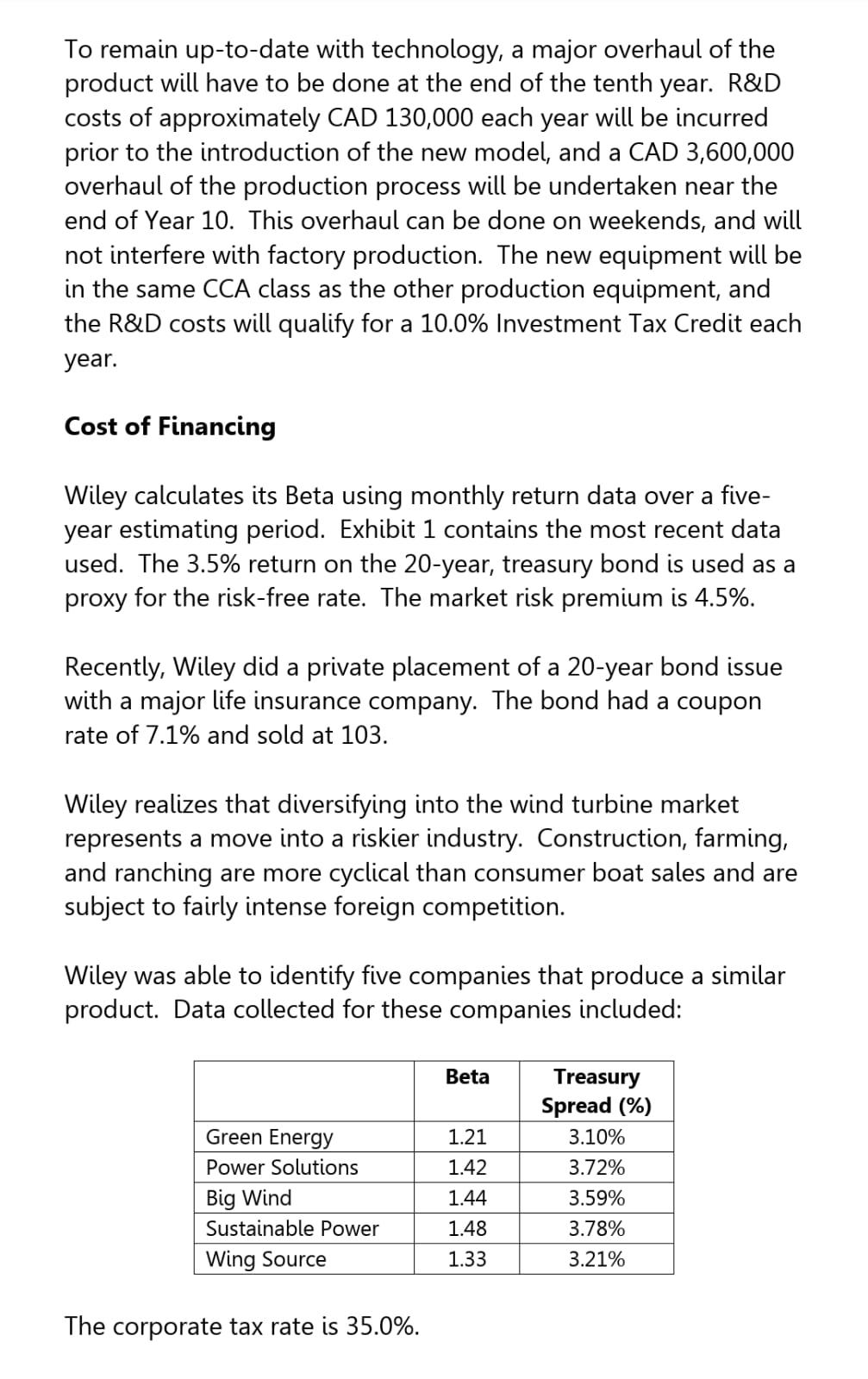

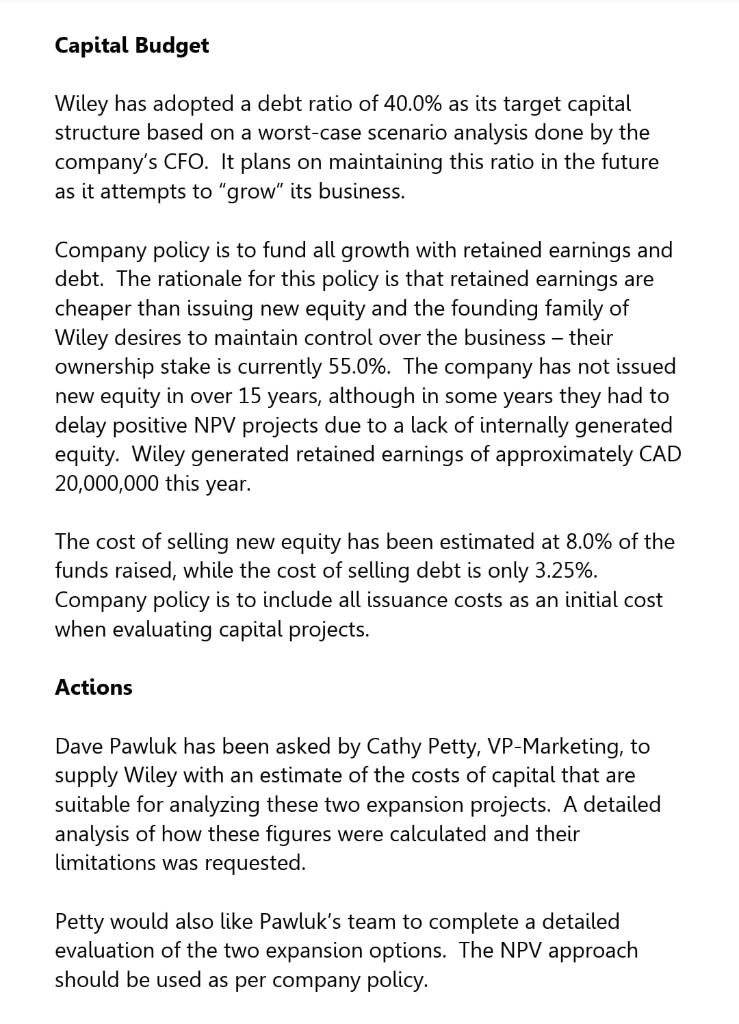

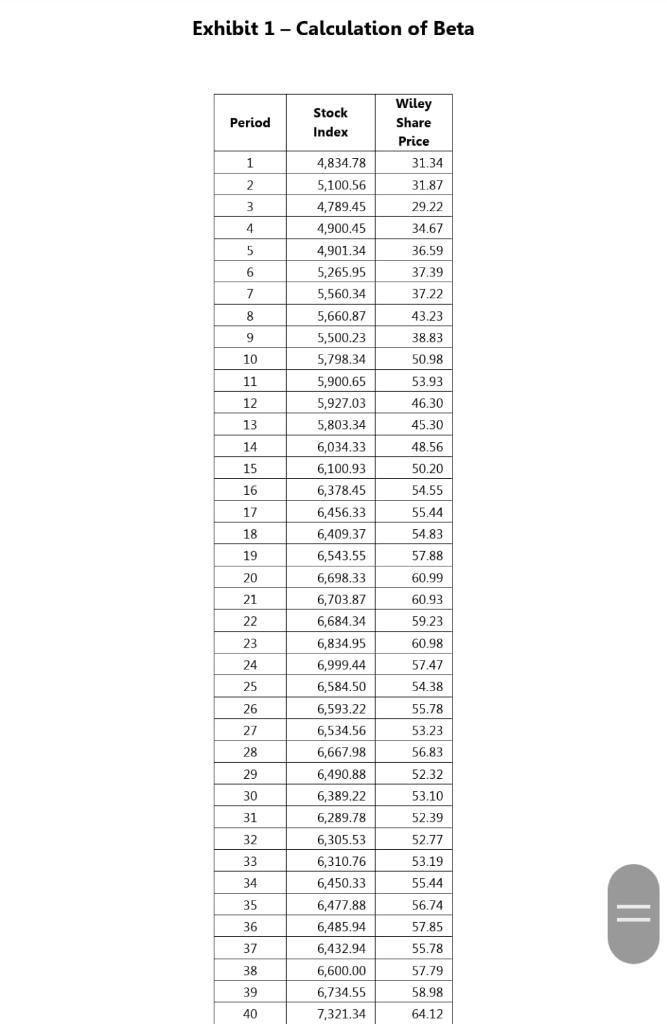

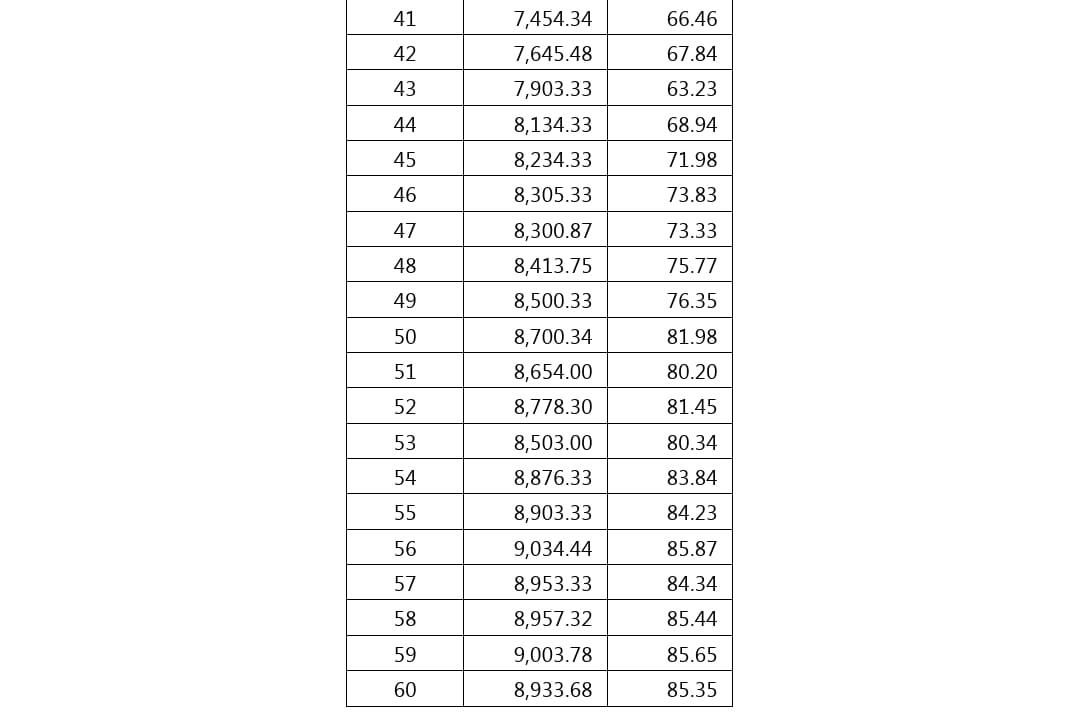

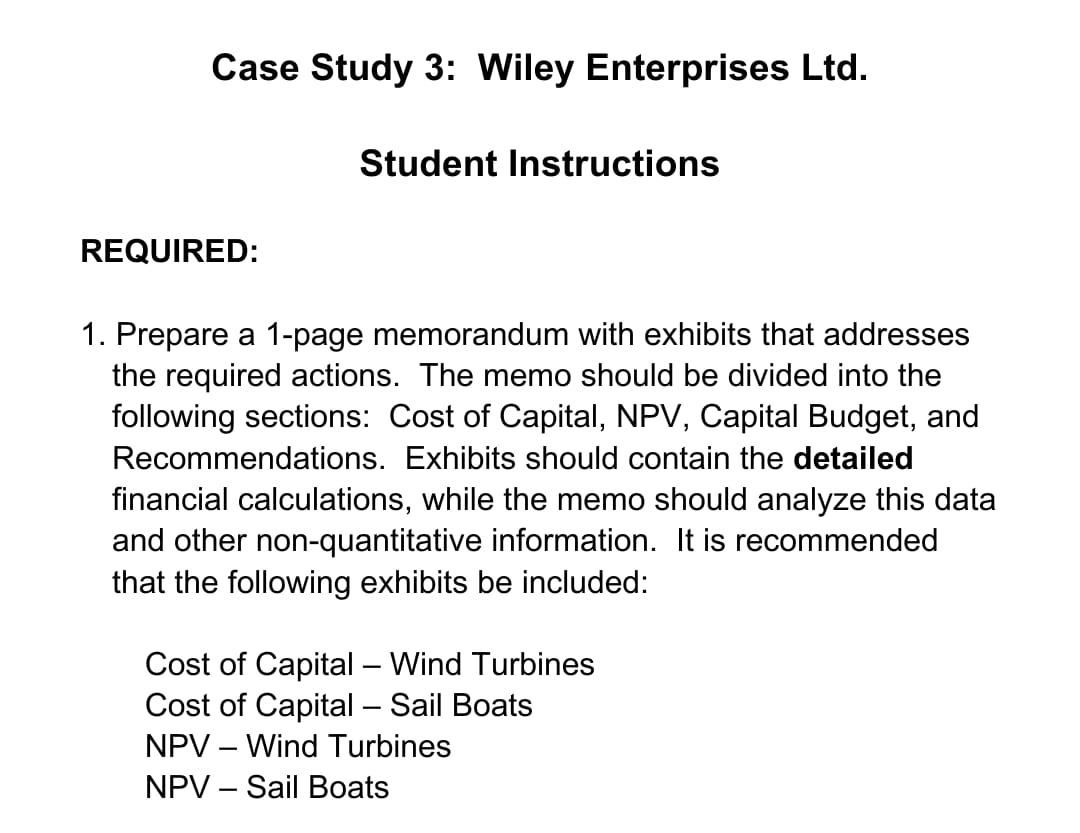

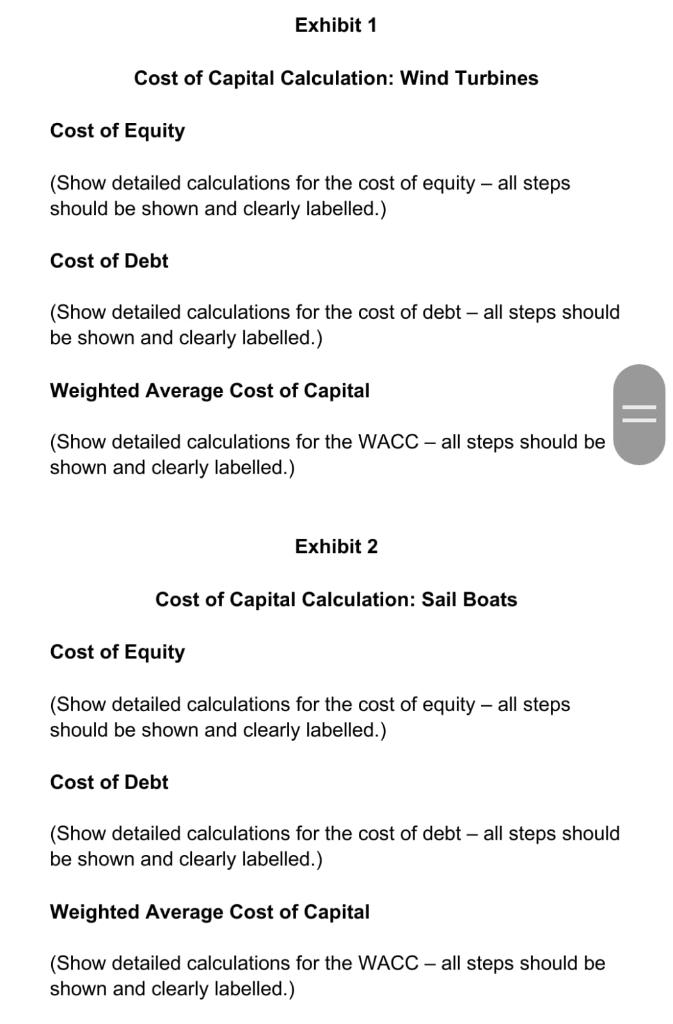

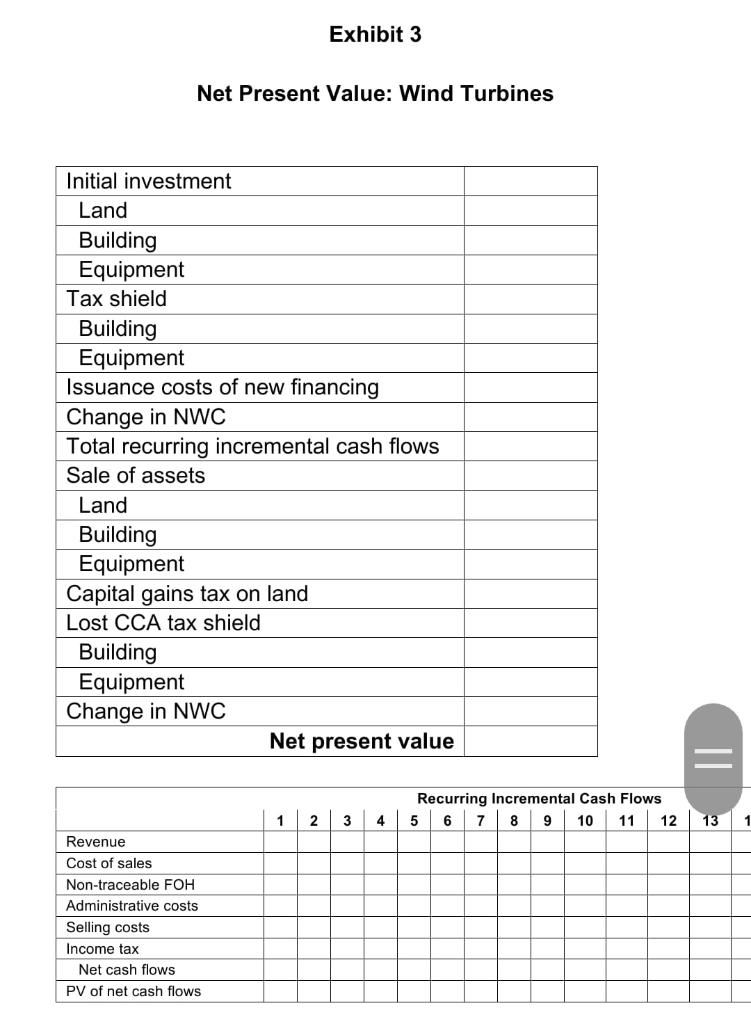

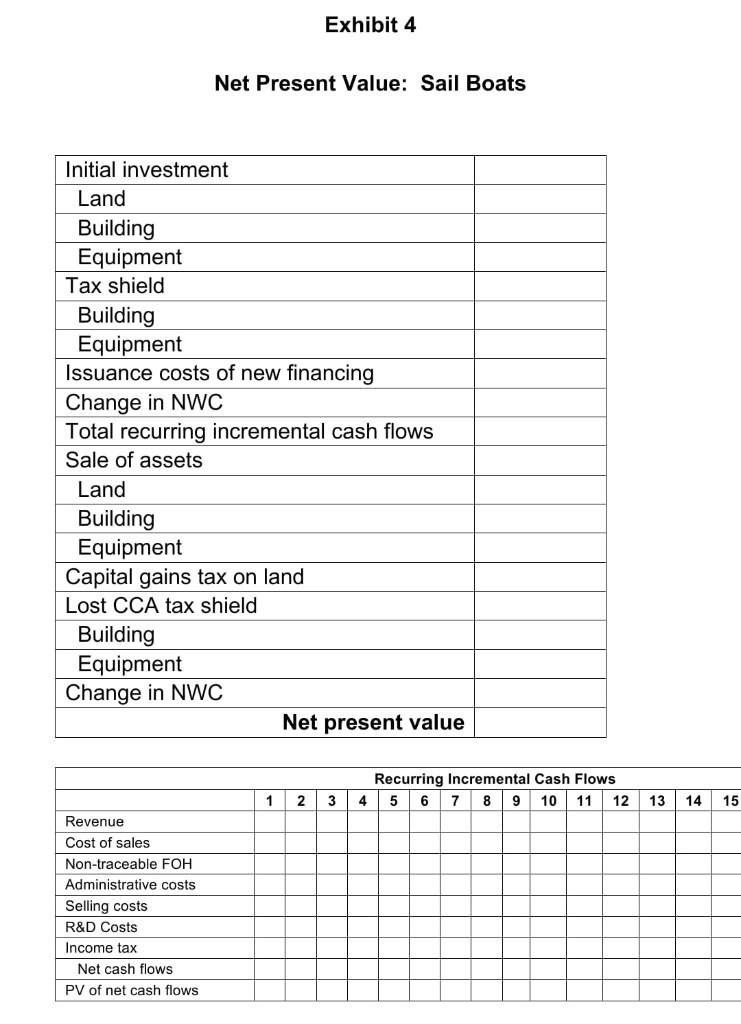

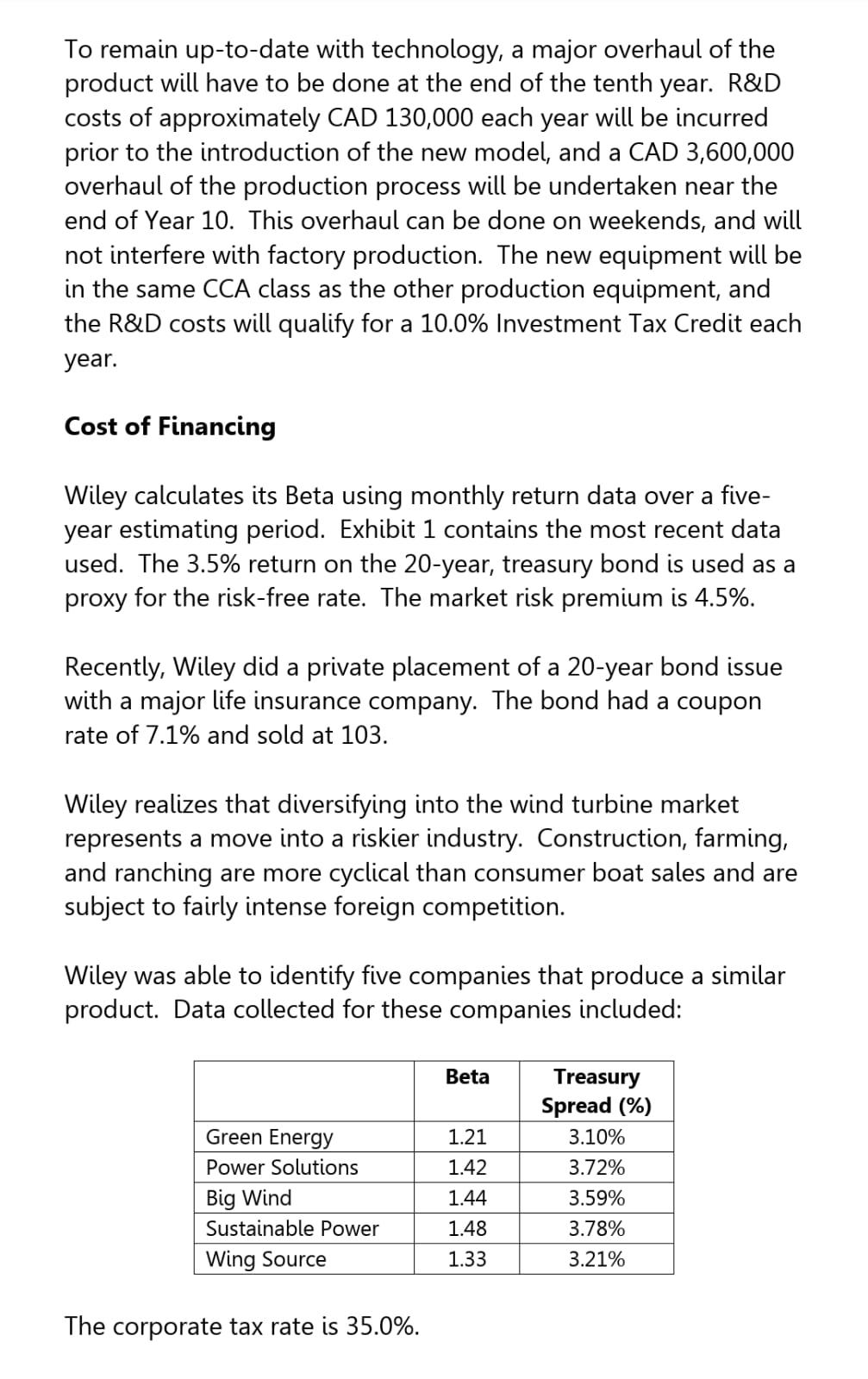

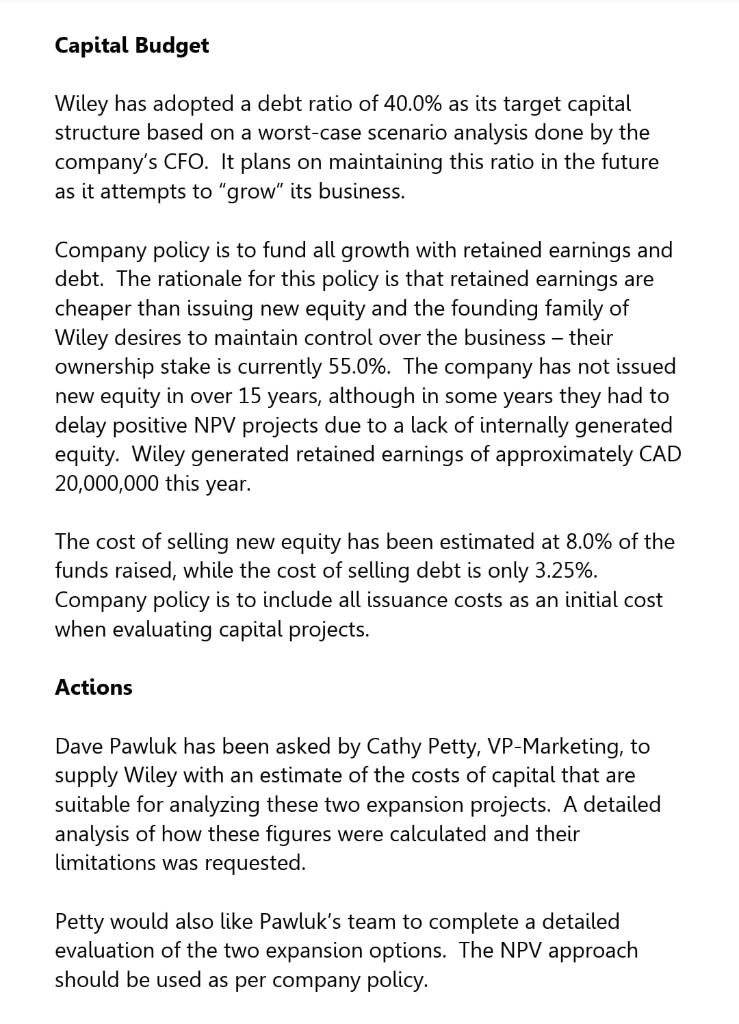

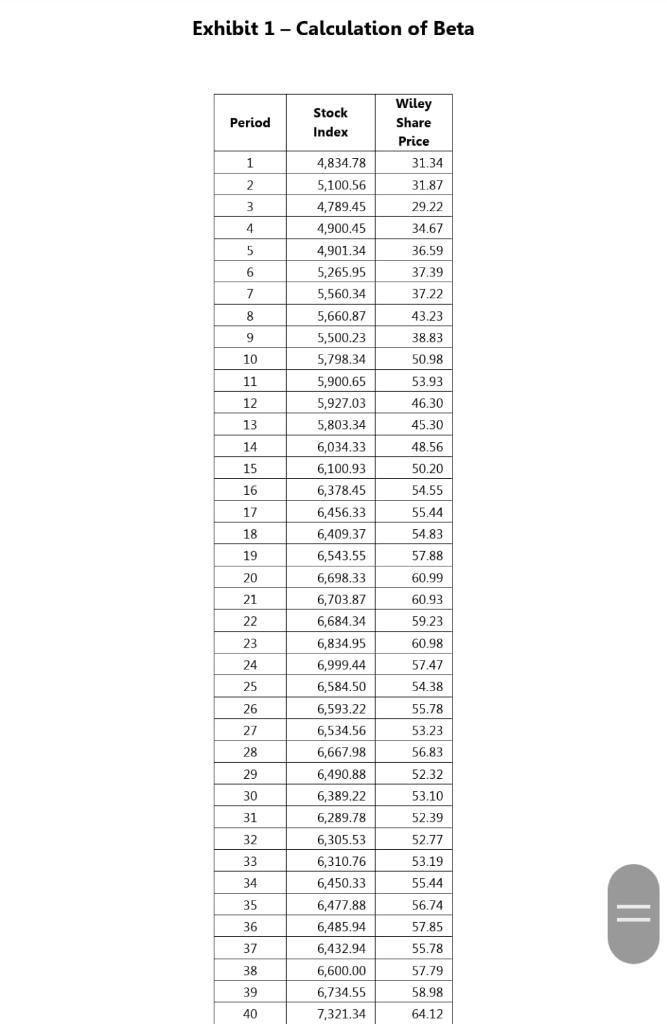

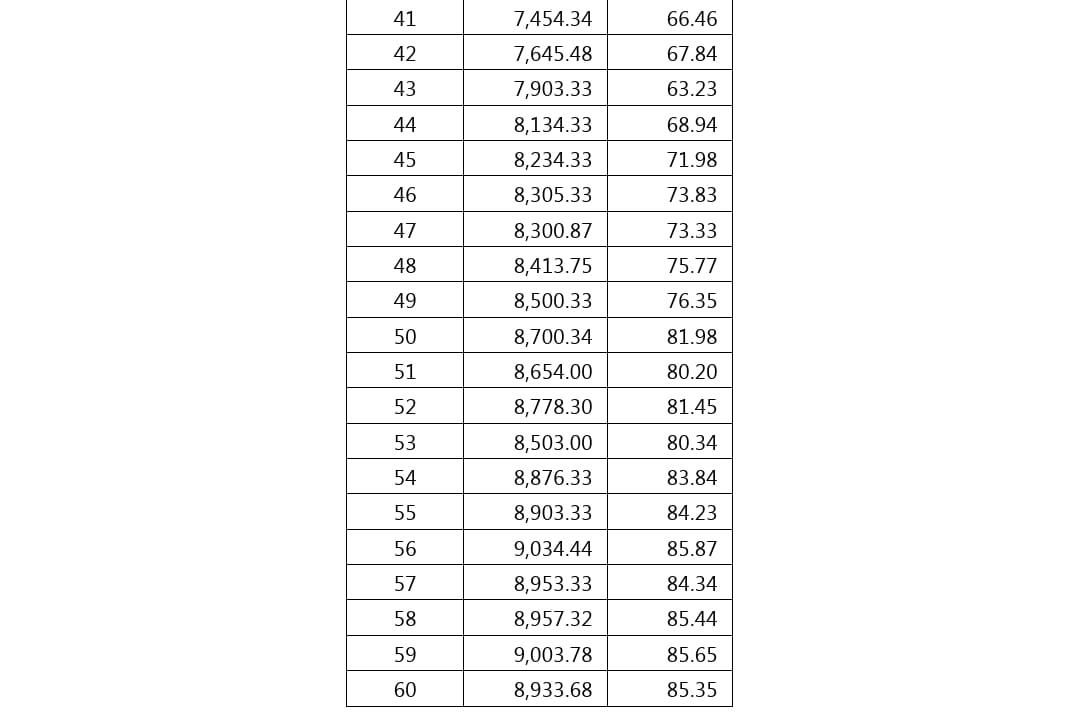

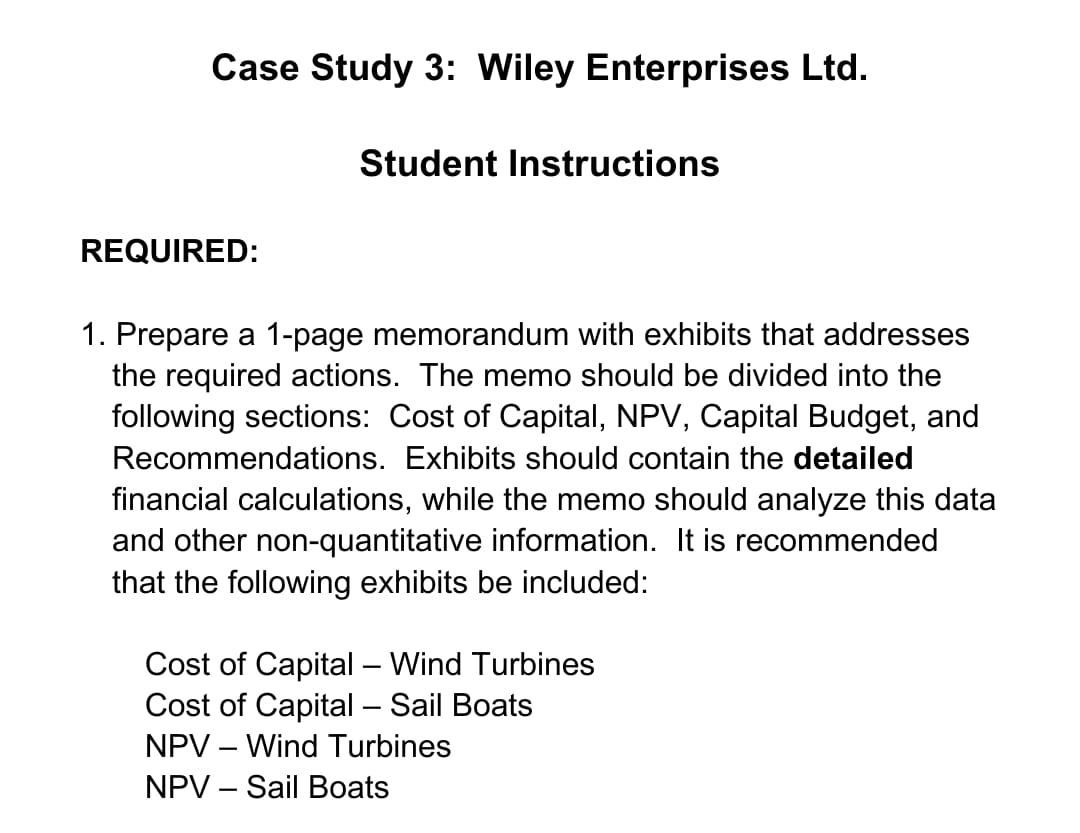

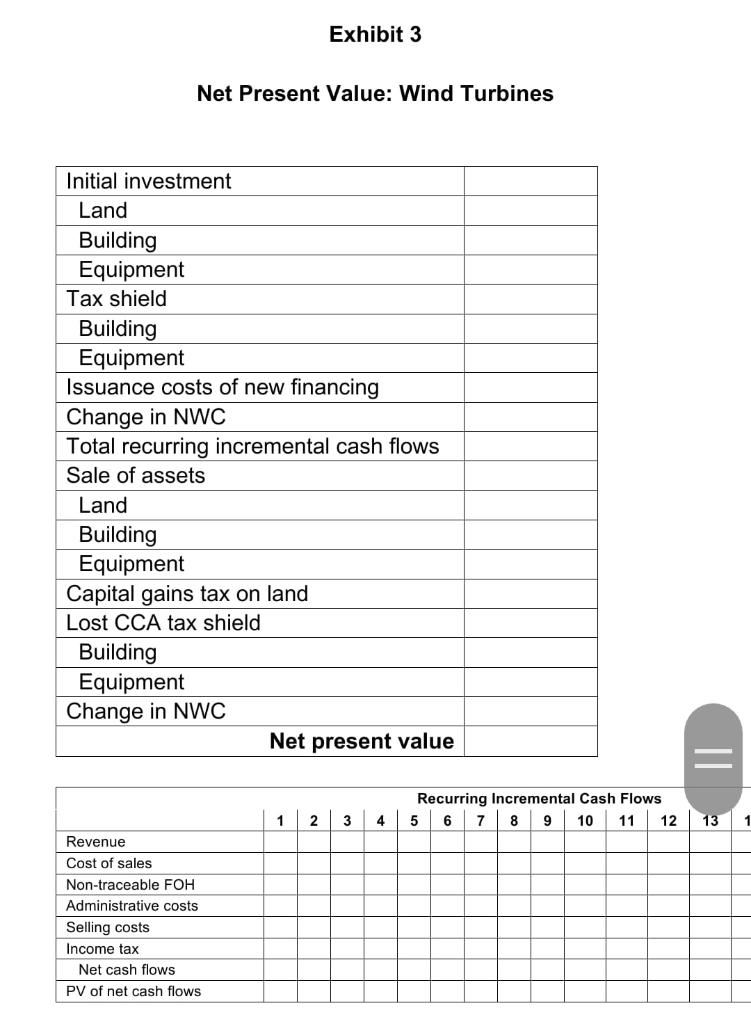

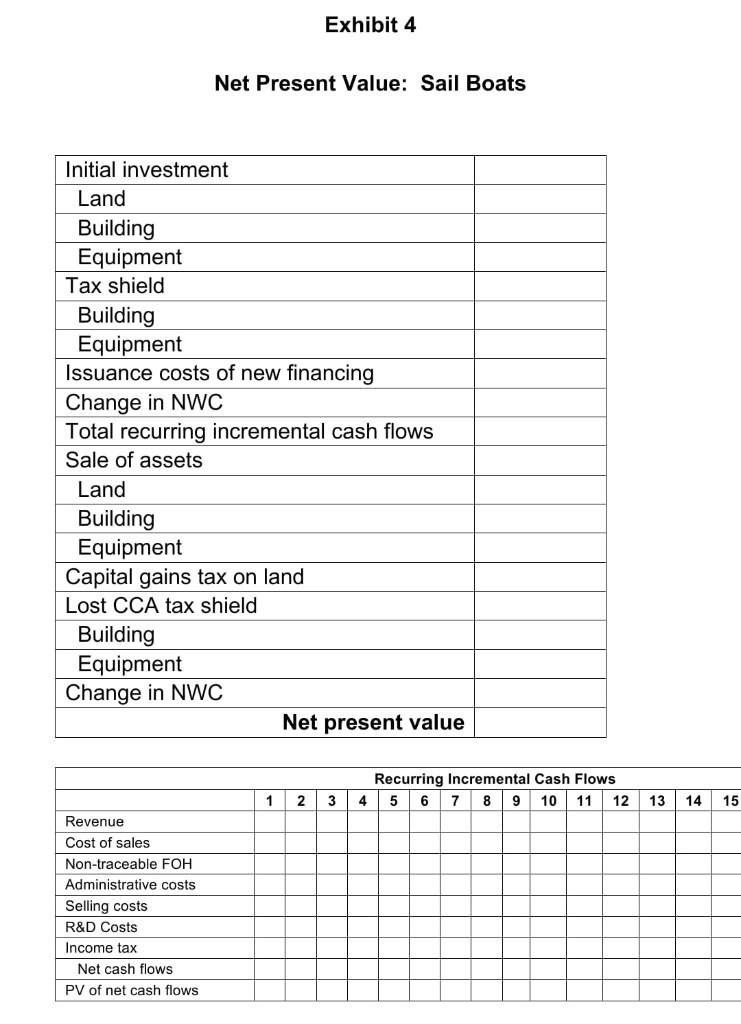

Wiley Enterprises Ltd. Background Wiley Enterprises Ltd. is a manufacturer of high-end inflatable boats and boat motors, which has been operating in Canada for over 35 years. It manufactures its inflatable boats in Didsbury, Alberta and its motors in Rocanville, Saskatchewan and sells them both domestically and internationally. The company has been very successful financially, but the board of directors feels that these two products do not offer strong potential for continued growth. One option for expansion is to manufacture commercial wind turbines, which will be sold primarily to construction companies, farmers, ranchers, the military, the resort industry, and municipal governments. The company feels that this new business has potential given high fuel costs, but it does realize it will be selling to the commercial market in which it has no previous sales experience. A second option is to expand their line of boats to include sail boats of various sizes. This expansion will allow the company to continue to focus on the consumer market and utilize its existing selling network. Expansion into either wind turbines or sail boats will be an expensive undertaking and necessitate the construction of a new manufacturing plant. Dave Pawluk has been assigned as the team leader of a group of engineers, accountants, human resource managers, and marketers responsible for investigating these new projects. Undertaking both projects is a possibility but is would be challenging for the company. Wind Turbines Wiley would have to build a new factory to manufacture wind turbines. The facility would have capacity to produce 15,000 units per year. The cost of the land would be CAD 1,540,000 and the building CAD 5,940,000. Equipment costing CAD 12,850,000 would also be needed. It is expected that the building and equipment will be either worn out or obsolete within 20 years and the company will reconsider its options relating to this product line then. It is estimated that the land will be worth CAD 3,350,000 at the end of the project's life. The building is subject to a CCA rate of 5.0% and the equipment a CCA rate of 35.0%. Land is not subject to CCA, but half of any capital gain realized on disposal is taxable. Half the capital gain is taxable under the Income Tax Act. In addition to property, plant, and equipment, additional net working capital of CAD 550,000 will be required. Sales are estimated to be 5,300 units in the first year, but are expected to grow at approximately 10.0% per year for the next six years before levelling out to 4.0% growth as the company reaches maximum market penetration. Construction companies, resort operators, farmers, and ranchers will purchase their units through local heavy equipment retailers, who will buy the units from Wiley at a list price of CAD 21,450. In addition to selling to retailers, Wiley's sales force will sell directly to its military and municipal clients, who will receive a 10.0% discount on the list price. Wiley expects sales to its military and municipal clients to be 40.0% of the total unit sales. The cost of goods sold are expected to be CAD 16,850 per unit. Non-traceable factory costs are expected to be CAD 1,410,000 per year. An additional CAD 462,000 in administration costs related to the new plant will be incurred at head office annually. Selling this new product will demand the hiring of a national sales manager at CAD 100,000 per year. It is felt that six additional sales people at a base salary of CAD 60,000 each would be needed to sell this new product. A commission equal to 3.0% of unit gross profit is to be received by the national sales manager, who will distribute a quarter of it to himself and the remainder to the individual sales people depending on whether they meet their quotas. The commission is based on the gross profit margin of the units sold to encourage sales of higher margin products. Sail Boats The new factory to build sail boats would last approximately 20 years and could produce approximately 35,000 units per year. The land would cost CAD 1,650,000 and the building CAD 6,850,000. Production equipment worth CAD 13,350,000 would also have to be acquired. It is estimated that the land will be worth CAD 2,550,000 and the building CAD 1,830,000 in 20 years. The equipment will have a negligible salvage value. The building is subject to a CCA rate of 5.0% and the equipment a rate of 35.0%. Additional net working capital of CAD 730,000 will be required to support this project. Sail boats are estimated to be 12,100 the first year, but will grow at 15.0% a year till the end of Year 6. Sail boats will grow at 4.0% a year after that reflecting general growth in the industry. Sail boats would be sold through the same retailers that carry inflatable boats and motors. The selling price will average CAD 3,500 per unit. The cost of goods sold are expected to be CAD 2,590 per unit. Non-traceable factory costs are expected to be CAD 1,050,000 per year and an additional CAD 320,000 in administration costs related to the new plant will be incurred at head office annually. No new sales staff will be required, but sales people will receive a commission equal to 5.0% of the gross profit on each unit. To remain up-to-date with technology, a major overhaul of the product will have to be done at the end of the tenth year. R&D costs of approximately CAD 130,000 each year will be incurred prior to the introduction of the new model, and a CAD 3,600,000 overhaul of the production process will be undertaken near the end of Year 10. This overhaul can be done on weekends, and will not interfere with factory production. The new equipment will be in the same CCA class as the other production equipment, and the R&D costs will qualify for a 10.0% Investment Tax Credit each year. Cost of Financing Wiley calculates its Beta using monthly return data over a five- year estimating period. Exhibit 1 contains the most recent data used. The 3.5% return on the 20-year, treasury bond is used as a proxy for the risk-free rate. The market risk premium is 4.5%. Recently, Wiley did a private placement of a 20-year bond issue with a major life insurance company. The bond had a coupon rate of 7.1% and sold at 103. Wiley realizes that diversifying into the wind turbine market represents a move into a riskier industry. Construction, farming, and ranching are more cyclical than consumer boat sales and are subject to fairly intense foreign competition. Wiley was able to identify five companies that produce a similar product. Data collected for these companies included: Beta Treasury Spread (%) 1.21 3.10% Green Energy Power Solutions 1.42 3.72% Big Wind 1.44 3.59% Sustainable Power 1.48 3.78% Wing Source 1.33 3.21% The corporate tax rate is 35.0%. Capital Budget Wiley has adopted a debt ratio of 40.0% as its target capital structure based on a worst-case scenario analysis done by the company's CFO. It plans on maintaining this ratio in the future as it attempts to "grow" its business. Company policy is to fund all growth with retained earnings and debt. The rationale for this policy is that retained earnings are cheaper than issuing new equity and the founding family of Wiley desires to maintain control over the business - their ownership stake is currently 55.0%. The company has not issued new equity in over 15 years, although in some years they had to delay positive NPV projects due to a lack of internally generated equity. Wiley generated retained earnings of approximately CAD 20,000,000 this year. The cost of selling new equity has been estimated at 8.0% of the funds raised, while the cost of selling debt is only 3.25%. Company policy is to include all issuance costs as an initial cost when evaluating capital projects. Actions Dave Pawluk has been asked by Cathy Petty, VP-Marketing, to supply Wiley with an estimate of the costs of capital that are suitable for analyzing these two expansion projects. A detailed analysis of how these figures were calculated and their limitations was requested. Petty would also like Pawluk's team to complete a detailed evaluation of the two expansion options. The NPV approach should be used as per company policy. Exhibit 1 - Calculation of Beta Wiley Stock Period Share Index Price 1 4,834.78 5,100.56 4,789.45 4,900.45 4,901.34 5,265.95 5,560.34 5,660.87 5,500.23 5,798.34 5,900.65 5,927.03 5,803.34 6,034.33 6,100.93 6,378.45 6,456.33 6,409.37 6,543.55 6,698.33 6,703.87 6,684.34 6,834.95 6,999.44 6,584.50 6,593.22 6,534.56 6,667.98 6,490.88 6,389.22 6,289.78 6,305.53 6,310.76 6,450.33 6,477.88 6,485.94 6,432.94 6,600.00 6,734.55 7,321.34 2 3 4 5. 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 31.34 31.87 29.22 34.67 36.59 37.39 37.22 43.23 38.83 50.98 53.93 46.30 45.30 48.56 50.20 54.55 55.44 54.83 57.88 60.99 60.93 59.23 60.98 57.47 54.38 55.78 53.23 56.83 52.32 53.10 52.39 52.77 53.19 55.44 56.74 57.85 55.78 57.79 58.98 64.12 || 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 7,454.34 7,645.48 7,903.33 8,134.33 8,234.33 8,305.33 8,300.87 8,413.75 8,500.33 8,700.34 8,654.00 8,778.30 8,503.00 8,876.33 8,903.33 9,034.44 8,953.33 8,957.32 9,003.78 8,933.68 66.46 67.84 63.23 68.94 71.98 73.83 73.33 75.77 76.35 81.98 80.20 81.45 80.34 83.84 84.23 85.87 84.34 85.44 85.65 85.35 Case Study 3: Wiley Enterprises Ltd. Student Instructions REQUIRED: 1. Prepare a 1-page memorandum with exhibits that addresses the required actions. The memo should be divided into the following sections: Cost of Capital, NPV, Capital Budget, and Recommendations. Exhibits should contain the detailed financial calculations, while the memo should analyze this data and other non-quantitative information. It is recommended that the following exhibits be included: Cost of Capital - Wind Turbines Cost of Capital - Sail Boats NPV - Wind Turbines NPV - Sail Boats Memorandum To: From: Subject: Date: (Short introductory paragraph) Cost of Capital (Describe why a separate cost of capital was adopted for the Wind Turbines and Sail boats projects. Also, discuss the process used to calculate the cost of capital for each project and why it is accurate. Do not provide detailed calculations here, they should be found in the exhibits.) Capital Budgeting (Describe the results of the NPV analysis for the two projects. Do not provide details here, they should be found in the exhibits.) Capital Budget (Describe how large of a capital budget the company could support given the constraints.) Recommendations (Based on the results of the NPV analysis for each project and other facts presented in the case, recommend whether none, one or all of the projects should be accepted.) Exhibit 1 Cost of Capital Calculation: Wind Turbines Cost of Equity (Show detailed calculations for the cost of equity - all steps should be shown and clearly labelled.) Cost of Debt (Show detailed calculations for the cost of debt - all steps should be shown and clearly labelled.) Weighted Average Cost of Capital (Show detailed calculations for the WACC - all steps should be shown and clearly labelled.) Exhibit 2 Cost of Capital Calculation: Sail Boats Cost of Equity (Show detailed calculations for the cost of equity - all steps should be shown and clearly labelled.) Cost of Debt (Show detailed calculations for the cost of debt - all steps should be shown and clearly labelled.) Weighted Average Cost of Capital (Show detailed calculations for the WACC - all steps should be shown and clearly labelled.) || Exhibit 3 Net Present Value: Wind Turbines Initial investment Land Building Equipment Tax shield Building Equipment Issuance costs of new financing Change in NWC Total recurring incremental cash flows Sale of assets Land Building Equipment Capital gains tax on land Lost CCA tax shield Building Equipment Change in NWC Revenue Cost of sales Non-traceable FOH Administrative costs Selling costs Income tax Net cash flows PV of net cash flows Net present value 1 2 3 4 Recurring Incremental Cash Flows 5 6 7 8 9 10 11 || 12 13 1 Exhibit 4 Net Present Value: Sail Boats Initial investment Land Building Equipment Tax shield Building Equipment Issuance costs of new financing Change in NWC Total recurring incremental cash flows Sale of assets Land Building Equipment Capital gains tax on land Lost CCA tax shield Building Equipment Change in NWC Revenue Cost of sales Non-traceable FOH Administrative costs Selling costs R&D Costs Income tax Net cash flows PV of net cash flows Net present value 1 2 3 Recurring Incremental Cash Flows 4 5 6 7 8 9 10 11 12 13 14 15 Wiley Enterprises Ltd. Background Wiley Enterprises Ltd. is a manufacturer of high-end inflatable boats and boat motors, which has been operating in Canada for over 35 years. It manufactures its inflatable boats in Didsbury, Alberta and its motors in Rocanville, Saskatchewan and sells them both domestically and internationally. The company has been very successful financially, but the board of directors feels that these two products do not offer strong potential for continued growth. One option for expansion is to manufacture commercial wind turbines, which will be sold primarily to construction companies, farmers, ranchers, the military, the resort industry, and municipal governments. The company feels that this new business has potential given high fuel costs, but it does realize it will be selling to the commercial market in which it has no previous sales experience. A second option is to expand their line of boats to include sail boats of various sizes. This expansion will allow the company to continue to focus on the consumer market and utilize its existing selling network. Expansion into either wind turbines or sail boats will be an expensive undertaking and necessitate the construction of a new manufacturing plant. Dave Pawluk has been assigned as the team leader of a group of engineers, accountants, human resource managers, and marketers responsible for investigating these new projects. Undertaking both projects is a possibility but is would be challenging for the company. Wind Turbines Wiley would have to build a new factory to manufacture wind turbines. The facility would have capacity to produce 15,000 units per year. The cost of the land would be CAD 1,540,000 and the building CAD 5,940,000. Equipment costing CAD 12,850,000 would also be needed. It is expected that the building and equipment will be either worn out or obsolete within 20 years and the company will reconsider its options relating to this product line then. It is estimated that the land will be worth CAD 3,350,000 at the end of the project's life. The building is subject to a CCA rate of 5.0% and the equipment a CCA rate of 35.0%. Land is not subject to CCA, but half of any capital gain realized on disposal is taxable. Half the capital gain is taxable under the Income Tax Act. In addition to property, plant, and equipment, additional net working capital of CAD 550,000 will be required. Sales are estimated to be 5,300 units in the first year, but are expected to grow at approximately 10.0% per year for the next six years before levelling out to 4.0% growth as the company reaches maximum market penetration. Construction companies, resort operators, farmers, and ranchers will purchase their units through local heavy equipment retailers, who will buy the units from Wiley at a list price of CAD 21,450. In addition to selling to retailers, Wiley's sales force will sell directly to its military and municipal clients, who will receive a 10.0% discount on the list price. Wiley expects sales to its military and municipal clients to be 40.0% of the total unit sales. The cost of goods sold are expected to be CAD 16,850 per unit. Non-traceable factory costs are expected to be CAD 1,410,000 per year. An additional CAD 462,000 in administration costs related to the new plant will be incurred at head office annually. Selling this new product will demand the hiring of a national sales manager at CAD 100,000 per year. It is felt that six additional sales people at a base salary of CAD 60,000 each would be needed to sell this new product. A commission equal to 3.0% of unit gross profit is to be received by the national sales manager, who will distribute a quarter of it to himself and the remainder to the individual sales people depending on whether they meet their quotas. The commission is based on the gross profit margin of the units sold to encourage sales of higher margin products. Sail Boats The new factory to build sail boats would last approximately 20 years and could produce approximately 35,000 units per year. The land would cost CAD 1,650,000 and the building CAD 6,850,000. Production equipment worth CAD 13,350,000 would also have to be acquired. It is estimated that the land will be worth CAD 2,550,000 and the building CAD 1,830,000 in 20 years. The equipment will have a negligible salvage value. The building is subject to a CCA rate of 5.0% and the equipment a rate of 35.0%. Additional net working capital of CAD 730,000 will be required to support this project. Sail boats are estimated to be 12,100 the first year, but will grow at 15.0% a year till the end of Year 6. Sail boats will grow at 4.0% a year after that reflecting general growth in the industry. Sail boats would be sold through the same retailers that carry inflatable boats and motors. The selling price will average CAD 3,500 per unit. The cost of goods sold are expected to be CAD 2,590 per unit. Non-traceable factory costs are expected to be CAD 1,050,000 per year and an additional CAD 320,000 in administration costs related to the new plant will be incurred at head office annually. No new sales staff will be required, but sales people will receive a commission equal to 5.0% of the gross profit on each unit. To remain up-to-date with technology, a major overhaul of the product will have to be done at the end of the tenth year. R&D costs of approximately CAD 130,000 each year will be incurred prior to the introduction of the new model, and a CAD 3,600,000 overhaul of the production process will be undertaken near the end of Year 10. This overhaul can be done on weekends, and will not interfere with factory production. The new equipment will be in the same CCA class as the other production equipment, and the R&D costs will qualify for a 10.0% Investment Tax Credit each year. Cost of Financing Wiley calculates its Beta using monthly return data over a five- year estimating period. Exhibit 1 contains the most recent data used. The 3.5% return on the 20-year, treasury bond is used as a proxy for the risk-free rate. The market risk premium is 4.5%. Recently, Wiley did a private placement of a 20-year bond issue with a major life insurance company. The bond had a coupon rate of 7.1% and sold at 103. Wiley realizes that diversifying into the wind turbine market represents a move into a riskier industry. Construction, farming, and ranching are more cyclical than consumer boat sales and are subject to fairly intense foreign competition. Wiley was able to identify five companies that produce a similar product. Data collected for these companies included: Beta Treasury Spread (%) 1.21 3.10% Green Energy Power Solutions 1.42 3.72% Big Wind 1.44 3.59% Sustainable Power 1.48 3.78% Wing Source 1.33 3.21% The corporate tax rate is 35.0%. Capital Budget Wiley has adopted a debt ratio of 40.0% as its target capital structure based on a worst-case scenario analysis done by the company's CFO. It plans on maintaining this ratio in the future as it attempts to "grow" its business. Company policy is to fund all growth with retained earnings and debt. The rationale for this policy is that retained earnings are cheaper than issuing new equity and the founding family of Wiley desires to maintain control over the business - their ownership stake is currently 55.0%. The company has not issued new equity in over 15 years, although in some years they had to delay positive NPV projects due to a lack of internally generated equity. Wiley generated retained earnings of approximately CAD 20,000,000 this year. The cost of selling new equity has been estimated at 8.0% of the funds raised, while the cost of selling debt is only 3.25%. Company policy is to include all issuance costs as an initial cost when evaluating capital projects. Actions Dave Pawluk has been asked by Cathy Petty, VP-Marketing, to supply Wiley with an estimate of the costs of capital that are suitable for analyzing these two expansion projects. A detailed analysis of how these figures were calculated and their limitations was requested. Petty would also like Pawluk's team to complete a detailed evaluation of the two expansion options. The NPV approach should be used as per company policy. Exhibit 1 - Calculation of Beta Wiley Stock Period Share Index Price 1 4,834.78 5,100.56 4,789.45 4,900.45 4,901.34 5,265.95 5,560.34 5,660.87 5,500.23 5,798.34 5,900.65 5,927.03 5,803.34 6,034.33 6,100.93 6,378.45 6,456.33 6,409.37 6,543.55 6,698.33 6,703.87 6,684.34 6,834.95 6,999.44 6,584.50 6,593.22 6,534.56 6,667.98 6,490.88 6,389.22 6,289.78 6,305.53 6,310.76 6,450.33 6,477.88 6,485.94 6,432.94 6,600.00 6,734.55 7,321.34 2 3 4 5. 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 31.34 31.87 29.22 34.67 36.59 37.39 37.22 43.23 38.83 50.98 53.93 46.30 45.30 48.56 50.20 54.55 55.44 54.83 57.88 60.99 60.93 59.23 60.98 57.47 54.38 55.78 53.23 56.83 52.32 53.10 52.39 52.77 53.19 55.44 56.74 57.85 55.78 57.79 58.98 64.12 || 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 7,454.34 7,645.48 7,903.33 8,134.33 8,234.33 8,305.33 8,300.87 8,413.75 8,500.33 8,700.34 8,654.00 8,778.30 8,503.00 8,876.33 8,903.33 9,034.44 8,953.33 8,957.32 9,003.78 8,933.68 66.46 67.84 63.23 68.94 71.98 73.83 73.33 75.77 76.35 81.98 80.20 81.45 80.34 83.84 84.23 85.87 84.34 85.44 85.65 85.35 Case Study 3: Wiley Enterprises Ltd. Student Instructions REQUIRED: 1. Prepare a 1-page memorandum with exhibits that addresses the required actions. The memo should be divided into the following sections: Cost of Capital, NPV, Capital Budget, and Recommendations. Exhibits should contain the detailed financial calculations, while the memo should analyze this data and other non-quantitative information. It is recommended that the following exhibits be included: Cost of Capital - Wind Turbines Cost of Capital - Sail Boats NPV - Wind Turbines NPV - Sail Boats Memorandum To: From: Subject: Date: (Short introductory paragraph) Cost of Capital (Describe why a separate cost of capital was adopted for the Wind Turbines and Sail boats projects. Also, discuss the process used to calculate the cost of capital for each project and why it is accurate. Do not provide detailed calculations here, they should be found in the exhibits.) Capital Budgeting (Describe the results of the NPV analysis for the two projects. Do not provide details here, they should be found in the exhibits.) Capital Budget (Describe how large of a capital budget the company could support given the constraints.) Recommendations (Based on the results of the NPV analysis for each project and other facts presented in the case, recommend whether none, one or all of the projects should be accepted.) Exhibit 1 Cost of Capital Calculation: Wind Turbines Cost of Equity (Show detailed calculations for the cost of equity - all steps should be shown and clearly labelled.) Cost of Debt (Show detailed calculations for the cost of debt - all steps should be shown and clearly labelled.) Weighted Average Cost of Capital (Show detailed calculations for the WACC - all steps should be shown and clearly labelled.) Exhibit 2 Cost of Capital Calculation: Sail Boats Cost of Equity (Show detailed calculations for the cost of equity - all steps should be shown and clearly labelled.) Cost of Debt (Show detailed calculations for the cost of debt - all steps should be shown and clearly labelled.) Weighted Average Cost of Capital (Show detailed calculations for the WACC - all steps should be shown and clearly labelled.) || Exhibit 3 Net Present Value: Wind Turbines Initial investment Land Building Equipment Tax shield Building Equipment Issuance costs of new financing Change in NWC Total recurring incremental cash flows Sale of assets Land Building Equipment Capital gains tax on land Lost CCA tax shield Building Equipment Change in NWC Revenue Cost of sales Non-traceable FOH Administrative costs Selling costs Income tax Net cash flows PV of net cash flows Net present value 1 2 3 4 Recurring Incremental Cash Flows 5 6 7 8 9 10 11 || 12 13 1 Exhibit 4 Net Present Value: Sail Boats Initial investment Land Building Equipment Tax shield Building Equipment Issuance costs of new financing Change in NWC Total recurring incremental cash flows Sale of assets Land Building Equipment Capital gains tax on land Lost CCA tax shield Building Equipment Change in NWC Revenue Cost of sales Non-traceable FOH Administrative costs Selling costs R&D Costs Income tax Net cash flows PV of net cash flows Net present value 1 2 3 Recurring Incremental Cash Flows 4 5 6 7 8 9 10 11 12 13 14 15