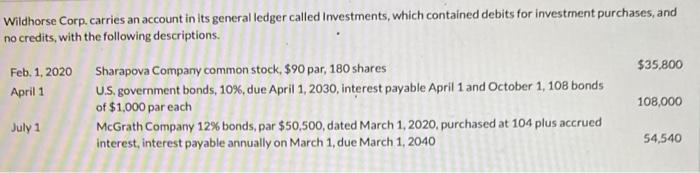

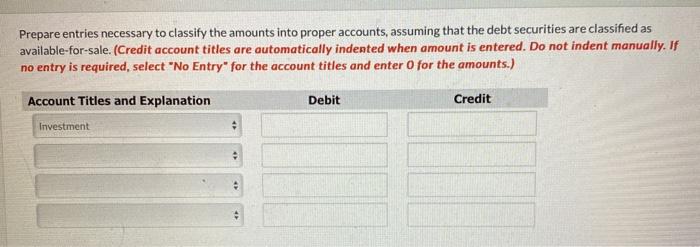

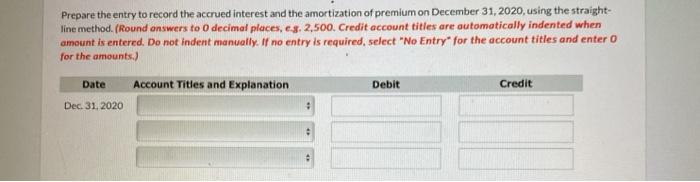

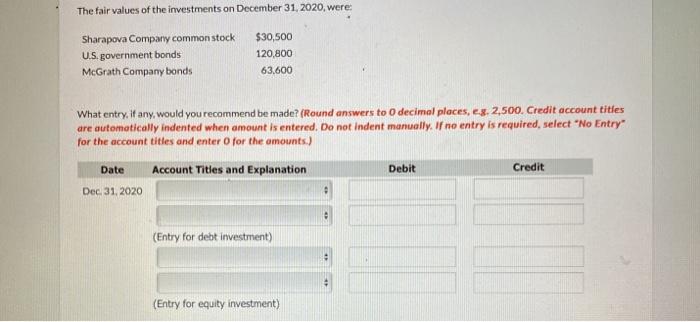

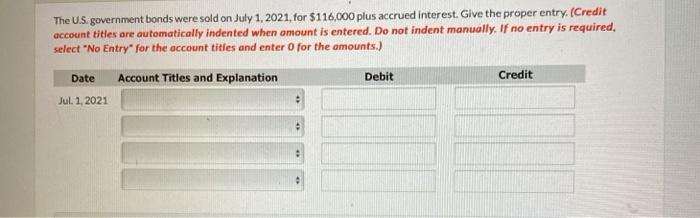

Wildhorse Corp.carries an account in its general ledger called Investments, which contained debits for investment purchases, and no credits, with the following descriptions. $35,800 Feb 1, 2020 Sharapova Company common stock, $90 par, 180 shares April 1 U.S. government bonds, 10%, due April 1, 2030, interest payable April 1 and October 1, 108 bonds of $1,000 par each July 1 McGrath Company 12% bonds, par $50,500, dated March 1, 2020, purchased at 104 plus accrued interest interest payable annually on March 1, due March 1, 2040 108,000 54,540 Prepare entries necessary to classify the amounts into proper accounts, assuming that the debt securities are classified as available-for-sale. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Investment 2 Prepare the entry to record the accrued interest and the amortization of premium on December 31, 2020, using the straight- line method. (Round answers to decimal places, eg, 2,500. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and entero for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31, 2020 . The fair values of the investments on December 31, 2020, were: Sharapova Company common stock U.S. government bonds McGrath Company bonds $30,500 120,800 63.600 What entry. If any, would you recommend be made? (Round answers to O decimal places, 8, 2,500. Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31, 2020 . (Entry for debt investment) (Entry for equity investment) The U.S. government bonds were sold on July 1, 2021, for $116,000 plus accrued interest. Give the proper entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required. select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jul. 1. 2021