Answered step by step

Verified Expert Solution

Question

1 Approved Answer

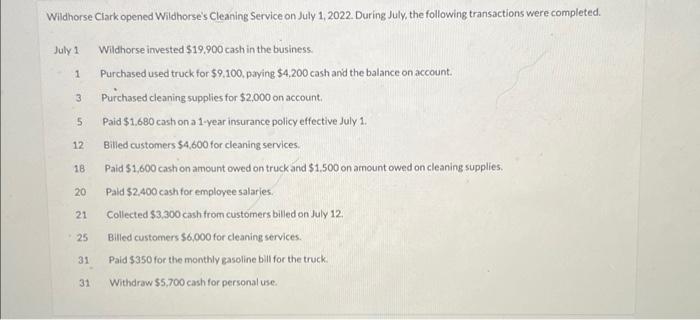

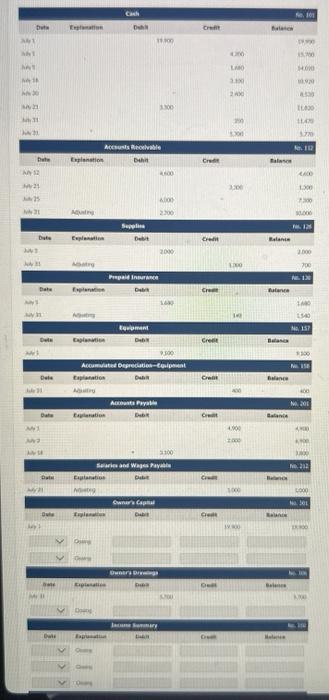

Wildhorse Clark opened Wildhorse's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 Wildhorse invested $19,900 cash in the

Step by Step Solution

There are 3 Steps involved in it

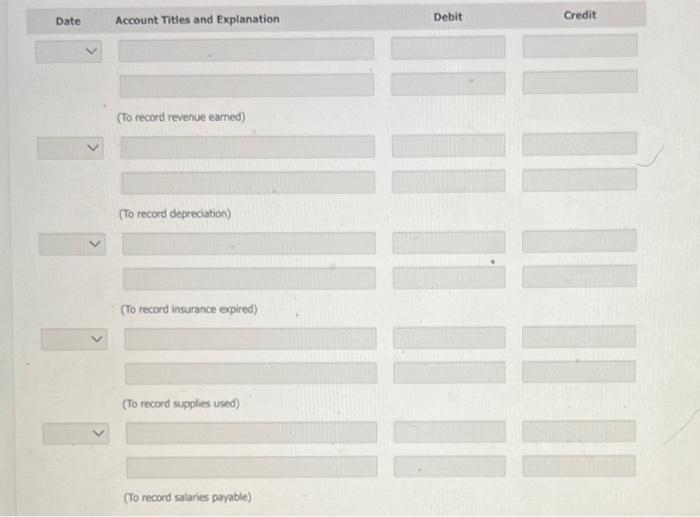

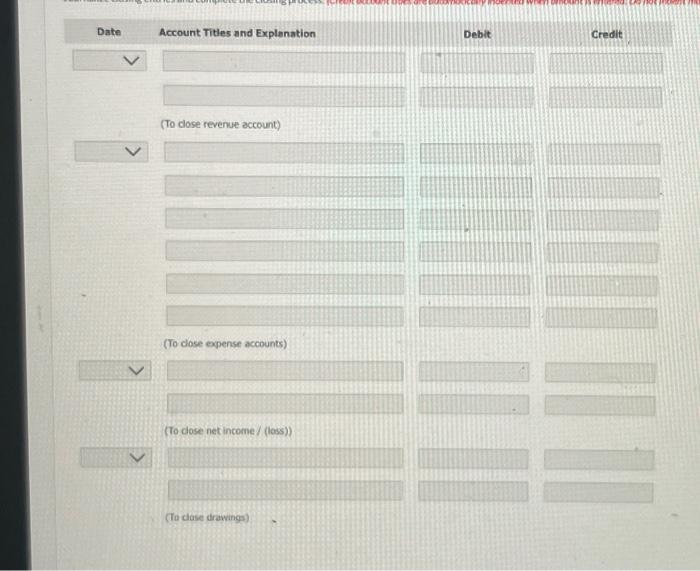

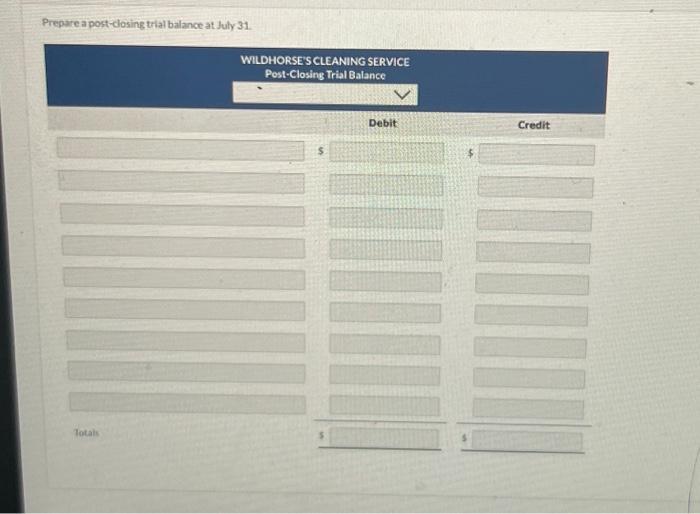

Step: 1

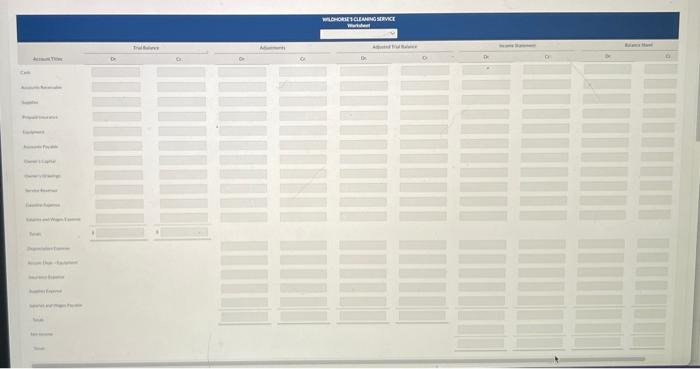

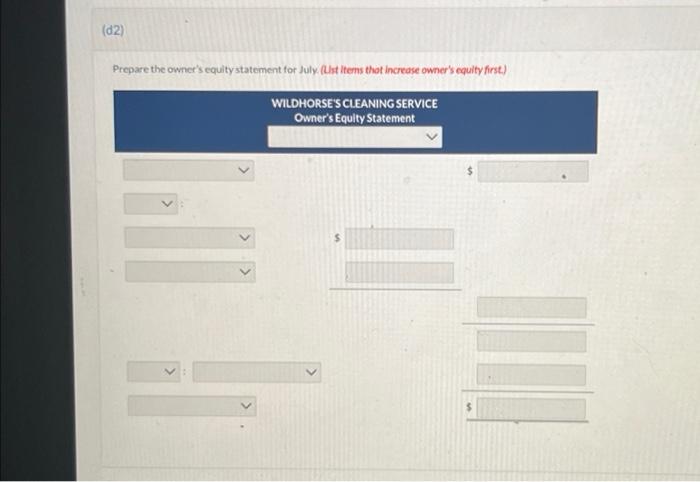

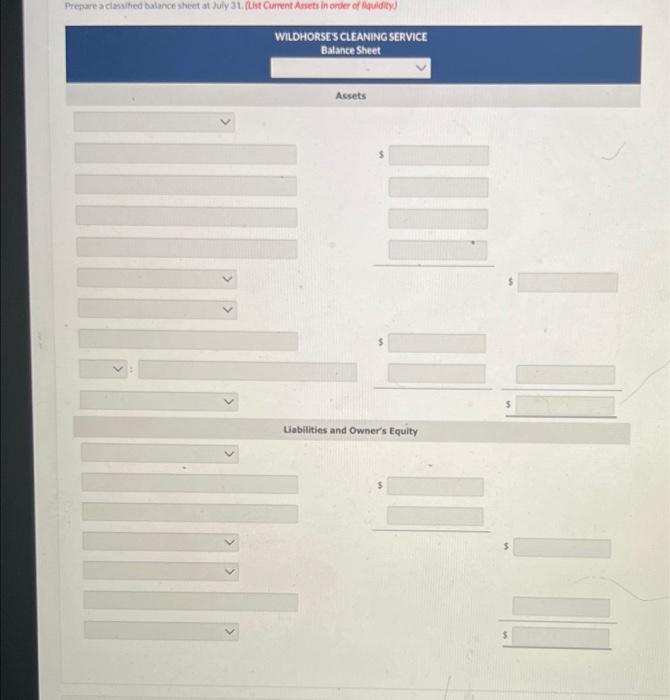

To complete the accounting tasks for Wildhorses Cleaning Service well go through the following steps 1 Prepare Financial Statements Owners Equity Stat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started