Answered step by step

Verified Expert Solution

Question

1 Approved Answer

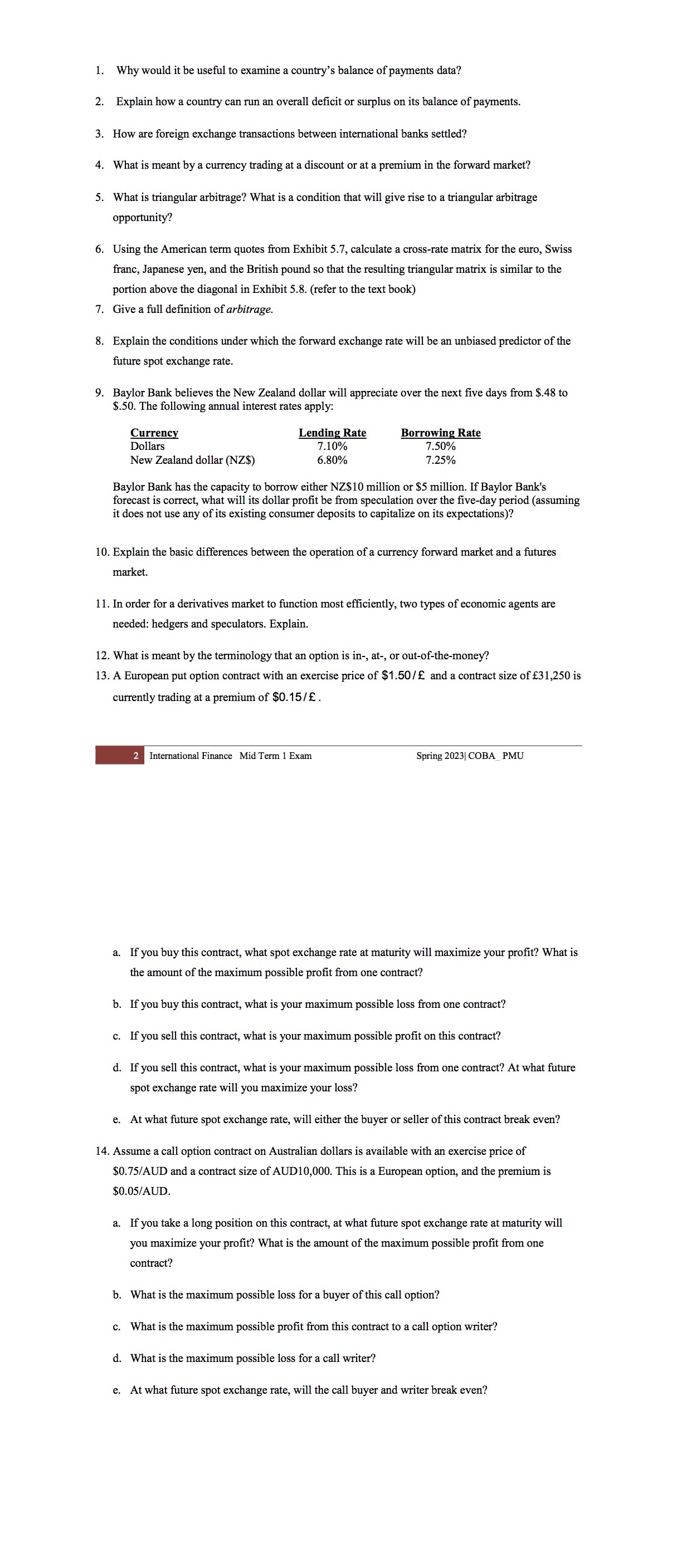

Why would it be useful to examine a country's balance of payments data? Explain how a country can run an overall deficit or surplus on

Why would it be useful to examine a country's balance of payments data?

Explain how a country can run an overall deficit or surplus on its balance of payments.

How are foreign exchange transactions between international banks settled?

What is meant by a currency trading at a discount or at a premium in the forward market?

What is triangular arbitrage? What is a condition that will give rise to a triangular arbitrage

opportunity?

Using the American term quotes from Exhibit calculate a crossrate matrix for the euro, Swiss

franc, Japanese yen, and the British pound so that the resulting triangular matrix is similar to the

portion above the diagonal in Exhibit refer to the text book

Give a full definition of arbitrage.

Explain the conditions under which the forward exchange rate will be an unbiased predictor of the

future spot exchange rate.

Baylor Bank believes the New Zealand dollar will appreciate over the next five days from $ to

$ The following annual interest rates apply:

Currency

Dollars

New Zealand dollar NZ$

Baylor Bank has the capacity to borrow either NZ $ million or $ million. If Baylor Bank's

forecast is correct, what will its dollar profit be from speculation over the fiveday period assuming

it does not use any of its existing consumer deposits to capitalize on its expectations

Explain the basic differences between the operation of a currency forward market and a futures

market.

In order for a derivatives market to function most efficiently, two types of economic agents are

needed: hedgers and speculators. Explain.

What is meant by the terminology that an option is in at or outofthemoney?

A European put option contract with an exercise price of $ and a contract size of is

currently trading at a premium of $

a If you buy this contract, what spot exchange rate at maturity will maximize your profit? What is

the amount of the maximum possible profit from one contract?

b If you buy this contract, what is your maximum possible loss from one contract?

c If you sell this contract, what is your maximum possible profit on this contract?

d If you sell this contract, what is your maximum possible loss from one contract? At what future

spot exchange rate will you maximize your loss?

e At what future spot exchange rate, will either the buyer or seller of this contract break even?

Assume a call option contract on Australian dollars is available with an exercise price of

$ AUD and a contract size of AUD This is a European option, and the premium is

$AUD

a If you take a long position on this contract, at what future spot exchange rate at maturity will

you maximize your profit? What is the amount of the maximum possible profit from one

contract?

b What is the maximum possible loss for a buyer of this call option?

c What is the maximum possible profit from this contract to a call option writer?

d What is the maximum possible loss for a call writer?

e At what future spot exchange rate, will the call buyer and writer break even?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started