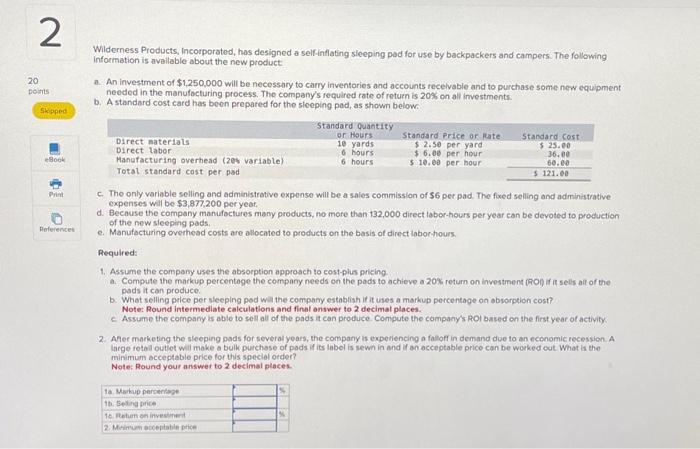

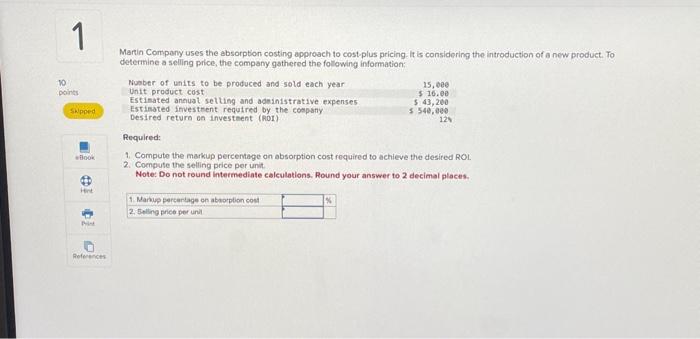

Wilderness Products, Incorporated, has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is avallable about the new product: a. An investment of $1,250,000 will be necessary to carry inventories and accounts recelvable and to purchase some new equipment needed in the manufacturing process. The company's required rate of return is 20% on all imvestments. b. A standard cost card has been prepared for the sleeping pad, as shown below. c. The only variable selling and administrative exponse will be a sales commission of $6 per pad. The fixed selling and administrative expenses will be $3,877,200 peryeat. d. Because the company manufoctures many products, no more than 132,000 direct labor-hours per year can be devoted to production of the now sleeping pads. e. Manufacturing overhead costs are allocated to products on the basis of direct labortiours. Required: 1. Assume the company uses the absorption approach to cost-plus pricing. a. Compute the markup percentoge the company needs on the pads to achieve a 20% retum on investment oron if it sels all of the pads it can produce. b. What selling pelce per sleeping pod wal the company establish if it uses a markup percentage on absorption cost? Note: Round intermediate calculations and final onswer to 2 decimal places. c. Assume the company is able to sell all of the pads it can produce. Compute the company's ROI based on the first year of activity. 2. Afer marketing the sleeping pads for several years, the company is experiencing a falloff in demand doe to an economic recession. A large retal outiot wil make a bulk purchase of pods if its label is sewn in and if an acceptable price can be worked cut What is the minimum acceptable price for this special otder? Note: Round your answer to 2 decimal places. Martin Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company gathered the following information: Required: 1. Compute the markup percentage on absorption cost required to achieve the desired ROL. 2. Compute the selling price per unit. Note: Do not round intermediate calculations. Round your answer to 2 decimal places