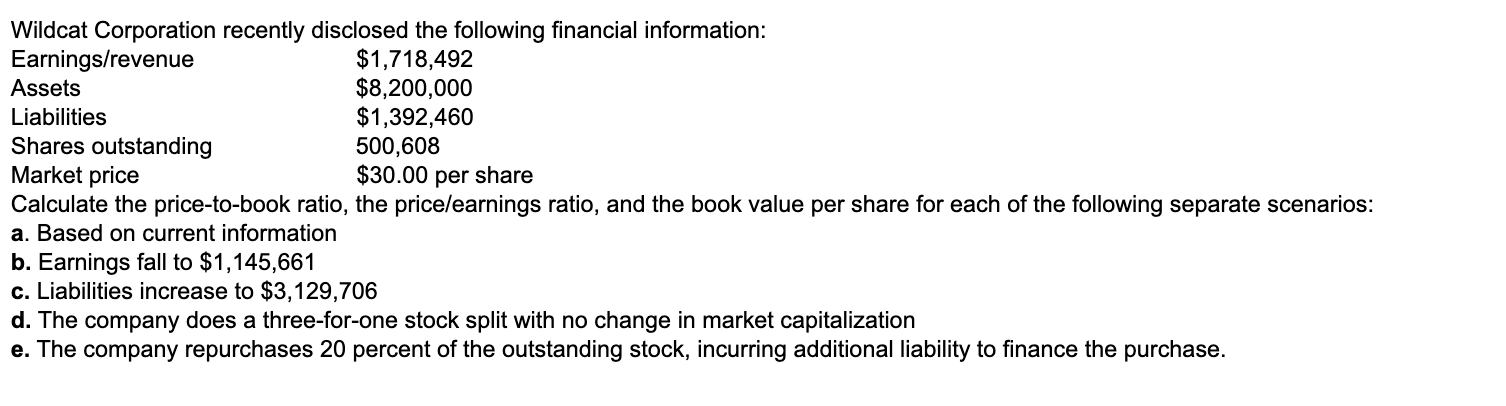

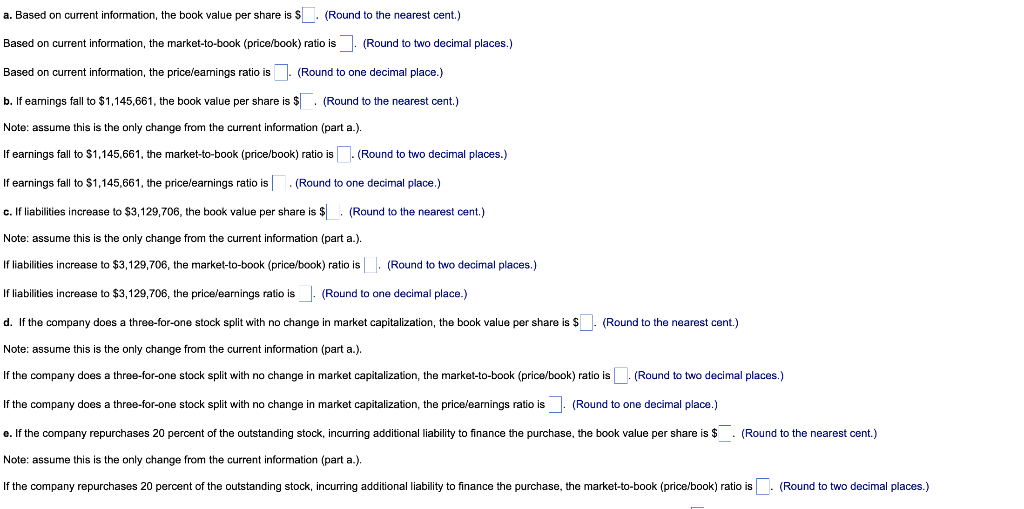

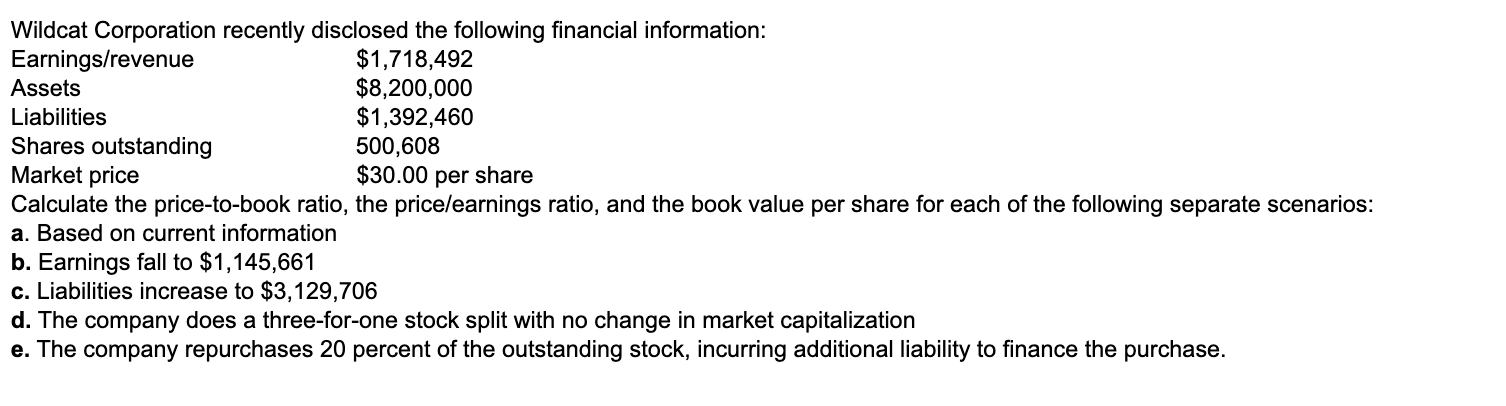

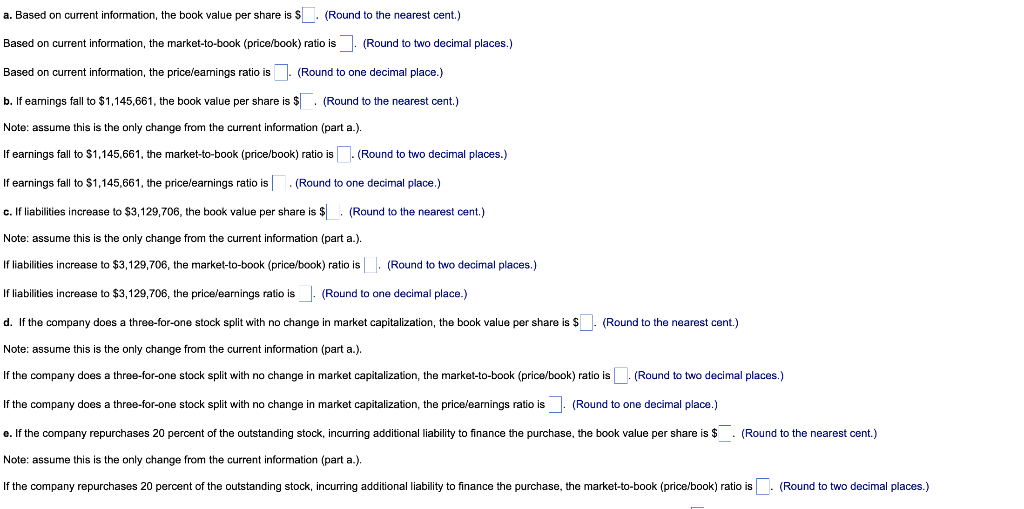

Wildcat Corporation recently disclosed the following financial information: Calculate the price-to-book ratio, the price/earnings ratio, and the book value per share for each of the following separate scenarios: a. Based on current information b. Earnings fall to $1,145,661 c. Liabilities increase to $3,129,706 d. The company does a three-for-one stock split with no change in market capitalization e. The company repurchases 20 percent of the outstanding stock, incurring additional liability to finance the purchase. a. Based on current information, the book value per share is $ (Round to the nearest cent.) Based on current information, the market-to-book (price/book) ratio is (Round to two decimal places.) Based on current information, the price/earnings ratio is (Round to one decimal place.) b. If eamings fall to $1,145,661, the book value per share is $ (Round to the nearest cent.) Note: assume this is the only change from the current information (part a.). If earnings fall to $1,145,661, the market-to-book (price/book) ratio is (Round to two decimal places.) If earnings fall to $1,145,661, the price/earnings ratio is . (Round to one decimal place.) c. If liabilities increase to $3,129,706, the book value per share is $ (Round to the nearest cent.) Note: assume this is the only change from the current information (part a.). If liabilities increase to $3,129,706, the market-to-book (price/book) ratio is (Round to two decimal places.) If liabilities increase to $3,129,706, the price/earnings ratio is (Round to one decimal place.) d. If the company does a three-for-one stock split with no change in market capitalization, the book value per share is \& Note: assume this is the only change from the current information (part a.). If the company does a three-for-one stock split with no change in market capitalization, the market-to-book (price/book) ratio is If the company does a three-for-one stock split with no change in market capitalization, the price/earnings ratio is . (Round to one decimal place.) Note: assume this is the only change from the current information (part a.). If the company repurchases 20 percent of the outstanding stock, incurring additional liability to finance the purchase, the market-to-book (price/book) ratio is (Round to two decimal places.) Wildcat Corporation recently disclosed the following financial information: Calculate the price-to-book ratio, the price/earnings ratio, and the book value per share for each of the following separate scenarios: a. Based on current information b. Earnings fall to $1,145,661 c. Liabilities increase to $3,129,706 d. The company does a three-for-one stock split with no change in market capitalization e. The company repurchases 20 percent of the outstanding stock, incurring additional liability to finance the purchase. a. Based on current information, the book value per share is $ (Round to the nearest cent.) Based on current information, the market-to-book (price/book) ratio is (Round to two decimal places.) Based on current information, the price/earnings ratio is (Round to one decimal place.) b. If eamings fall to $1,145,661, the book value per share is $ (Round to the nearest cent.) Note: assume this is the only change from the current information (part a.). If earnings fall to $1,145,661, the market-to-book (price/book) ratio is (Round to two decimal places.) If earnings fall to $1,145,661, the price/earnings ratio is . (Round to one decimal place.) c. If liabilities increase to $3,129,706, the book value per share is $ (Round to the nearest cent.) Note: assume this is the only change from the current information (part a.). If liabilities increase to $3,129,706, the market-to-book (price/book) ratio is (Round to two decimal places.) If liabilities increase to $3,129,706, the price/earnings ratio is (Round to one decimal place.) d. If the company does a three-for-one stock split with no change in market capitalization, the book value per share is \& Note: assume this is the only change from the current information (part a.). If the company does a three-for-one stock split with no change in market capitalization, the market-to-book (price/book) ratio is If the company does a three-for-one stock split with no change in market capitalization, the price/earnings ratio is . (Round to one decimal place.) Note: assume this is the only change from the current information (part a.). If the company repurchases 20 percent of the outstanding stock, incurring additional liability to finance the purchase, the market-to-book (price/book) ratio is (Round to two decimal places.)