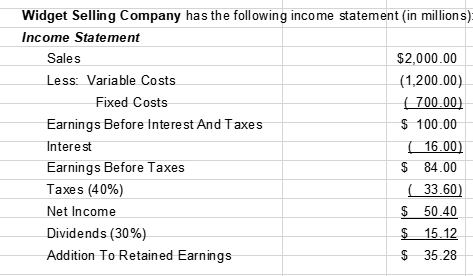

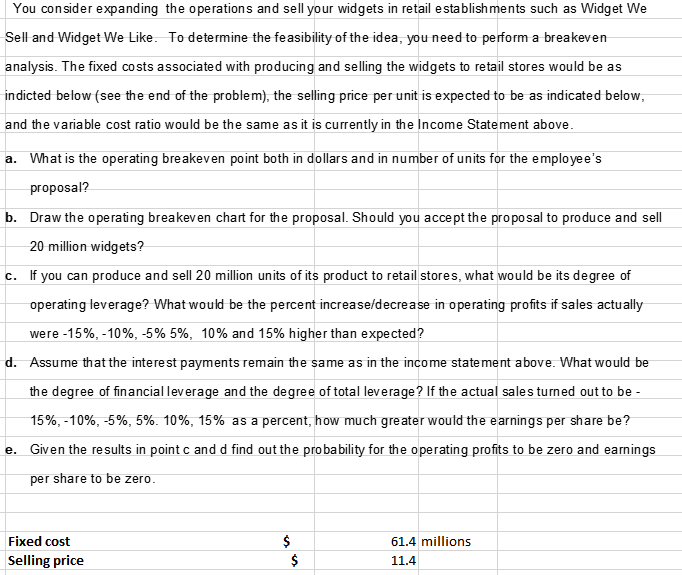

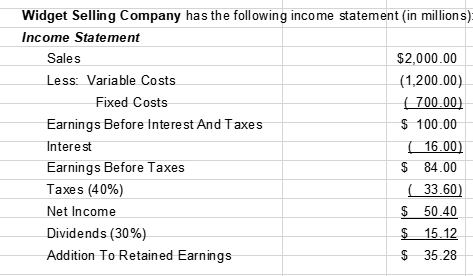

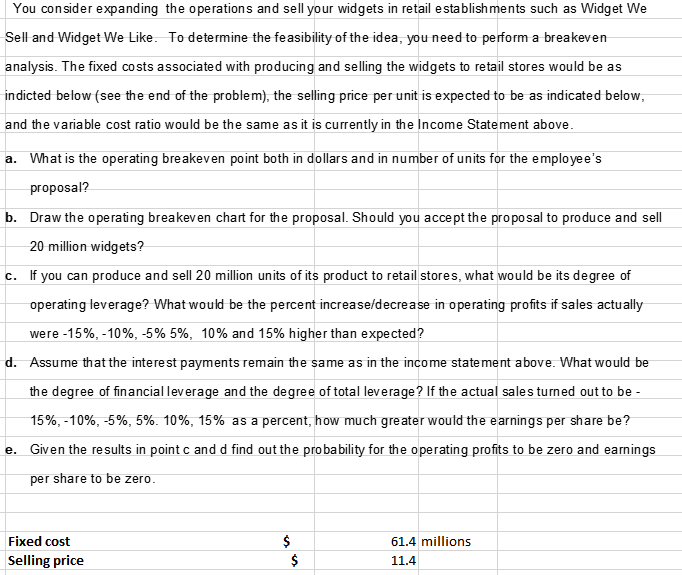

Widget Selling Company has the following income statement (in millions) Income Statement Sales $2,000.00 Less: Variable Costs (1,200.00) Fixed Costs | 700.00) Earnings Before Interest And Taxes $ 100.00 Interest 16.00) Earnings Before Taxes $ 84.00 Taxes (40%) (33.60) Net Income $ 50.40 Dividends (30%) $15.12 Addition To Retained Earnings $ 35.28 You consider expanding the operations and sell your widgets in retail establishments such as Widget We Sell and Widget We Like. To determine the feasibility of the idea, you need to perform a breakeven analysis. The fixed costs associated with producing and selling the widgets to retail stores would be as indicted below (see the end of the problem), the selling price per unit is expected to be as indicated below, and the variable cost ratio would be the same as it is currently in the Income Statement above. a. What is the operating breakeven point both in dollars and in number of units for the employee's proposal? b. Draw the operating breakeven chart for the proposal. Should you accept the proposal to produce and sell 20 million widgets? c. If you can produce and sell 20 million units of its product to retail stores, what would be its degree of operating leverage? What would be the percent increase/decrease in operating profits if sales actually were -15%, -10%, -5% 5%, 10% and 15% higher than expected? d. Assume that the interest payments remain the same as in the income statement above. What would be the degree of financial leverage and the degree of total leverage? If the actual sales turned out to be- 15%, -10%, -5%, 5%. 10%, 15% as a percent, how much greater would the earnings per share be? e. Given the results in point c and d find out the probability for the operating profits to be zero and earnings per share to be zero. Fixed cost Selling price $ $ 61.4 millions 11.4 Widget Selling Company has the following income statement (in millions) Income Statement Sales $2,000.00 Less: Variable Costs (1,200.00) Fixed Costs | 700.00) Earnings Before Interest And Taxes $ 100.00 Interest 16.00) Earnings Before Taxes $ 84.00 Taxes (40%) (33.60) Net Income $ 50.40 Dividends (30%) $15.12 Addition To Retained Earnings $ 35.28 You consider expanding the operations and sell your widgets in retail establishments such as Widget We Sell and Widget We Like. To determine the feasibility of the idea, you need to perform a breakeven analysis. The fixed costs associated with producing and selling the widgets to retail stores would be as indicted below (see the end of the problem), the selling price per unit is expected to be as indicated below, and the variable cost ratio would be the same as it is currently in the Income Statement above. a. What is the operating breakeven point both in dollars and in number of units for the employee's proposal? b. Draw the operating breakeven chart for the proposal. Should you accept the proposal to produce and sell 20 million widgets? c. If you can produce and sell 20 million units of its product to retail stores, what would be its degree of operating leverage? What would be the percent increase/decrease in operating profits if sales actually were -15%, -10%, -5% 5%, 10% and 15% higher than expected? d. Assume that the interest payments remain the same as in the income statement above. What would be the degree of financial leverage and the degree of total leverage? If the actual sales turned out to be- 15%, -10%, -5%, 5%. 10%, 15% as a percent, how much greater would the earnings per share be? e. Given the results in point c and d find out the probability for the operating profits to be zero and earnings per share to be zero. Fixed cost Selling price $ $ 61.4 millions 11.4