Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wildhorse Equipment Corp. usually closes its books on December 31, but at the end of 2023 it held its cash book open so that a

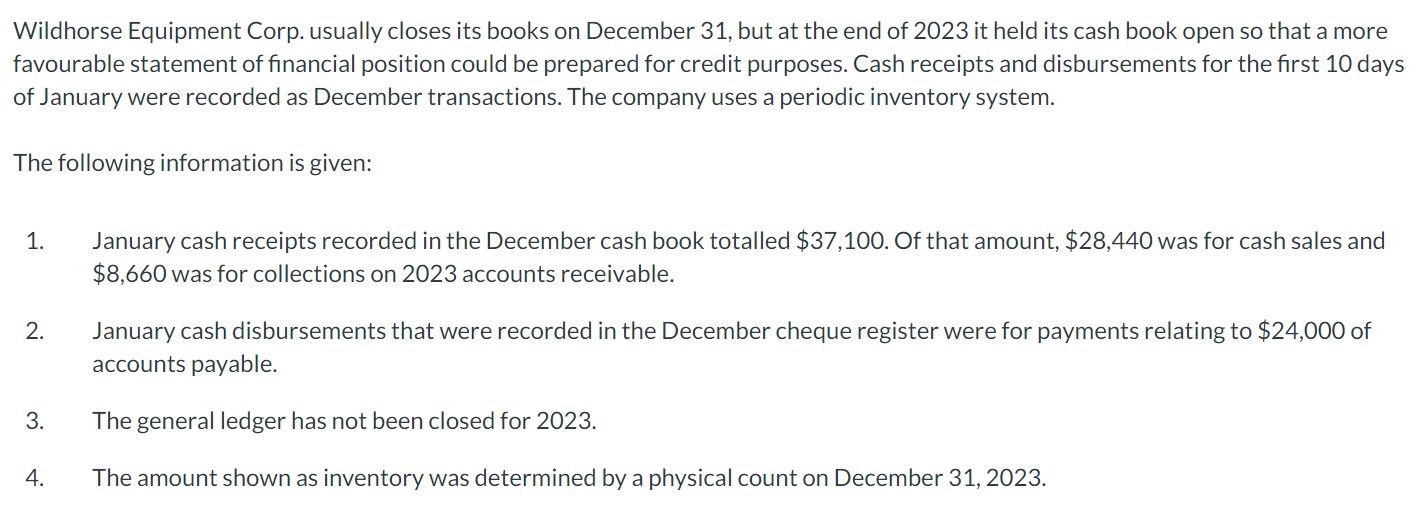

Wildhorse Equipment Corp. usually closes its books on December 31, but at the end of 2023 it held its cash book open so that a more favourable statement of financial position could be prepared for credit purposes. Cash receipts and disbursements for the first 10 days of January were recorded as December transactions. The company uses a periodic inventory system. The following information is given: 1. January cash receipts recorded in the December cash book totalled $37,100. Of that amount, $28,440 was for cash sales and $8,660 was for collections on 2023 accounts receivable. 2. January cash disbursements that were recorded in the December cheque register were for payments relating to $24,000 of accounts payable. 3. The general ledger has not been closed for 2023. 4. The amount shown as inventory was determined by a physical count on December 31, 2023

Wildhorse Equipment Corp. usually closes its books on December 31, but at the end of 2023 it held its cash book open so that a more favourable statement of financial position could be prepared for credit purposes. Cash receipts and disbursements for the first 10 days of January were recorded as December transactions. The company uses a periodic inventory system. The following information is given: 1. January cash receipts recorded in the December cash book totalled $37,100. Of that amount, $28,440 was for cash sales and $8,660 was for collections on 2023 accounts receivable. 2. January cash disbursements that were recorded in the December cheque register were for payments relating to $24,000 of accounts payable. 3. The general ledger has not been closed for 2023. 4. The amount shown as inventory was determined by a physical count on December 31, 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started