Answered step by step

Verified Expert Solution

Question

1 Approved Answer

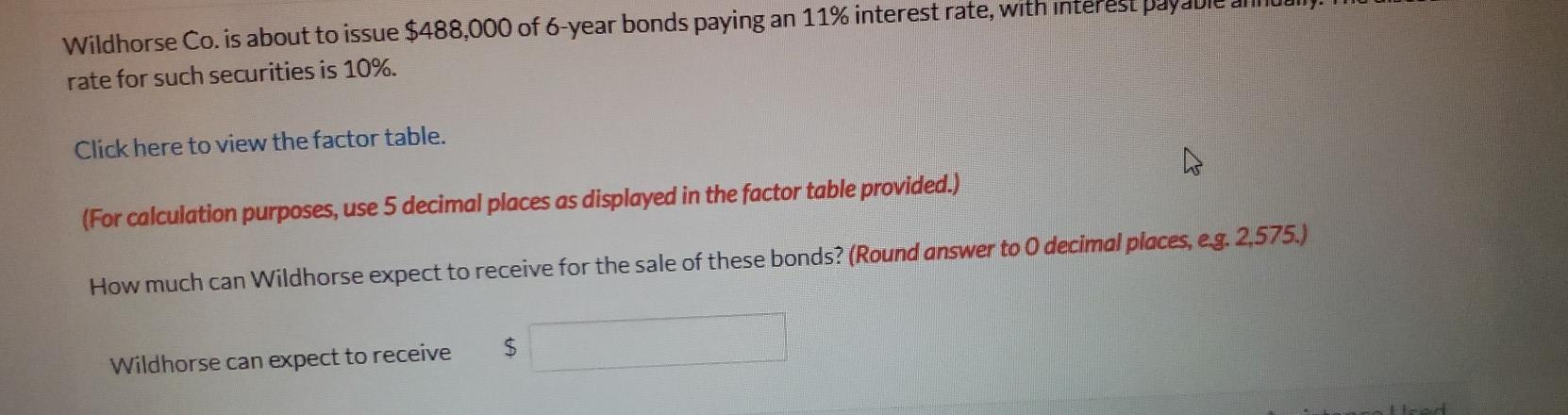

Wildhorse Co. is about to issue $488,000 of 6-year bonds paying an 11% interest rate, with interest pay rate for such securities is 10%. Click

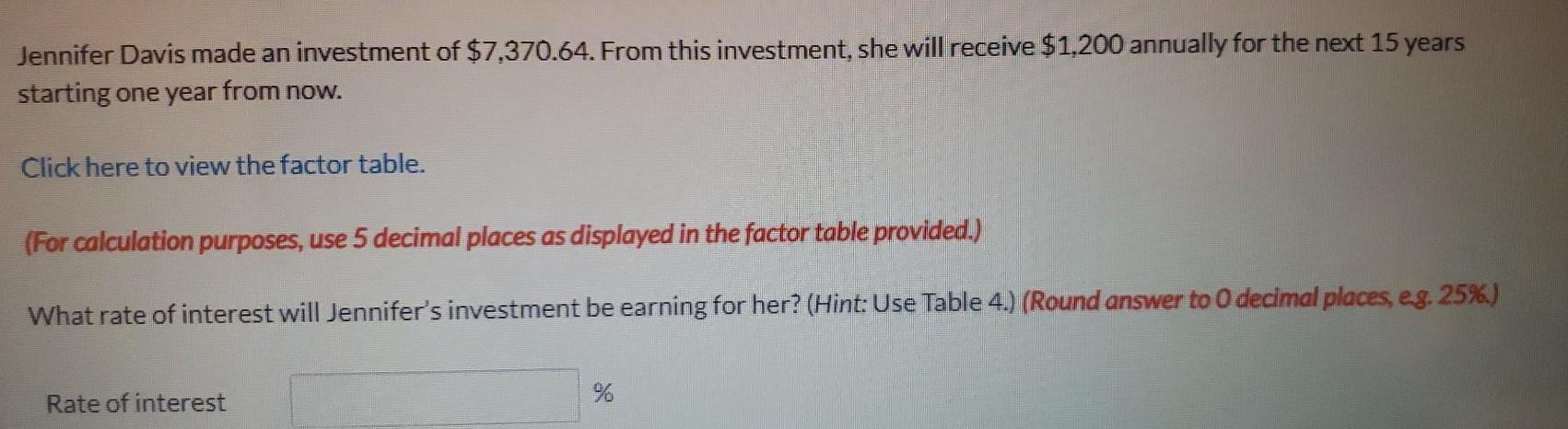

Wildhorse Co. is about to issue $488,000 of 6-year bonds paying an 11% interest rate, with interest pay rate for such securities is 10%. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) How much can Wildhorse expect to receive for the sale of these bonds? (Round answer to O decimal places, eg. 2,575.) $ Wildhorse can expect to receive ed Jennifer Davis made an investment of $7,370.64. From this investment, she will receive $1,200 annually for the next 15 years starting one year from now. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What rate of interest will Jennifer's investment be earning for her? (Hint: Use Table 4.) (Round answer to O decimal places, eg. 25%6) Rate of interest % Wildhorse Co. is about to issue $488,000 of 6-year bonds paying an 11% interest rate, with interest pay rate for such securities is 10%. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) How much can Wildhorse expect to receive for the sale of these bonds? (Round answer to O decimal places, eg. 2,575.) $ Wildhorse can expect to receive ed Jennifer Davis made an investment of $7,370.64. From this investment, she will receive $1,200 annually for the next 15 years starting one year from now. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What rate of interest will Jennifer's investment be earning for her? (Hint: Use Table 4.) (Round answer to O decimal places, eg. 25%6) Rate of interest %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started