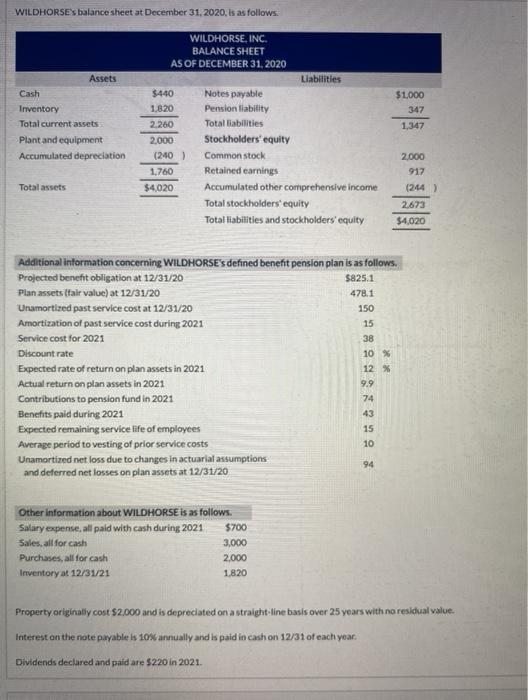

WILDHORSE's balance sheet at December 31, 2020, is as follows. Assets Cash Inventory Total current assets Plant and equipment Accumulated depreciation $1,000 347 1,347 WILDHORSE, INC. BALANCE SHEET AS OF DECEMBER 31, 2020 Liabilities $440 Notes payable 1.820 Pension liability 2,260 Total liabilities 2.000 Stockholders' equity (240) Common stock 1.760 Retained earnings $4,020 Accumulated other comprehensive income Total stockholders equity Total liabilities and stockholders' equity Total assets 2.000 917 (244) 2,673 $4,020 Additional information concerning WILDHORSE's defined benefit pension plan is as follows. Projected benefit obligation at 12/31/20 $825.1 Plan assets (fair value) at 12/31/20 Unamortized past service cost at 12/31/20 Amortization of past service cost during 2021 Service cost for 2021 Discount rate Expected rate of return on plan assets in 2021 Actual return on plan assets in 2021 Contributions to pension fund in 2021 74 Benefits paid during 2021 Expected remaining service life of employees Average period to vesting of prior service costs Unamortized net loss due to changes in actuarial assumptions and deferred net losses on plan assets at 12/31/20 478.1 150 15 38 10 % 12% 9.9 43 15 10 94 Other information about WILDHORSE is as follows. Salary expense, all paid with cash during 2021 $700 Sales, all for cash 3,000 Purchases, all for cash 2,000 Inventory at 12/31/21 1.820 Property originally cost $2.000 and is depreciated on a straight line basis over 25 years with no residual value Interest on the note payable is 10% annually and is paid in cash on 12/31 of each year. Dividends declared and paid are $220 in 2021 Prepare an income statement for 2021. (Round answers to 1 decimal place, e.g. 52.7) WILDHORSE, INC. Income Statement WILDHORSE's balance sheet at December 31, 2020, is as follows. Assets Cash Inventory Total current assets Plant and equipment Accumulated depreciation $1,000 347 1,347 WILDHORSE, INC. BALANCE SHEET AS OF DECEMBER 31, 2020 Liabilities $440 Notes payable 1.820 Pension liability 2,260 Total liabilities 2.000 Stockholders' equity (240) Common stock 1.760 Retained earnings $4,020 Accumulated other comprehensive income Total stockholders equity Total liabilities and stockholders' equity Total assets 2.000 917 (244) 2,673 $4,020 Additional information concerning WILDHORSE's defined benefit pension plan is as follows. Projected benefit obligation at 12/31/20 $825.1 Plan assets (fair value) at 12/31/20 Unamortized past service cost at 12/31/20 Amortization of past service cost during 2021 Service cost for 2021 Discount rate Expected rate of return on plan assets in 2021 Actual return on plan assets in 2021 Contributions to pension fund in 2021 74 Benefits paid during 2021 Expected remaining service life of employees Average period to vesting of prior service costs Unamortized net loss due to changes in actuarial assumptions and deferred net losses on plan assets at 12/31/20 478.1 150 15 38 10 % 12% 9.9 43 15 10 94 Other information about WILDHORSE is as follows. Salary expense, all paid with cash during 2021 $700 Sales, all for cash 3,000 Purchases, all for cash 2,000 Inventory at 12/31/21 1.820 Property originally cost $2.000 and is depreciated on a straight line basis over 25 years with no residual value Interest on the note payable is 10% annually and is paid in cash on 12/31 of each year. Dividends declared and paid are $220 in 2021 Prepare an income statement for 2021. (Round answers to 1 decimal place, e.g. 52.7) WILDHORSE, INC. Income Statement