Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wild Things, a zoo management company, has asked your team to evaluate a proposed capital budgeting project. Your team has been charged with analyzing

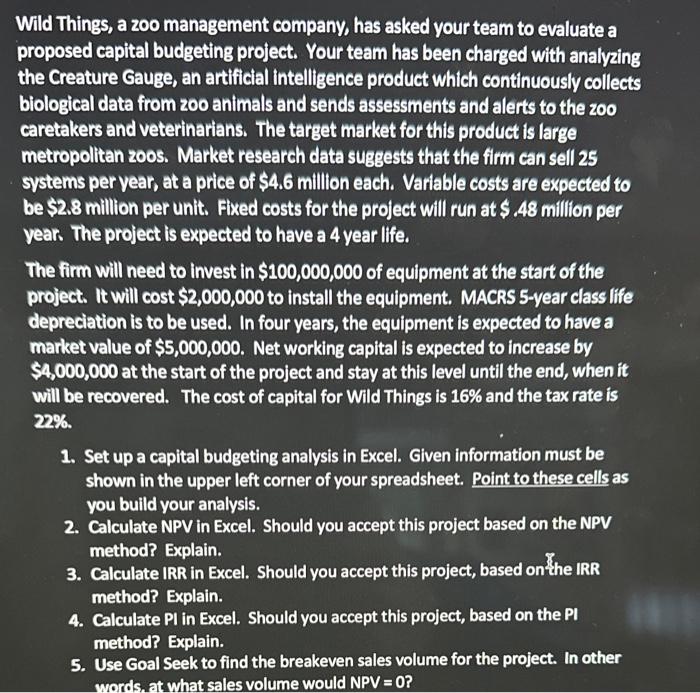

Wild Things, a zoo management company, has asked your team to evaluate a proposed capital budgeting project. Your team has been charged with analyzing the Creature Gauge, an artificial intelligence product which continuously collects biological data from zoo animals and sends assessments and alerts to the zoo caretakers and veterinarians. The target market for this product is large metropolitan zoos. Market research data suggests that the firm can sell 25 systems per year, at a price of $4.6 million each. Variable costs are expected to be $2.8 million per unit. Fixed costs for the project will run at $.48 million per year. The project is expected to have a 4 year life. The firm will need to invest in $100,000,000 of equipment at the start of the project. It will cost $2,000,000 to install the equipment. MACRS 5-year class life depreciation is to be used. In four years, the equipment is expected to have a market value of $5,000,000. Net working capital is expected to increase by $4,000,000 at the start of the project and stay at this level until the end, when it will be recovered. The cost of capital for Wild Things is 16% and the tax rate is 22%. 1. Set up a capital budgeting analysis in Excel. Given information must be shown in the upper left corner of your spreadsheet. Point to these cells as you build your analysis. 2. Calculate NPV in Excel. Should you accept this project based on the NPV method? Explain. 3. Calculate IRR in Excel. Should you accept this project, based on the IRR method? Explain. 4. Calculate Pl in Excel. Should you accept this project, based on the Pl method? Explain. 5. Use Goal Seek to find the breakeven sales volume for the project. In other words, at what sales volume would NPV = 0?

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To set up the analysis in Excel we can create a table that lists the cash flows for each year of the project and then use Excels builtin functions to calculate the NPV IRR and PI In the upper left cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started