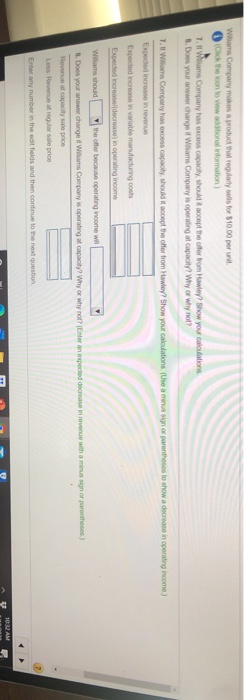

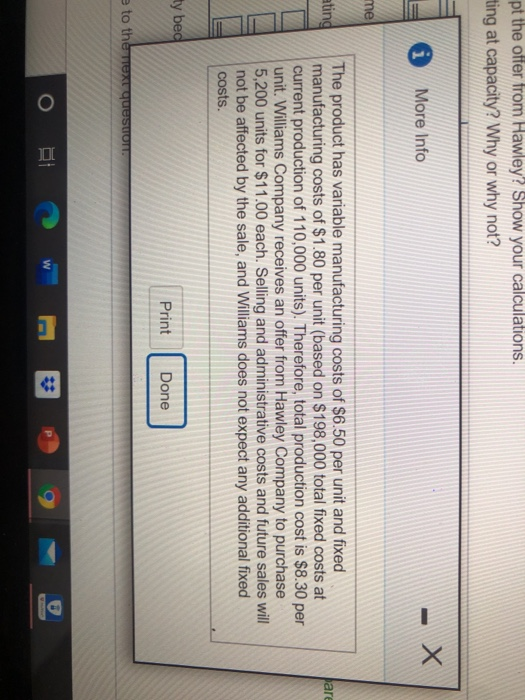

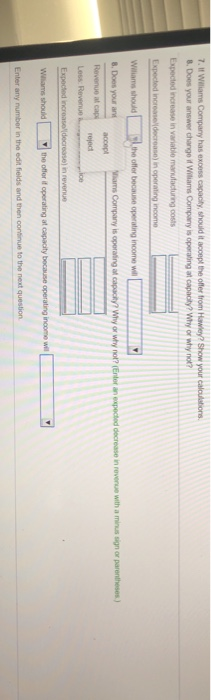

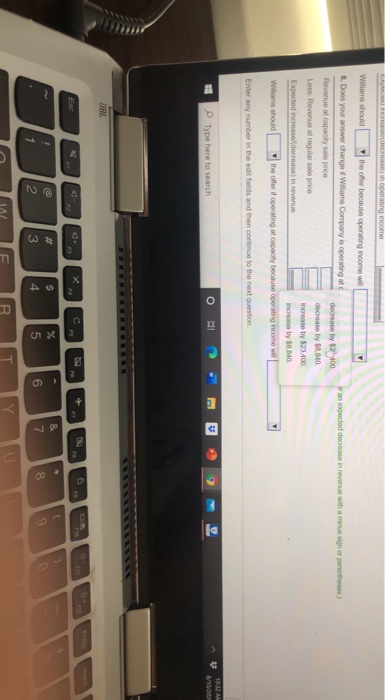

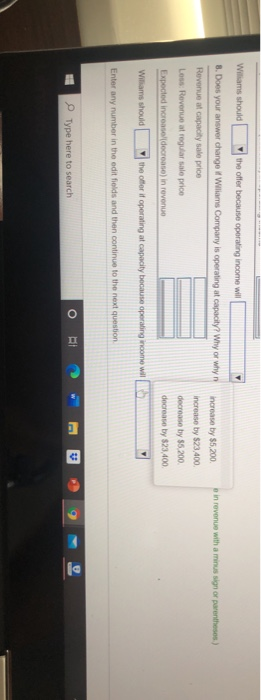

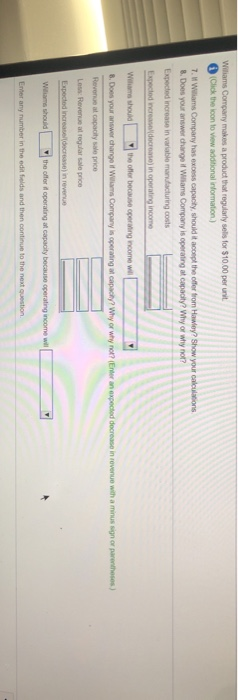

Wiliams Compary make a product that regularly for $10.00 per un Click the icon to view itional information) 7. Wrams Company has enco capacity, should accept the offer from Hawley Show your calculations 8. Does your wwwer change it Wim Company is operating at capacity? Why or why not? 7. Williams Compartment capacity, should it accept the offer from Hawley? Show your calculations. (Utamina signor parentheses to show a decrease in operating income) Expected increase even Expected increase in variable manufacturing coulis Expected increased decrease in operating income Wiams should the offer because operating income wil 8. Does your answer change it was company is operating at capacity? Why or why not? (Enter an expected decrease in revenue with a mission or prontos ) Reverse capacity sale price Los Revenue regular sale ce Enter ww number in the fields and then continue to the next question 10:12 AM pt the offer from Hawley? Show your calculations. ting at capacity? Why or why not? More Info me ating are The product has variable manufacturing costs of $6.50 per unit and fixed manufacturing costs of $1.80 per unit (based on $198,000 total fixed costs at current production of 110,000 units). Therefore, total production cost is $8.30 per unit. Williams Company receives an offer from Hawley Company to purchase 5,200 units for $11.00 each. Selling and administrative costs and future sales will not be affected by the sale, and Williams does not expect any additional fixed costs. ty bed Print Done e to the text question E 7. Williams Company has excess capacity, should it accept the offer from Hawley Show your calculations 8. Does your answer change if Williams Company is operating at capacity? Why or why not? Expected increase in variable manufacturing costs Expected incredecrease in operating income Williams should sl the offer because operating income will Mhams Company is operating at capacity Why or why not? (Enter an expected decrease in revenue with a minus sign or parentheses) 8. Does your and accep Revenue at cap roject Loss Revenue ice Expected increase decrease in revenue Wiams should the offer operating at capacity because operating income wil Enter any number in the edit fields and then continue to the next question CROS Operating income Wan expected decrease in revenue with a mission or parentheses) Williams should the offer because operating income will 8. Does your answer change i Wiams Company is operating at decrease by 2 400 Revenue at capacity sale price decrease by 58,840 Los Revenue at regular sale price increase by $23.400 Expected increasedecrease in revenue increase by 58,840 Williams should the offer if operating at capacity because operating income wil Enter any number in the edit fields and then continue to the next question Type here to search O 9 101 AN AVTO/20 B Esc $ 4 & 7 8 6 9 3 1 5 R Williams should the other because operating income wil 8. Does your answer change il Williams Company is operating at capacity? Why or why not? (Enter an expected decrease in revenue with a minus signor press) Revenue al capacity sale price Less: Revenue regular sale price Expected increase (decrease in revenue Williams should the other operating at capacity because operating income wil Enter any numbe ds and then continue to the next question act Toot 103 AM W10/200 Type here to search 30 F $ 4 # 3 = & 7 % 5 0 9 8 6 1 2 o P U E T Y R W o in revenue with a minus sign or parentheses) Williams should the offer because operating income will 8. Does your answer change Williams Company is operating at capacity? Why or whyn increase by $5,200 Revenue at capacity sale price increase by $23.400 Loss: Revenue at regular sale price decrease by 55.200 Expected increase (decrease) in revenue decrease by $23.400 Williams should the other it operating at capacity because operating income il 15 Enter any number in the edit fields and then continue to the next question Type here to search O Wiliams Company makes a product that regularly sells for $10.00 per unit Click the icon to view additional information) 7. Wiliams Company has excess capacity, should it accept the offer from Hawley? Show your calculations 8. Does your answer change if Wiliams Company is operating at capacity? Why of why not? Expected increase in variable manufacturing costs Expected incredere in operating income Wish the offer serving income will 8. Does your answer change i Wilm Company is operating at capachy? Why or why not? (Enter an expected decrease in revenue with a minus signor parentheses) Revenue at capacity sale price Los: Revenue at regular sale price Expected increases in revenue Wiams should the offer i operating at capacity because operating income wil Enter any number in the edit fields and then continue to the next