Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Widget Ltd. makes and sells two lines of vacuum cleaners: Regular and Deluxe. Widget has a small factory and a showroom/store. The company has

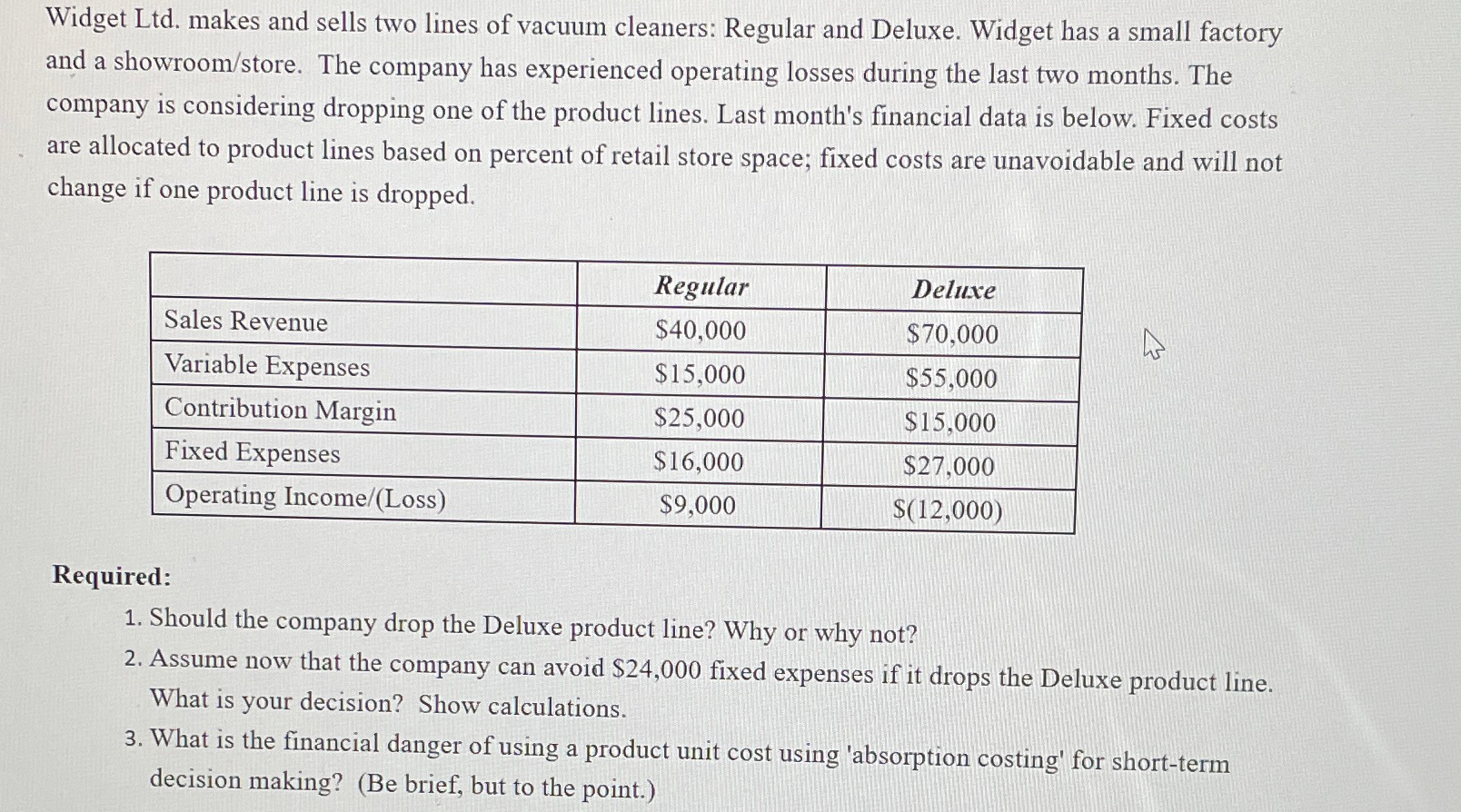

Widget Ltd. makes and sells two lines of vacuum cleaners: Regular and Deluxe. Widget has a small factory and a showroom/store. The company has experienced operating losses during the last two months. The company is considering dropping one of the product lines. Last month's financial data is below. Fixed costs are allocated to product lines based on percent of retail store space; fixed costs are unavoidable and will not change if one product line is dropped. Regular Deluxe Sales Revenue $40,000 $70,000 Variable Expenses $15,000 $55,000 Contribution Margin $25,000 $15,000 Fixed Expenses $16,000 $27,000 Operating Income/(Loss) $9,000 $(12,000) Required: 1. Should the company drop the Deluxe product line? Why or why not? 2. Assume now that the company can avoid $24,000 fixed expenses if it drops the Deluxe product line. What is your decision? Show calculations. 3. What is the financial danger of using a product unit cost using 'absorption costing' for short-term decision making? (Be brief, but to the point.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started