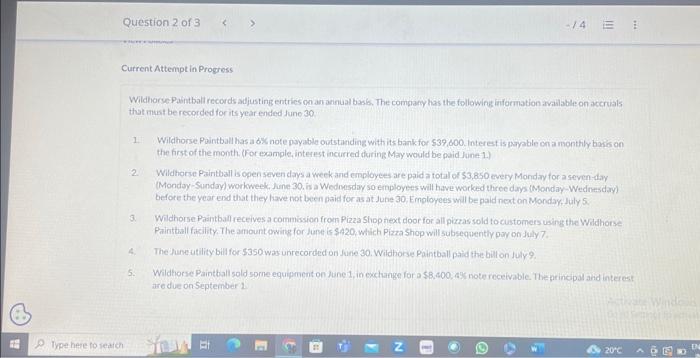

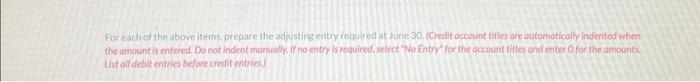

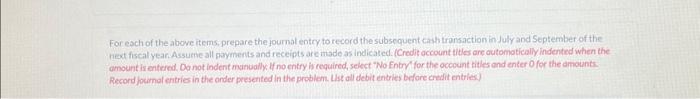

Wildhorse Paintball records adjusting entries on an annual bask. The company has the followine information avalable on accruals that must be recorded for its year ended June 30 1. Wildhorse Pointball has a 6% note payable outstanding with its bank for $39,600. interest is pable on a monthly bris on the first of the month. (For example, interest incurred during May would be paid June 1) 2. Wildhorse Paintball is open seven days a week and employees are paid a total or $3,850 every Monday for a seven-day (Mondoy-Sunday) workweek, June 30, is a Wednesday so employes will have worked three days (Manday-Wednesday) before the year end that they tave not been paid for as at June 30, Employees und be paid neat on Monday. July 5 . 3. Widhorse Paintbalf receives a commission from Pizza Shop next door for all pirzas sold to customers using the Wildhorse Painthall ficility. The amount owing for lune is $720, which Pizza Shop will subsequently pay on duly 7. 4. The June utility bill for $350 was unrecorded on June 30 . Wildhorse Paintball paid the bill on July 9 . 5. Wildhocse Paintball sold sprne equipment on June 1 , in exchange for a$8,400,485 note receivable. Theprincipal and interest are due on September 2 Foreach of the above items prepare the adjusting entry required at Jure 30, iCredit occount fities are eutomatically indented when the amount is entered. Do not indent manually. If no entry is required, select 'No Entry' for the occount titles ond enter Ofor the amounts. List all debit entries before credit entries) For each of the above items, prepare the journal entry to record the subsequent cash transaction in Julyand September of the hext fiscal year. Assume all pryments and receipts are made as indicated. (Credit occount titles are outomotically indented when the amount is entered. Do not indent munually. If no entry his required, select "No Entry' for the occount tities and enter 0 for the amounts. Record fournal entries in the onder presented in the problem. Ust all debit entries bdore credit entries) Wildhorse Paintball records adjusting entries on an annual bask. The company has the followine information avalable on accruals that must be recorded for its year ended June 30 1. Wildhorse Pointball has a 6% note payable outstanding with its bank for $39,600. interest is pable on a monthly bris on the first of the month. (For example, interest incurred during May would be paid June 1) 2. Wildhorse Paintball is open seven days a week and employees are paid a total or $3,850 every Monday for a seven-day (Mondoy-Sunday) workweek, June 30, is a Wednesday so employes will have worked three days (Manday-Wednesday) before the year end that they tave not been paid for as at June 30, Employees und be paid neat on Monday. July 5 . 3. Widhorse Paintbalf receives a commission from Pizza Shop next door for all pirzas sold to customers using the Wildhorse Painthall ficility. The amount owing for lune is $720, which Pizza Shop will subsequently pay on duly 7. 4. The June utility bill for $350 was unrecorded on June 30 . Wildhorse Paintball paid the bill on July 9 . 5. Wildhocse Paintball sold sprne equipment on June 1 , in exchange for a$8,400,485 note receivable. Theprincipal and interest are due on September 2 Foreach of the above items prepare the adjusting entry required at Jure 30, iCredit occount fities are eutomatically indented when the amount is entered. Do not indent manually. If no entry is required, select 'No Entry' for the occount titles ond enter Ofor the amounts. List all debit entries before credit entries) For each of the above items, prepare the journal entry to record the subsequent cash transaction in Julyand September of the hext fiscal year. Assume all pryments and receipts are made as indicated. (Credit occount titles are outomotically indented when the amount is entered. Do not indent munually. If no entry his required, select "No Entry' for the occount tities and enter 0 for the amounts. Record fournal entries in the onder presented in the problem. Ust all debit entries bdore credit entries)