Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wildhorse Inc manufactures snowsuits. Wildhorse is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased 5 years

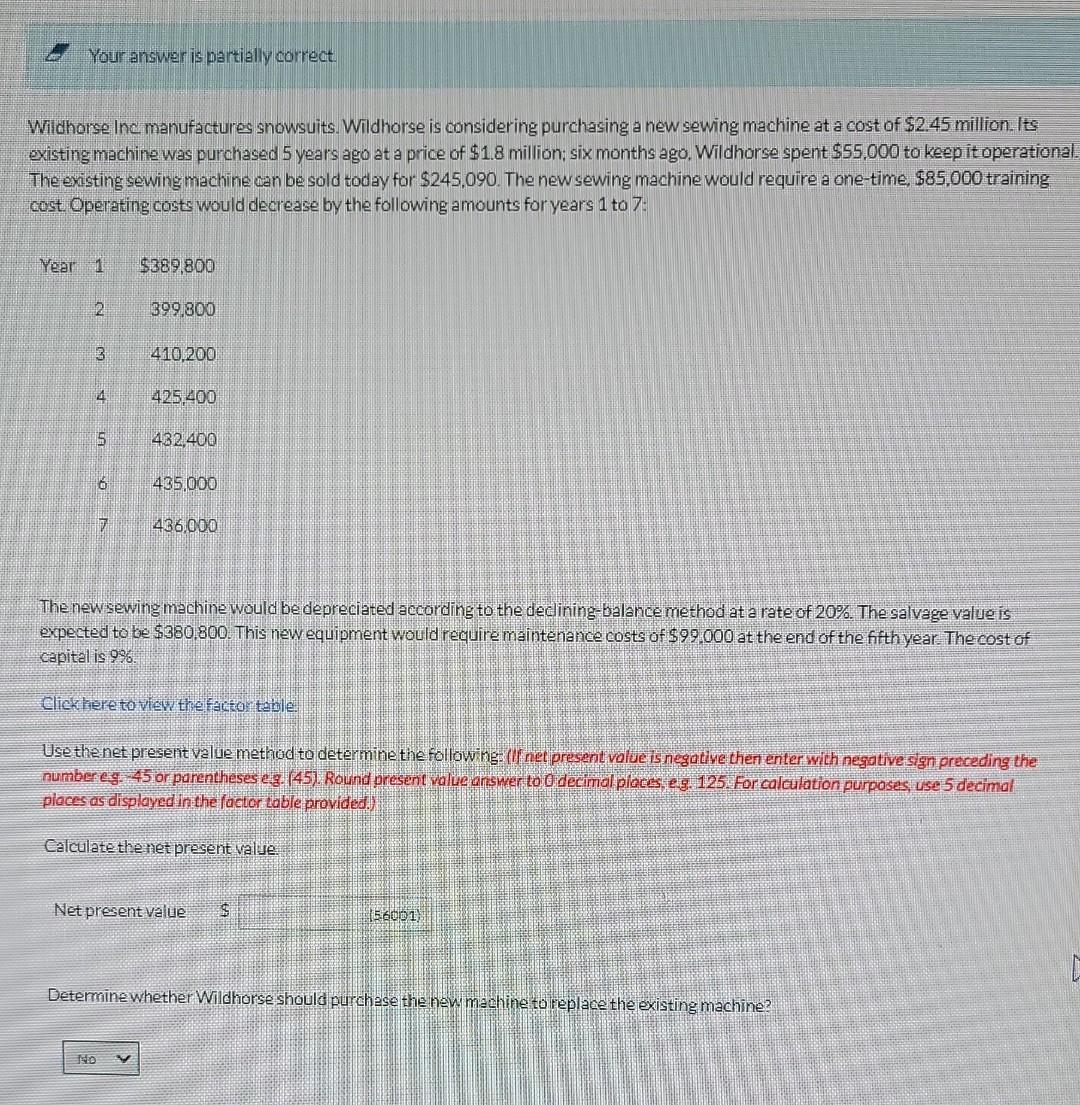

Wildhorse Inc manufactures snowsuits. Wildhorse is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased 5 years ago at a price of $1.8 million; six months ago. Wildhor se spent $55,000 to keep it operationa The existing sewing machine can be sold today for $245,090. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: The newsewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $380.800. This new equipment would require maintenance costs of $99.000 at the end of the fifthyear. The cost of capital is 9%. Click heretoview the frector table Use thenet present value method to determine the following: (Ir net present volue is negative then enter with negative sign preceding the numbereg. 45 or parentheses e.g. 45). Round present value arswer to odecimal pioces, eg. 125 for calculation purposes, use 5 decimal places as displayed in the factor table provided.) Calculate thenetpresent value. Netpresent value $ 156001) Determine whether Wildhorse should purchase the new machine to replace the existing machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started