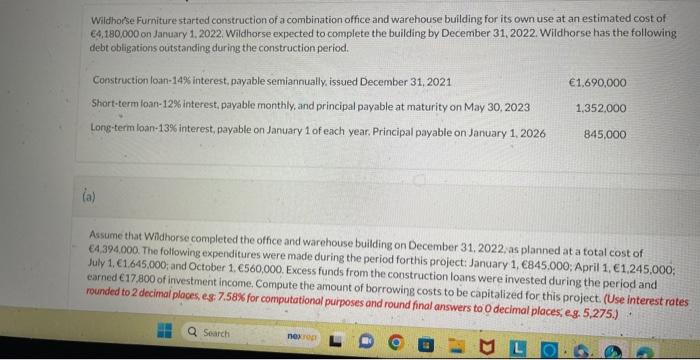

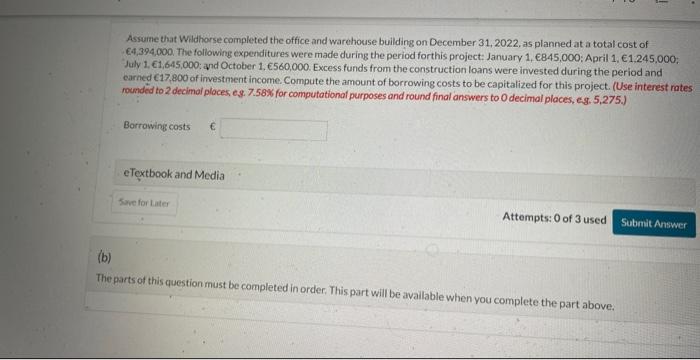

Wildhorse Fumiture started construction of a combination office and warehouse building for its own use at an estimated cost of 4,180,000 on January 1,2022. Wildhorse expected to complete the building by December 31,2022 . Wildhorse has the following debt obligations outstanding during the construction period. (a) Assume that Wildhorse completed the office and warehouse building on December 31, 2022, as planned at a total cost of 64,394,000. The following expenditures were made during the period forthis project: January 1, 845.000; April 1, 1,245,000; July 1, 1,645,000; and October 1. 560,000. Excess funds from the construction loans were invested during the period and earned 17,800 of investment income, Compute the amount of borrowing costs to be capitalized for this project. (Use interest rates munded to 2 decimal places, es. 7.58\% for computational purposes and round final answers to O decimal places, eg. 5.275.) Assume that Wildhorse completed the office and warehouse building on December 31,2022, as planned at a total cost of 64,394,000. The following expenditures were made during the period forthis project: January 1, 6845,000; April 1, 1,245,000; July 1, 61,645,000: and October 1, E560,000. Excess funds from the construction loans were invested during the period and earned 17,800 of investment income. Compute the amount of borrowing costs to be capitalized for this project. (Use interest rates rounded to 2 decimal ploces, e.3. 7.58\% for computational purposes and round final answers to 0 decimal places, eg. 5,275.) Borrowing costs eTextbook and Media Attempts: 0 of 3 used (b) The parts of this question must be completed in order. This part will be avallable when you complete the part above. Assume that Wildionse completed the office and warehouse building on December 31, 2022, as planned at a total cost of 4,394,000 The following expenditures were made during the period forthis project. January 1, 845,000; April 1, 1,245,000; Julv 1C,645,000; and October 1. 560,000. Excess funds from the construction loans were invested during the period and varned 17,800 of iqvestment income. Compute the amount of borrowing costs to be capitalized for this project. (Use interest rates rounded to 2 decimal places, es. 7.56% for computatianal purposes and round final answers to 0 decimal places, eg. 5,275 .) Borrowing costs eTextbook and Media Attempts: 0 of 3 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above