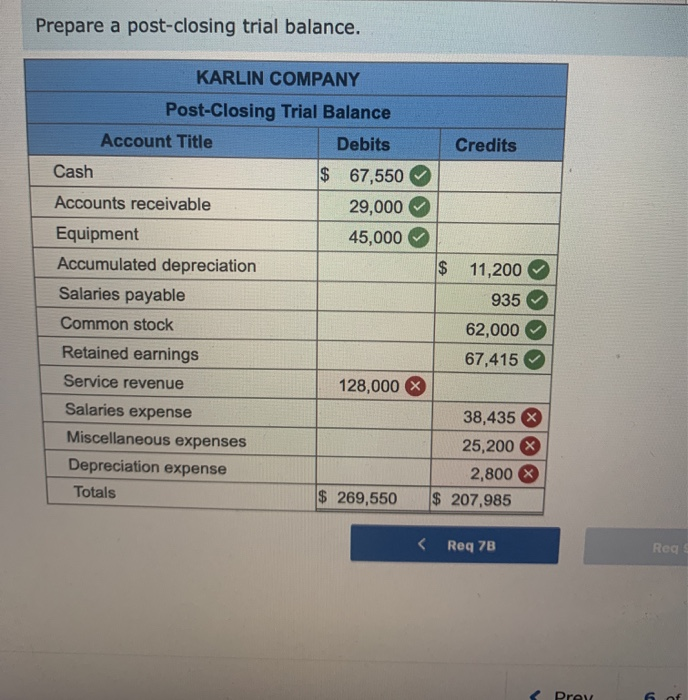

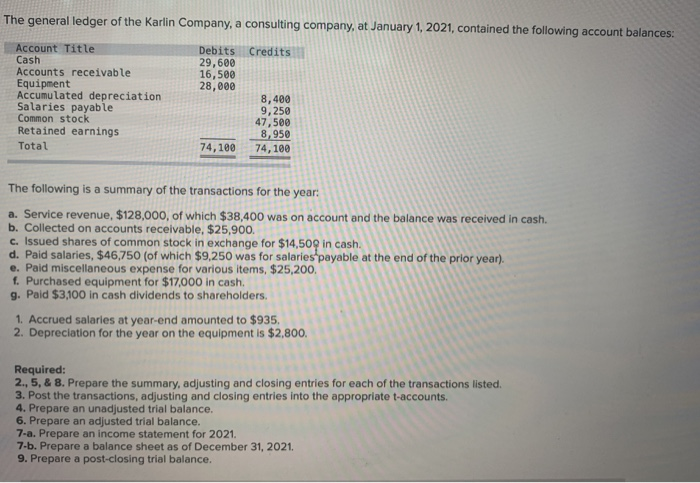

The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances: Credits Debits 29,600 16,500 28,000 Account Title Cash Accounts receivable Equipment Accumulated depreciation Salaries payable Common stock Retained earnings Total 8,400 9, 250 47,500 8,950 74,100 74,100 The following is a summary of the transactions for the year: a. Service revenue, $128,000, of which $38,400 was on account and the balance was received in cash. b. Collected on accounts receivable, $25,900. c. Issued shares of common stock in exchange for $14,500 in cash. d. Paid salaries, $46,750 (of which $9,250 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $25,200. f. Purchased equipment for $17,000 in cash. g. Paid $3,100 in cash dividends to shareholders. 1. Accrued salaries at year-end amounted to $935, 2. Depreciation for the year on the equipment is $2,800. Required: 2., 5,& 8. Prepare the summary, adjusting and closing entries for each of the transactions listed. 3. Post the transactions, adjusting and closing entries into the appropriate t-accounts. 4. Prepare an unadjusted trial balance. 6. Prepare an adjusted trial balance. 7-a. Prepare an income statement for 2021. 7-b. Prepare a balance sheet as of December 31, 2021. 9. Prepare a post-closing trial balance. Req 2 5 and 8 Reg 3 Req 4 Req 6 Req 7A Req 7B Req 9 Prepare a post-closing trial balance. KARLIN COMPANY Post-Closing Trial Balance Account Title Debits Credits Cash $ 67,550 Accounts receivable 29,000 Equipment 45,000 Accumulated depreciation $ 11,200 Salaries payable 935 Common stock 62,000 Retained earnings 67,415 Service revenue 128,000 X Salaries expense 38,435 Miscellaneous expenses 25,200 x Depreciation expense 2,800 Totals $ 207,985 $ 269,550 Prepare a post-closing trial balance. Credits KARLIN COMPANY Post-Closing Trial Balance Account Title Debits Cash $ 67,550 Accounts receivable 29,000 Equipment 45,000 Accumulated depreciation Salaries payable Common stock Retained earnings Service revenue 128,000 Salaries expense Miscellaneous expenses Depreciation expense Totals $ 269,550 $ 11,200 935 62,000 67,415 38,435 X 25,200 X 2,800 207,985