Answered step by step

Verified Expert Solution

Question

1 Approved Answer

why w = 0.54 Given, H1 = 0.14, H2 = 0.08, Risk-free asset return, H3 = 0.06 01 = 0.2, 02 = 0.15 and p

why w = 0.54

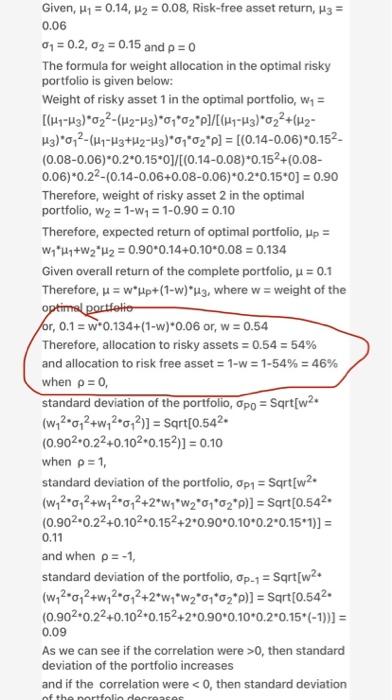

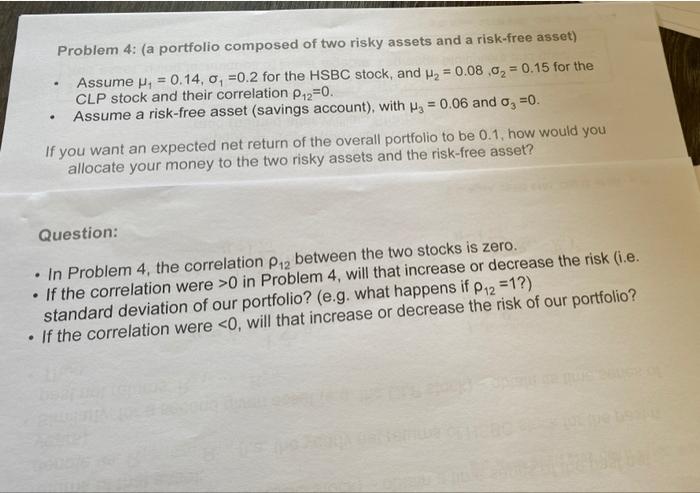

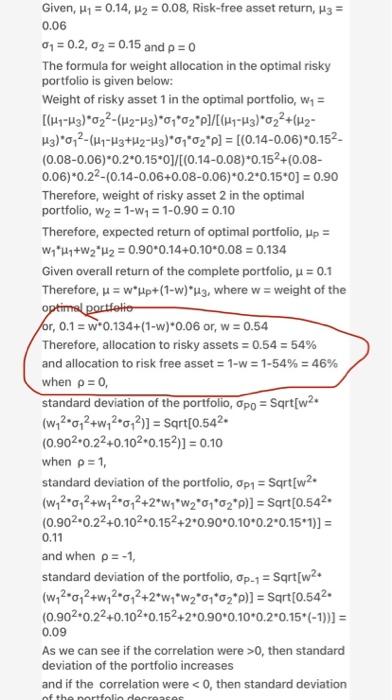

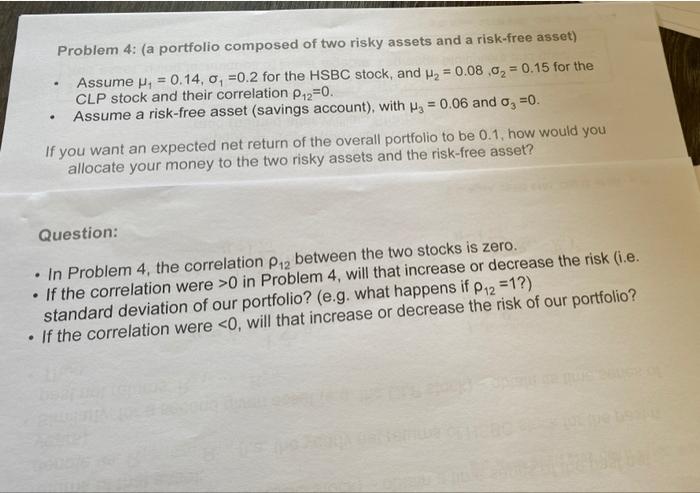

Given, H1 = 0.14, H2 = 0.08, Risk-free asset return, H3 = 0.06 01 = 0.2, 02 = 0.15 and p = 0 The formula for weight allocation in the optimal risky portfolio is given below: Weight of risky asset 1 in the optimal portfolio, w4 = [(H1-43)*022-(H2-H3)*07*02*p]/[(41-43)*022+(12- H3)*0,2-(441-43+42-43)*07*02*p] = [(0.14-0.06)*0.152 (0.08-0.06)*0.2*0.15*01/[(0.14-0.08)*0.152 (0.08- 0.06)*0.22-(0.14-0.06+0.08-0.06)*0.2*0.15*0] = 0.90 Therefore, weight of risky asset 2 in the optimal portfolio, W2 = 1-W7 = 1-0.90 = 0.10 Therefore, expected return of optimal portfolio, Hp = W *H4+W2H2 = 0.90*0.14+0.10*0.08 = 0.134 Given overall return of the complete portfolio, u = 0.1 Therefore, u = W*Hp+(1-w)*43, where w = weight of the optimal portfolio for, 0.1 = w*0.134+(1-2)*0.06 or, w = 0.54 Therefore, allocation to risky assets = 0.54 = 54% and allocation to risk free asset = 1-w = 1-54% = 46% when p = 0, standard deviation of the portfolio, Opo = Sart[w2* (W12*0,2+W4200, 2)] = Sart[0.542. (0.90200.22+0.102.0.152)] = 0.10 when p=1, standard deviation of the portfolio, Opa = Sart[w2. (W42+0,2+wq2*0,2+2*W7*W2*07*02*p)] = Sart[0.542 (0.902.0.22+0.10200.152+2*0.90*0.10*0.2.0.15*1)] = 0.11 and when p=-1, standard deviation of the portfolio, Op-1 = Sart[w2. (W, 2-0,2+w2.0,2+2*w7*W2*07*62*P)] = sqrt{0.542. (0.902.0.22+0.102.0.152+2*0.90*0,10*0.2.0.15*(-1))] = 0.09 As we can see if the correlation were >0, then standard deviation of the portfolio increases and if the correlation were O in Problem 4, will that increase or decrease the risk (i.e. standard deviation of our portfolio? (e.g. what happens if P12 =1?) If the correlation were

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started