Question

Wigorn Bros. has a petty cash fund of $150. The following items were paid this fund during the month of August. (a) Enter these payments

Wigorn Bros. has a petty cash fund of $150. The following items were paid this fund during the month of August.

(a) Enter these payments on a petty cash sheet, beginning with Vol

#44. Ask your instructor which of the following tax rates to use:

i. No taxes

hi. Add 5% GST only ifi. Add 13% HST

iv. Add 5% GST + 7% PST

20-

Aug. 6 Broom for the warehouse, $12.08.

8 Coffee and creamer for the staff room, $16.25 (tax exempt)

9 Delivery of special order of office supplies, $7.88.

12 Pens for office, $7.35.

14 Special order of merchandise, $23.52.

15 Delivery of sale brochures, $22.89.

16 Masking tape for warehouse, $6.09.

20 Donation to charity, $20 (tax exempt).

22 Pens and pencils for the office, $6.51.

24 Postage, $6.62.

(b) 'Total the petty cash sheet and prove equal debits and credits. Calculate the cash on hand.

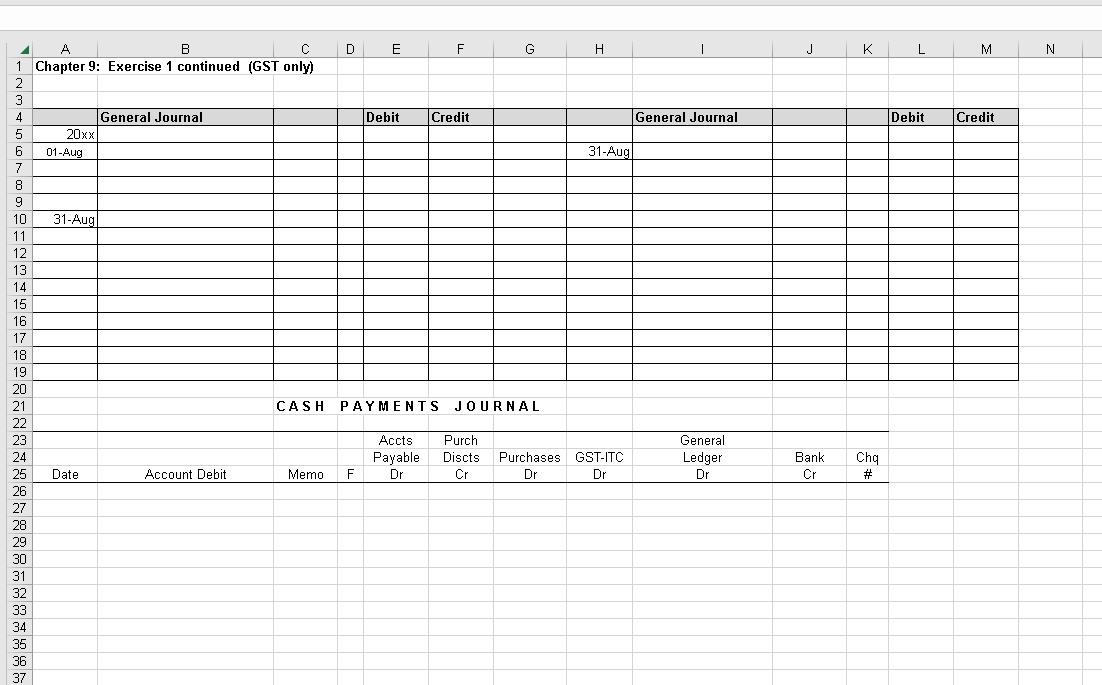

(c) Prepare a General Journal entry to establish the fund on August 1.

(d) Prepare a General Journal entry to reimburse the fund at month-end. Cheque #101 was issued.

(e) Prepare a General Journal entry to increase the petty cash fund to $200.

(F) Prepare a Cash Payments Journal entry to reimburse the fund at month-end, Cheque #101 was issued.

NOTE: PLEASE ANSWER THE QUESTION ON THE ATTACHED SPREADSHEET.

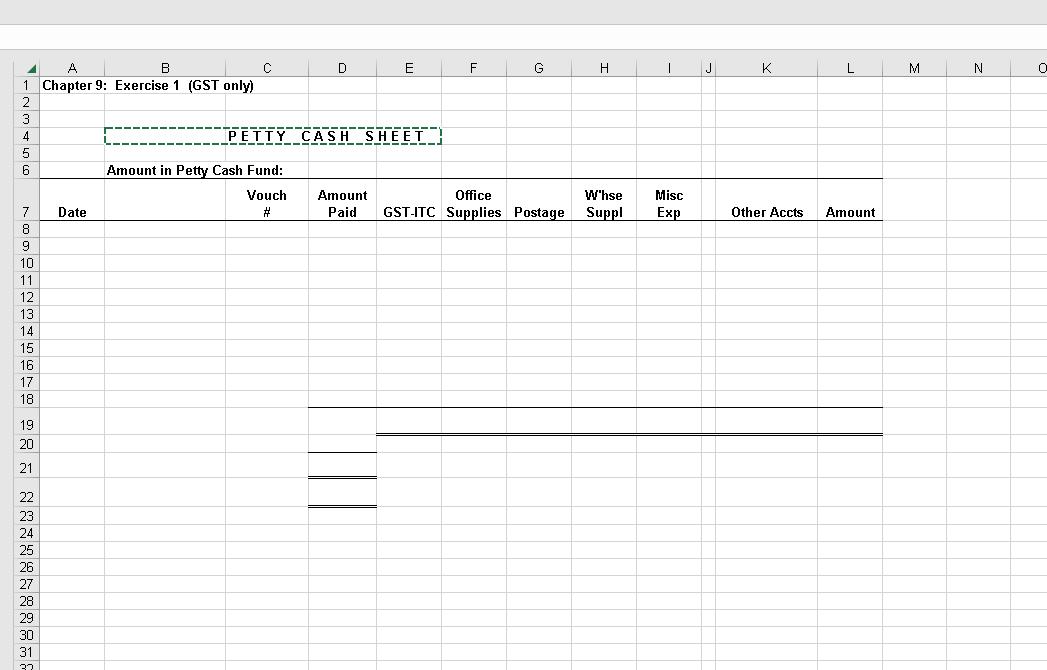

A 1 Chapter 9: Exercise 1 (GST only) 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Date D Amount in Petty Cash Fund: Vouch # PETTY CASH SHEET E Amount Paid F G Office GST-ITC Supplies Postage H W'hse Suppl I Misc Exp J K Other Accts L Amount M N 0

Step by Step Solution

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed workings a Petty Cash Sheet using tax rate of 5 GST 7 PST Vol Date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started