Answered step by step

Verified Expert Solution

Question

1 Approved Answer

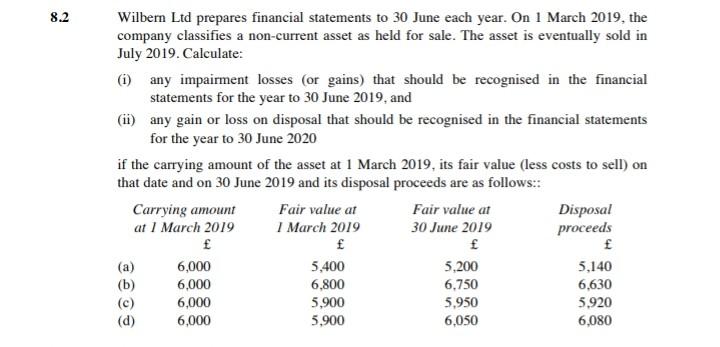

Wilbern Ltd prepares financial statements to 30 June each year. On 1 March 2019, the company classifies a non-current asset as held for sale. The

Wilbern Ltd prepares financial statements to 30 June each year. On 1 March 2019, the company classifies a non-current asset as held for sale. The asset is eventually sold in July 2019. Calculate: (i) any impairment losses (or gains) that should be recognised in the financial statements for the year to 30 June 2019, and (ii) any gain or loss on disposal that should be recognised in the financial statements for the year to 30 June 2020 if the carrying amount of the asset at 1 March 2019, its fair value (less costs to sell) on that date and on 30 June 2019 and its disposal proceeds are as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started