Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Widgets, Inc., which is not a large corporation, paid income tax in Year 1 in the amount of $35,000. For Year 2, their total

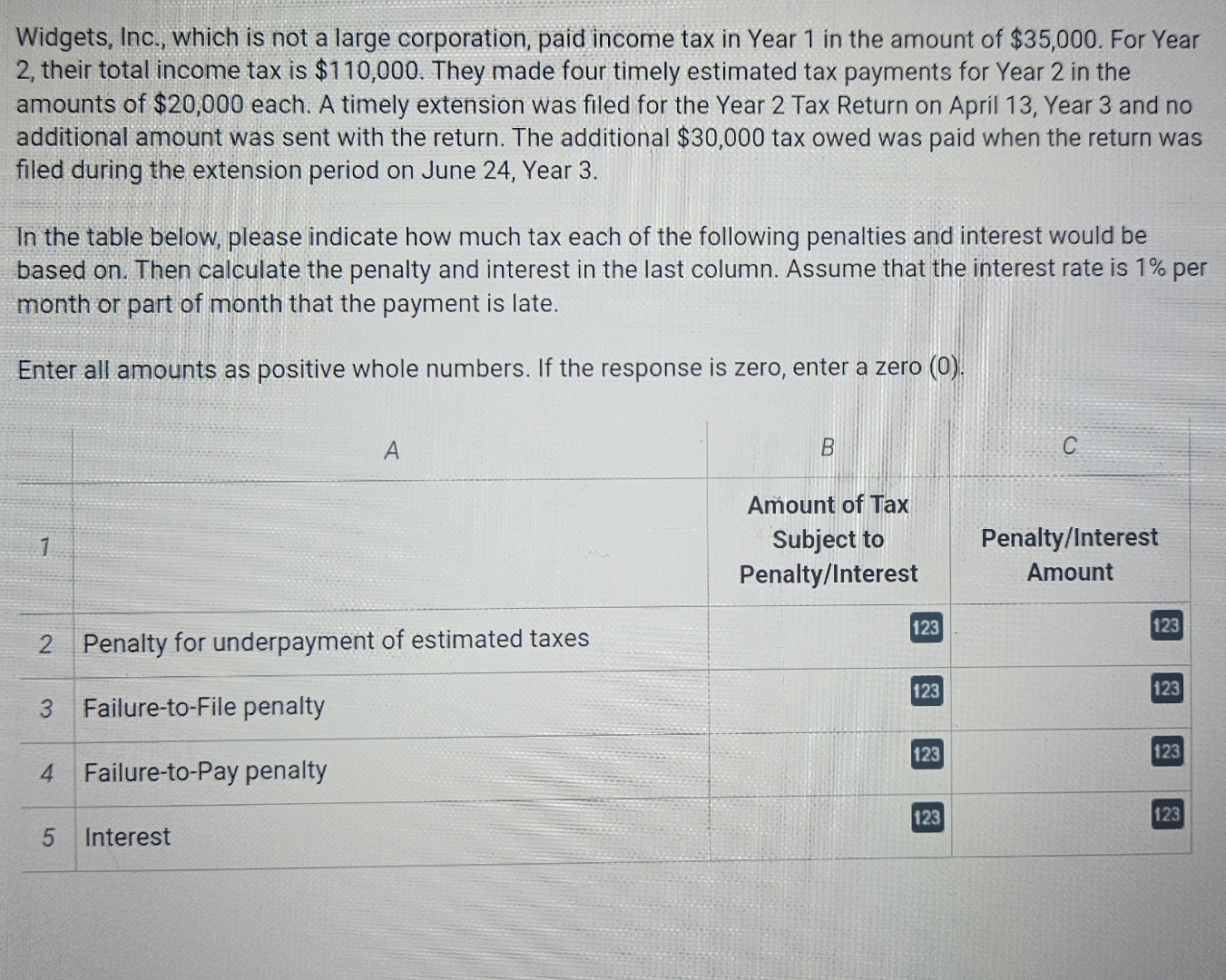

Widgets, Inc., which is not a large corporation, paid income tax in Year 1 in the amount of $35,000. For Year 2, their total income tax is $110,000. They made four timely estimated tax payments for Year 2 in the amounts of $20,000 each. A timely extension was filed for the Year 2 Tax Return on April 13, Year 3 and no additional amount was sent with the return. The additional $30,000 tax owed was paid when the return was filed during the extension period on June 24, Year 3. In the table below, please indicate how much tax each of the following penalties and interest would be based on. Then calculate the penalty and interest in the last column. Assume that the interest rate is 1% per month or part of month that the payment is late. Enter all amounts as positive whole numbers. If the response is zero, enter a zero (0). 1 A 2 Penalty for underpayment of estimated taxes 3 Failure-to-File penalty 4 Failure-to-Pay penalty 5 Interest B C Amount of Tax Subject to Penalty/Interest Penalty/Interest Amount 123 123 123 123 123 123 123 123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets calculate the penalties and interest for Widgets Inc based on the provided information A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started