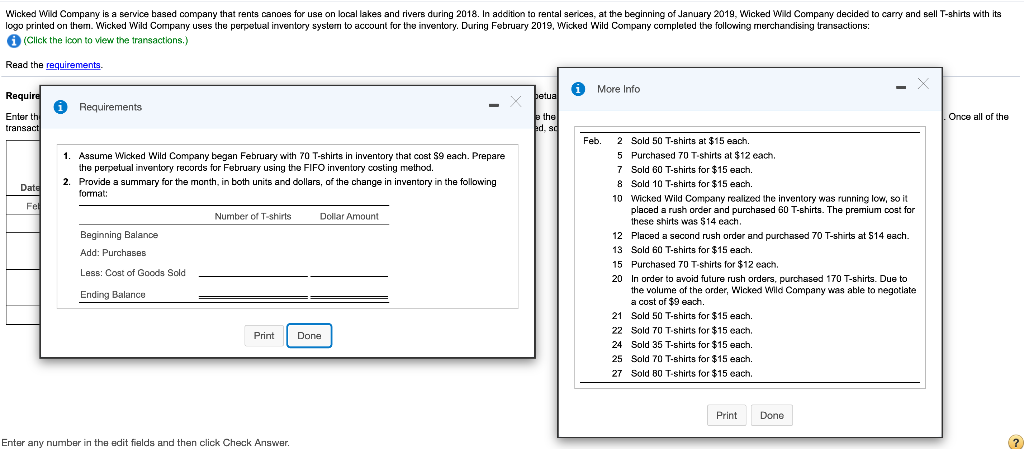

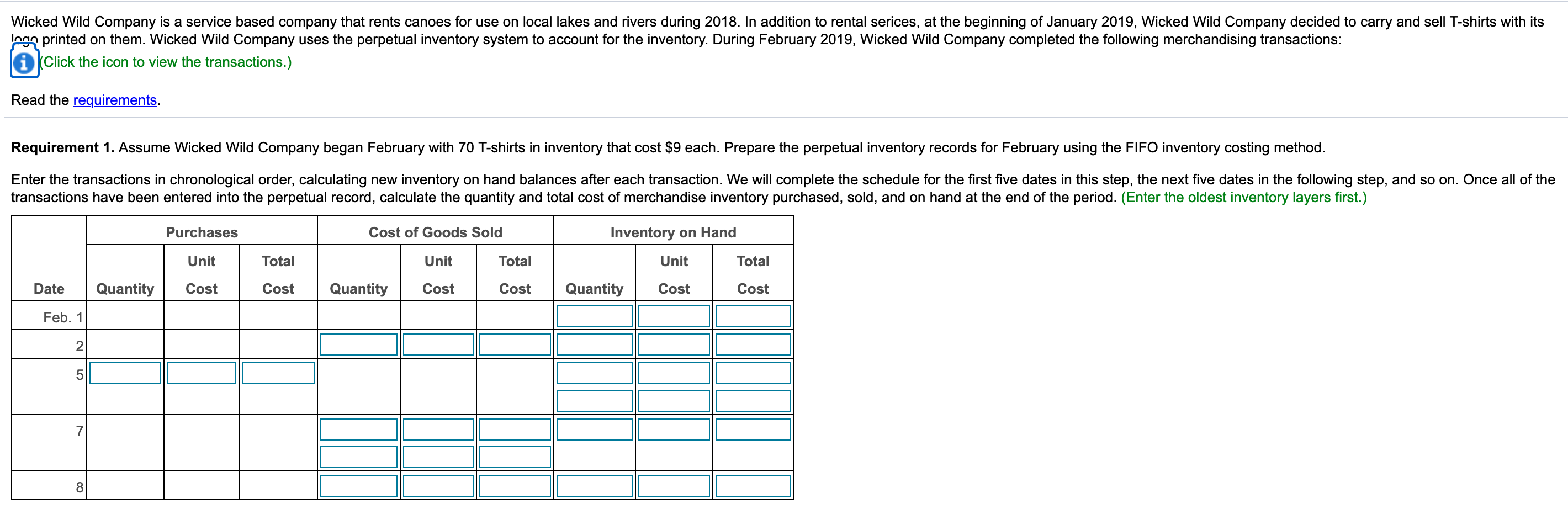

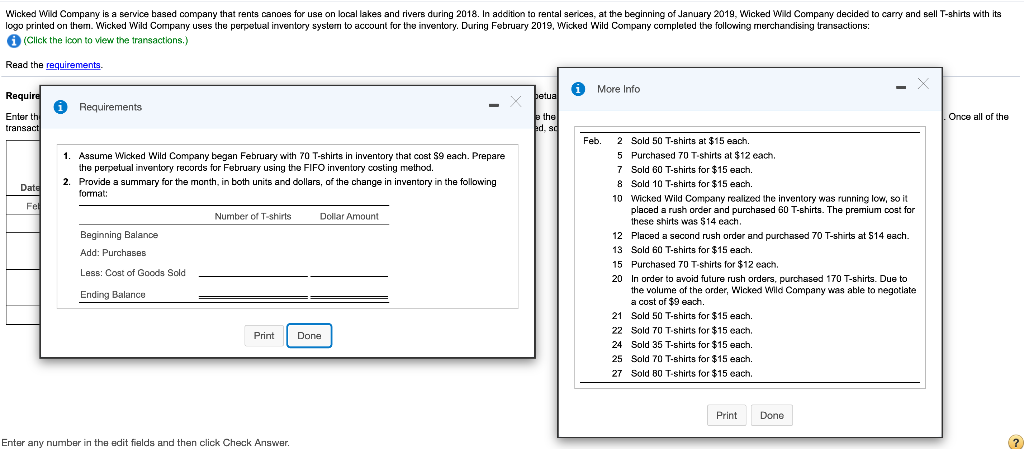

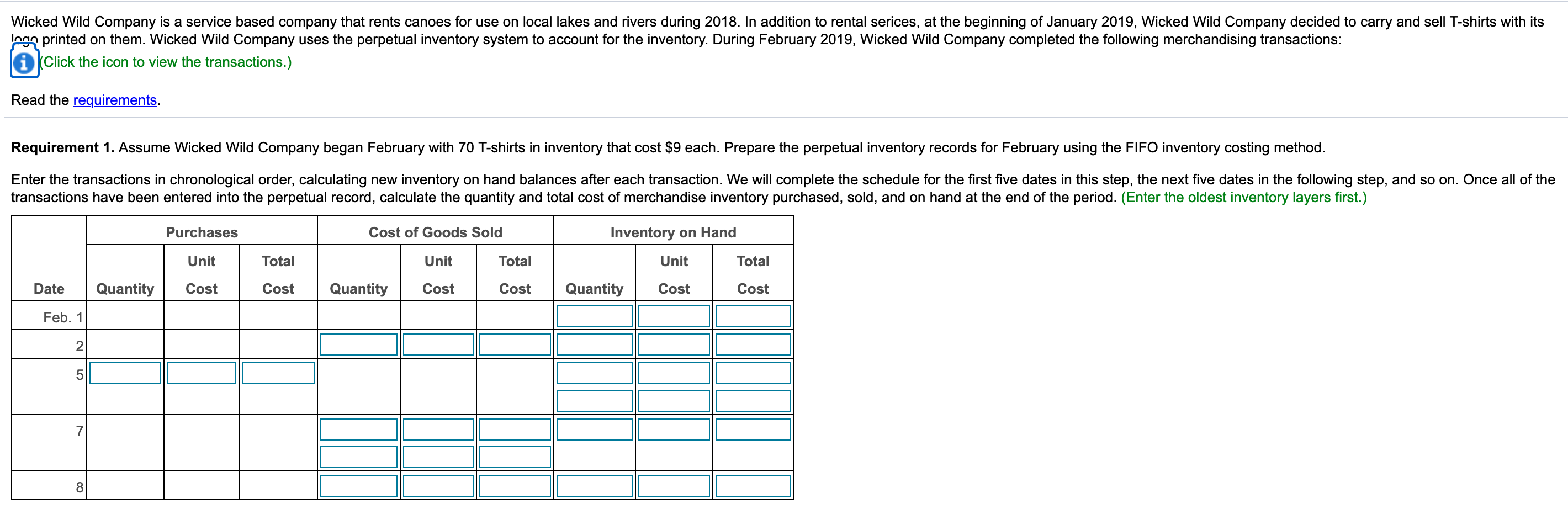

Wicked Wild Company is a service based company that rents canoes for use on local lakes and rivers during 2018. In addition to rental serices, at the beginning of January 2019, Wicked Wild Company decided to carry and sell T-shirts with its logo printed on them. Wicked Wild Company uses the perpetual inventory system to account for the inventory. During February 2019, Wicked Wild Company completed the following merchandising transactions: (Click the icon to view the transactions.) Read the requirements More Info Require betua i Requirements the Once all of the Enter th transact ed, ad Feb. 1. Assume Wicked Wild Company began February with 70 T-shirts in inventory that cost $9 each. Prepare the perpetual inventory records for February using the FIFO inventory costing method. 2. Provide a summary for the month, in both units and dollars, of the change in inventory in the following format: Date Fel Number of T-shirts Dollar Amount Beginning Balance Add: Purchases 2 Sold 50 T-shirts at $15 each. 5 Purchased 70 T-shirts at $12 each. 7 Sold 60 T-shirts for $15 each. 8 Sold 10 T-shirts for $15 each. 10 Wicked Wild Company realized the inventory was running low, so it placed a rush order and purchased 60 T-shirts. The premium cost for these shirts was $14 each. 12 Placed a second rush order and purchased 70 T-shirts at S14 each. 13 Sold 60 T-shirts for $15 each. 15 Purchased 70 T-Shirts for $12 each. 20 In order to avoid future rush orders, purchased 170 T-shirts. Due to the volume of the order, Wicked Wild Company was able to negotiate a cost of $9 each 21 Sold 50 T-shirts for $15 each. 22 Sold 70 T-shirts for $15 each. 24 Sold 35 T-shirts for $15 each. 25 Sold 70 T-shirts for $15 each. 27 Sold T-shirts for $15 each Less: Cost of Goods Sold Ending Balance Print Done Print Done Enter any number in the edit fields and then click Check Answer. 2 Wicked Wild Company is a service based company that rents canoes for use on local lakes and rivers during 2018. In addition to rental serices, at the beginning of January 2019, Wicked Wild Company decided to carry and sell T-shirts with its Ipan printed on them. Wicked Wild Company uses the perpetual inventory system to account for the inventory. During February 2019, Wicked Wild Company completed the following merchandising transactions: Click the icon to view the transactions.) Read the requirements. Requirement 1. Assume Wicked Wild Company began February with 70 T-shirts in inventory that cost $9 each. Prepare the perpetual inventory records for February using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. We will complete the schedule for the first five dates in this step, the next five dates in the following step, and so on. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Feb. 1 2. 5 8