Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wildhorse Inc.s general ledger at April 30, 2021, included the following: Cash $6,600; Supplies $400; Equipment $21,000; Accounts Payable $2,100; Deferred Revenue (from gift certificates)

Wildhorse Inc.s general ledger at April 30, 2021, included the following: Cash $6,600; Supplies $400; Equipment $21,000; Accounts Payable $2,100; Deferred Revenue (from gift certificates) $1,100; Bank Loan Payable $10,000; Common Shares $5,000; and Retained Earnings $9,800. The following transactions occurred during May:

| May | 1 | Paid rent for the month of May, $1,100. | |

| 4 | Paid $1,500 of the account payable outstanding at April 30. | ||

| 7 | Issued gift certificates for future services for $1,800 cash. | ||

| 15 | Received $2,900 from customers for services performed to date. | ||

| 15 | Paid $1,200 in salaries to employees. | ||

| 17 | Customers receiving services worth $700 used gift certificates in payment. | ||

| 18 | Paid the remaining accounts payable from April 30. | ||

| 22 | Purchased supplies of $700 on account. | ||

| 24 | Received a bill for advertising for $500. This bill is due on June 22. | ||

| 25 | Received and paid a utilities bill for $400. | ||

| 28 | Received $2,100 from customers for services performed. | ||

| 29 | Customers receiving services worth $600 used gift certificates in payment. | ||

| 30 | Interest of $50 was paid on the bank loan. | ||

| 31 | Paid $1,200 in salaries to employees. | ||

| 31 | Paid income tax instalment for the month, $150. |

Please check why my answer for this is not correct?

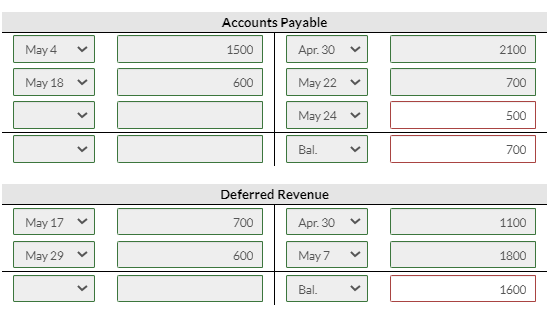

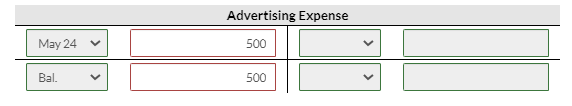

Accounts Payable May 4 1500 Apr. 30 2100 May 18 600 May 22 700 > May 24Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started