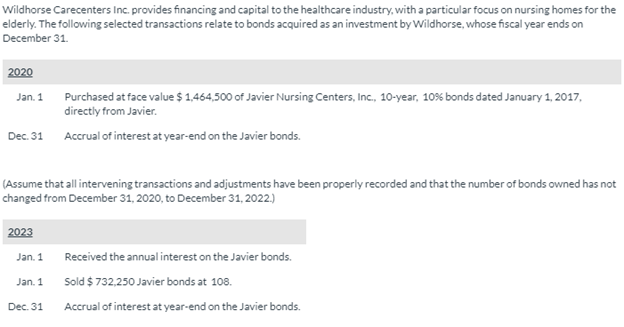

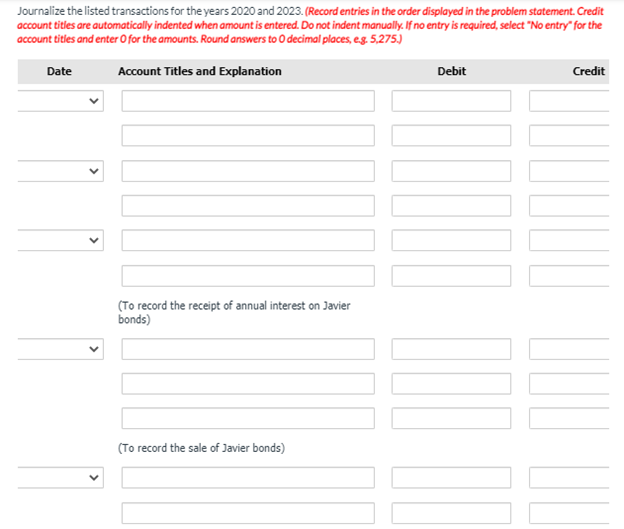

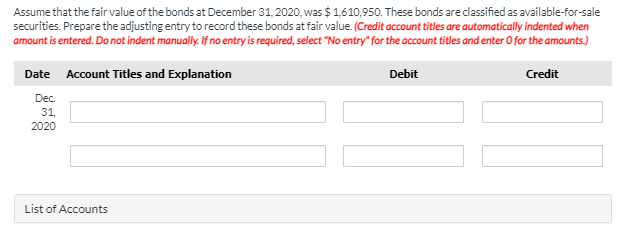

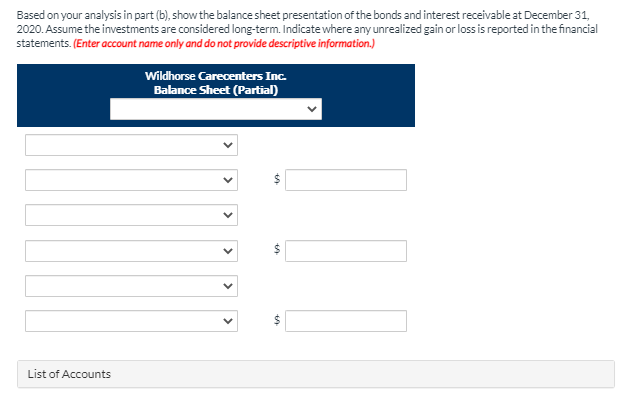

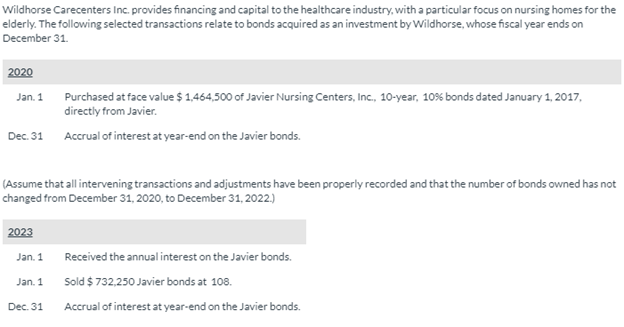

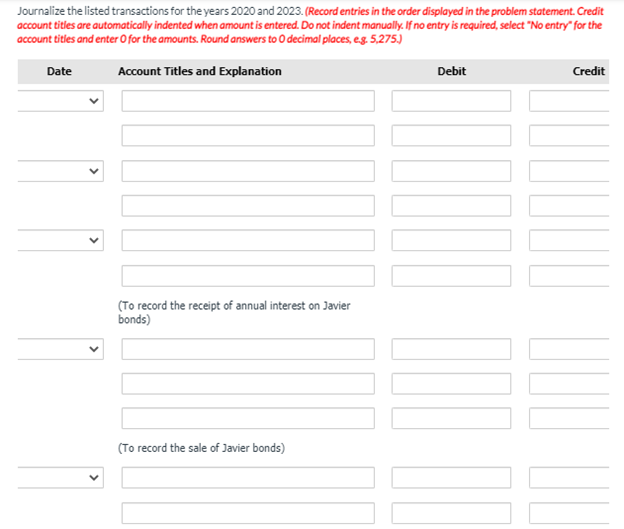

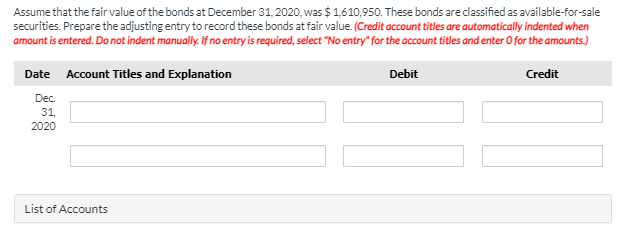

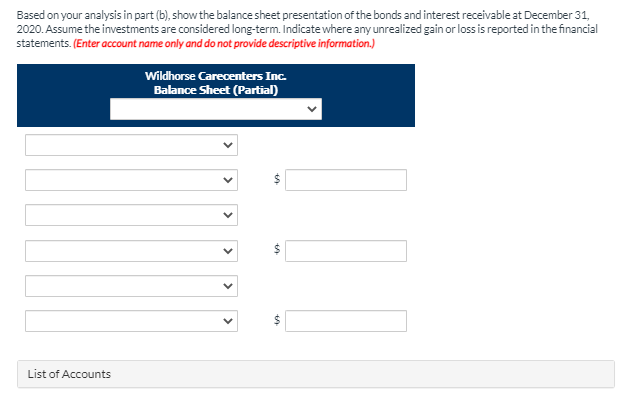

Wildhorse Carecenters Inc. provides financing and capital to the healthcare industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds acquired as an investment by Wildhorse, whose fiscal year ends on December 31 2020 Jan. 1 Purchased at face value $ 1,464,500 of Javier Nursing Centers, Inc., 10-year, 10% bonds dated January 1, 2017, directly from Javier Dec 31 Accrual of interest at year-end on the Javier bonds. (Assume that all intervening transactions and adjustments have been properly recorded and that the number of bonds owned has not changed from December 31, 2020, to December 31, 2022.) 2023 Jan. 1 Jan. 1 Received the annual interest on the Javier bonds. Sold $ 732,250 Javier bonds at 108. Accrual of interest at year-end on the Javier bonds. Dec. 31 Journalize the listed transactions for the years 2020 and 2023. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts. Round answers to decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit (To record the receipt of annual interest on Javier bonds) (To record the sale of Javier bonds) Assume that the fair value of the bonds at December 31, 2020, was $ 1,610,950. These bonds are classified as available-for-sale securities. Prepare the adjusting entry to record these bonds at fair value. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Dec. 31, 2020 List of Accounts Based on your analysis in part (b), show the balance sheet presentation of the bonds and interest receivable at December 31, 2020. Assume the investments are considered long-term. Indicate where any unrealized gain or loss is reported in the financial statements. (Enter account name only and do not provide descriptive information.) Wildhorse Carecenters Inc Balance Sheet (Partial) $