Answered step by step

Verified Expert Solution

Question

1 Approved Answer

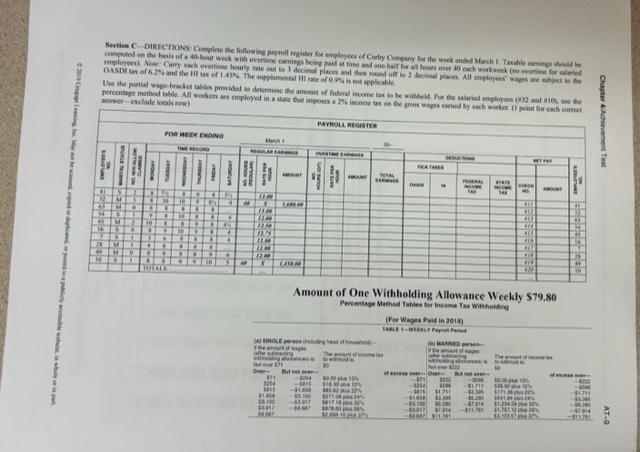

wigan picty amable 39 Cenge Leaming Mescopo dplice, se pod v Section C-DIRECTIONS: Complete the following payroll register for employees of Carty Company for

wigan picty amable 39 Cenge Leaming Mescopo dplice, se pod v Section C-DIRECTIONS: Complete the following payroll register for employees of Carty Company for the week ended March 1. Taxable canings should be computed on the basis of a 40-hour week with overtime camings being paid at time and one-half for all hours over 40 cach workweek (no overtime employees). Noe Carry each overtime hourly rate out to 3 decimal places and the round off to 2 decimal places. All employees wages OASDI tax of 6.2% and the H te of 1.45%. The supplemental 1 rate of 0.9% is not applicable salaried subject to the Use the partial wage-bracket tables provided to determine the amount of foderal income tax to be widheid. For the salaried employees (832 and #10, the percentage method table. All workers are employed in a state that imposes a 2% income tax on the gross wages earned by each worker. (1 point for each cont answer-exclude totals row) PAYROLL REGISTER M M B FOR WEEK ENDING TOTALS 16 RECORD 14 # 4 L 4 4 3# REA March 13.40 13.00 1200 12.M 12.25 12.M 220 1200 Over TAP 971 1214 I $14 $3.100 31/ 19.37 L T OVER SINGLE er onding head of the amou H But not even 3214 -15 -ALASA $100 -41807 -0.007 AMANT 0.001% $13 8271 Ope 6 TOTAL s 320 45 3.25 FATAKER 1 19 Amount of One Withholding Allowance Weekly $79.80 Percentage Method Tabies for Income Tax Withholding (For Wages Paid in 2018) TABLE-WEEKLY P MARRIED per over of Ove FEDERAL stare MOME WCOM CHECK TAR 1002 -8254 -I $1,211 $1.000 kum -$1100 M -4330 3314 422 $11.791 MET PAY the 8171 --$1.30 sin M 1141 -82314 -411361 CITA 412 418 414 413 416 # 418 373 121 AMOUNT 11,21424164 32 $15. ASEM f POHOSTIRRA ---------- -404 -811.191 Chapter 4 Achievement Test AT-9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started