Question

Wildhorse Corporation sponsors a defined benefit pension plan for its 100 employees. On January 1, 2020, the companys actuary provided the following information: Pension plan

Wildhorse Corporation sponsors a defined benefit pension plan for its 100 employees. On January 1, 2020, the companys actuary provided the following information:

| Pension plan assets (fair value) | $1,090,000 | ||

| Defined benefit obligation | 1,450,000 |

The actuary calculated that the present value of future benefits earned for employee services rendered in 2020 amounted to $213,200, the December 31, 2020 defined benefit obligation was $1,825,200, and the appropriate interest or discount rate was 9%. The plan assets generated a return of $80,600 during 2020. The company funded the 2020 current service cost as well as $106,600 of the past service costs recognized in a previous year; however, no benefits were paid during the year. Wildhorse Corporation is a private company and applies ASPE.

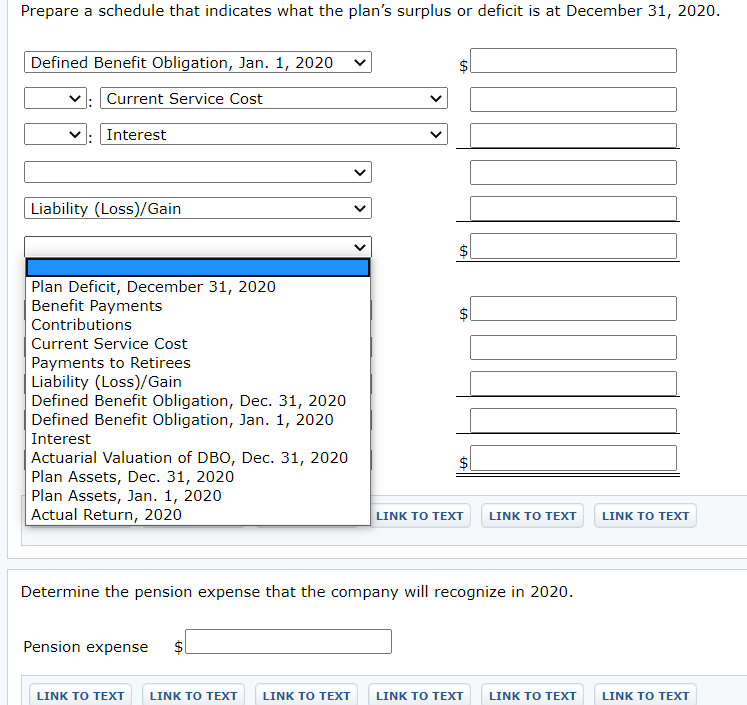

Question is in picture

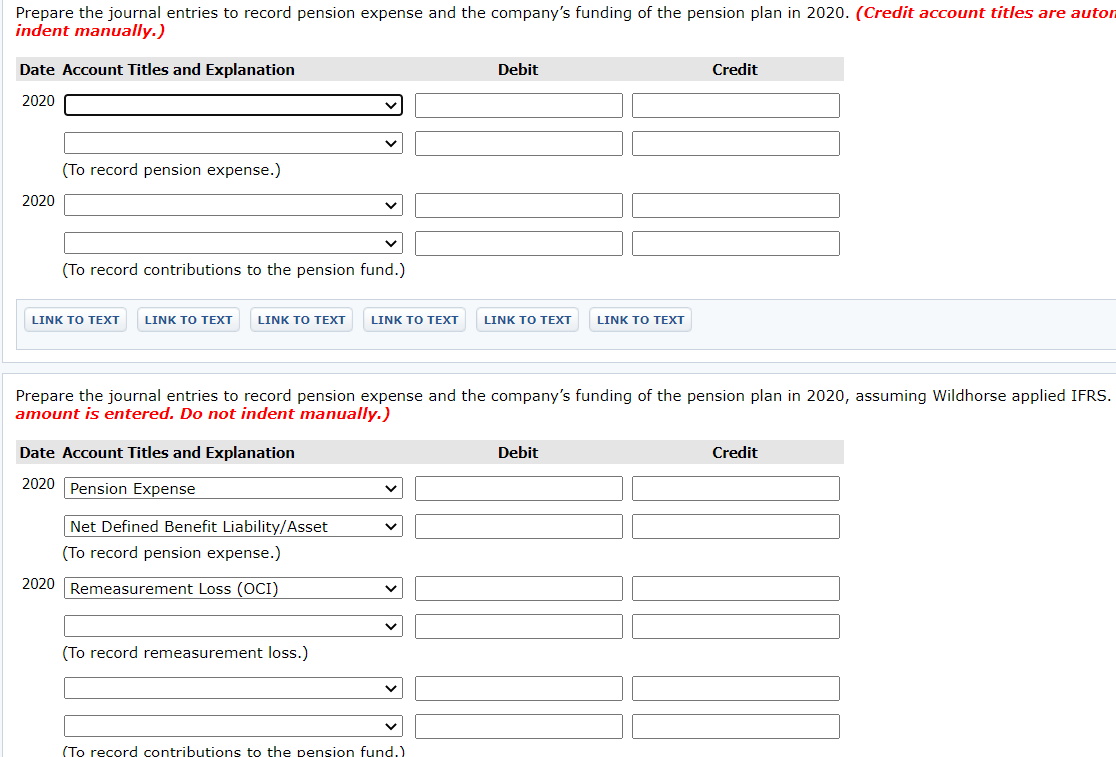

#2

(Extra)

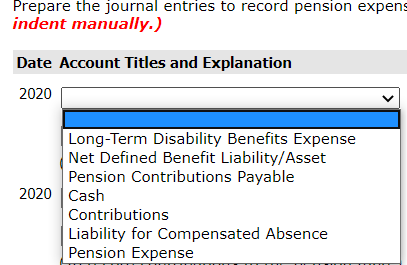

These are the accounts u can choose from for the bottom pic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started