Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wick Co was established on 1 January 20X0. In the first three years' accounts development expenditure was carried forward as an asset in the

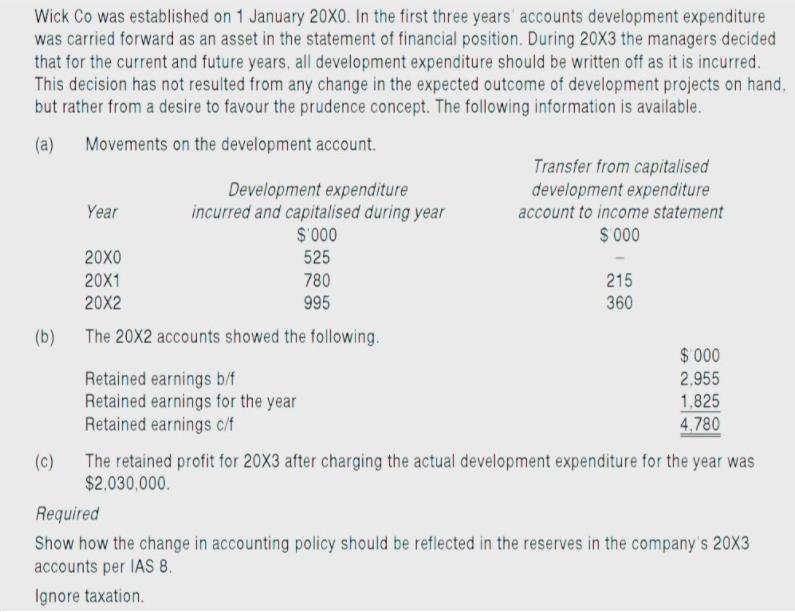

Wick Co was established on 1 January 20X0. In the first three years' accounts development expenditure was carried forward as an asset in the statement of financial position. During 20X3 the managers decided that for the current and future years, all development expenditure should be written off as it is incurred. This decision has not resulted from any change in the expected outcome of development projects on hand, but rather from a desire to favour the prudence concept. The following information is available. (a) Movements on the development account. Transfer from capitalised development expenditure Development expenditure incurred and capitalised during year $ 00 525 Year account to income statement $ 000 20X0 20X1 780 215 20X2 995 360 (b) The 20X2 accounts showed the following. $ 000 Retained earnings b/f Retained earnings for the year Retained earnings c/f 2,955 1.825 4.780 The retained profit for 20X3 after charging the actual development expenditure for the year was $2,030,000. (c) Required Show how the change in accounting policy should be reflected in the reserves in the company's 20X3 accounts per IAS 8. Ignore taxation.

Step by Step Solution

★★★★★

3.51 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Question As per IAS 8 whenever an entity changes its accountin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started