Answered step by step

Verified Expert Solution

Question

1 Approved Answer

will be incurred during his styr Opales mat each oil change will stil Remaining Time: 1 hour, 33 minutes, 11 seconds. Question Completion Status: Path

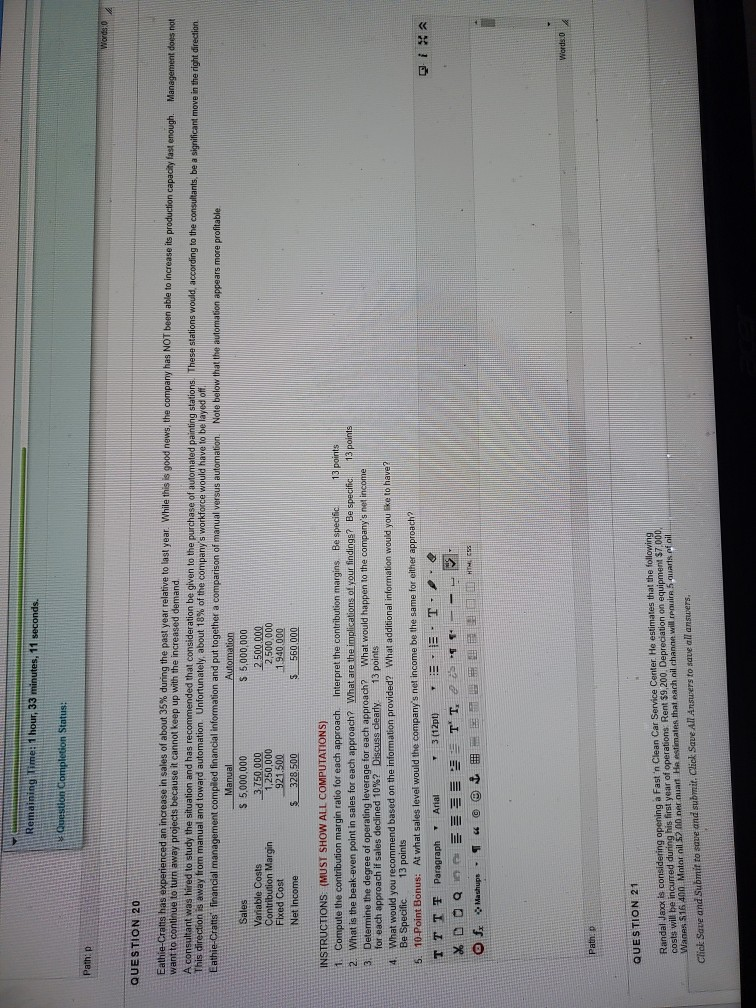

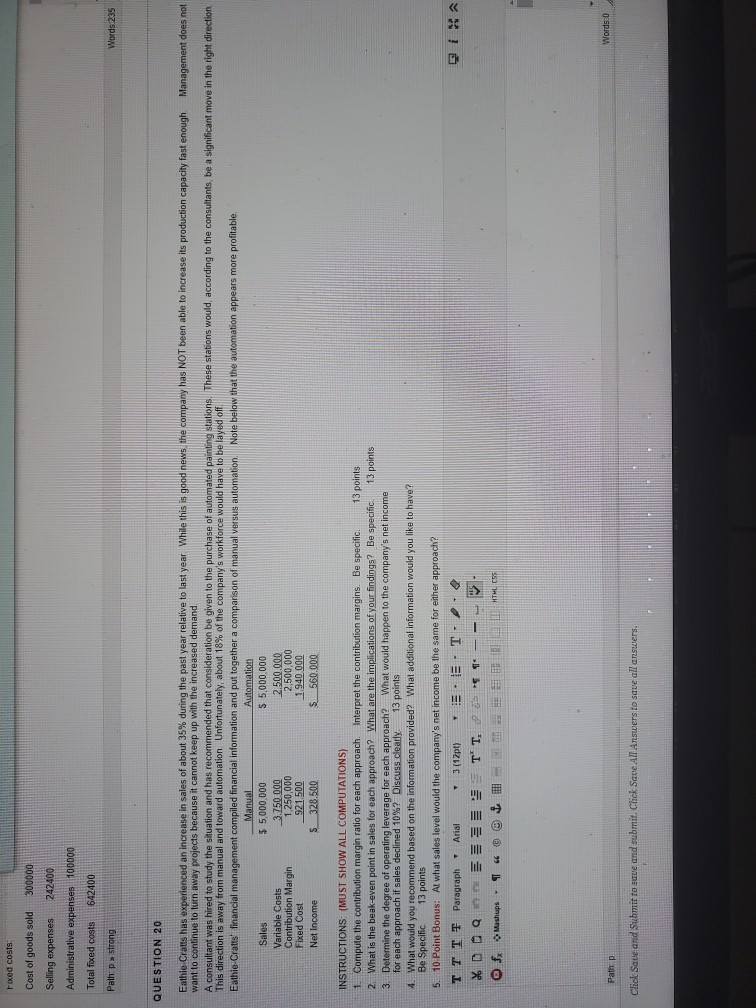

will be incurred during his styr Opales mat each oil change will stil Remaining Time: 1 hour, 33 minutes, 11 seconds. Question Completion Status: Path Words QUESTION 20 Eathie-Cratts has experienced an increase in sales of about 35% during the past year relative to last year. While this is good news, the company has NOT been able to increase its production capacity fast enough. Management does not want to continue to turn away projects because it cannot keep up with the increased demand A consultant was hired to study the situation and has recommended that consideration be given to the purchase of automated painting stations. These stations would according to the consultants, be a significant move in the right direction This direction is away from manual and toward automation. Unfortunately, about 18% of the company's workforce would have to be layed off Eathie-Cratts financial management compiled financial information and put together a comparison of manual versus automation. Note below that the automation appears more profitable Manual Automation Sales $ 5,000,000 S 5,000,000 Variable Costs 3.750,000 2.500.000 Contribution Margin 1,250,000 2,500,000 Fixed Cost 921.500 1.940.000 Net Income $_328,500 $_560.000 13 points INSTRUCTIONS: (MUST SHOW ALL COMPUTATIONS) 1. Compute the contribution margin ratio for each approach. Interpret the contribution margins. Be specific 2. What is the beak-even point in sales for each approach? What are the implications of your findings? Be specific 15 points 3. Determine the degree of operating leverage for each approach? What would happen to the company's net income for each approach if sales declined 10%? Discuss clearly 13 points 4. What would you recommend based on the information provided? What additional information would you like to have? Be Specific 13 points 5. 10-Point Bonus: At what sales level would the company's net income be the same for either approach? TTTT Paragraph Arial 3 (12pt) E T. X DOO E T' T. - - fx Mashups @ HMS Qi& Words.0 Path. QUESTION 21 Randal Jaxx is considering opening a Fast'n Clean Car Service Center He estimates that the following Rent $9,200 Depreciation on equipment $7,000 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Foxed costs: Cost of goods sold 300000 Selling expenses 242400 Administrative expenses 100000 Total fixed costs 642400 Path:p strong Words 235 QUESTION 20 Eathie Cralls has experienced an increase in sales of about 35% during the past year relative to last year. While this is good news the company has NOT been able to increase its production capacity fast enough Management does not want to continue to turn away projects because it cannot keep up with the increased demand A consultant was hired to study the situation and has recommended that consideration be given to the purchase of automated painting stations. These stations would, according to the consultants be a significant move in the right direction This direction is away from manual and toward automation Unfortunately, about 18% of the company's workforce would have be layed off Eathie Cralis financial management compiled financial information and put together a comparison of manual versus automation Note below that the automation appears more profitable. Manual Automation Sales $ 5.000.000 5 5,000,000 Variable Costs 3.750.000 2.500.000 Contribution Margin 1.250,000 Fixed Cost 921,500 1.940 000 Net Income 328.500 $ 560.000 2.500,000 13 points INSTRUCTIONS (MUST SHOW ALL COMPUTATIONS) 1. Compute the contribution margin ratio for each approach. Interpret the contribution margins. Be specific. 13 points 2. What is the beak-even point in sales for each approach? What are the implications of your findings? Be specific 13 points 3. Determine the degree of operating leverage for each approach? What would happen to the company's net income for each approach if sales declined 10%? Discuss clearly 13 points 4. What would you recommend based on the information provided? What additional information would you like to have? Be Specific 5. 10 Point Bonus: At what sales level would the company's net income be the same for either approach? TTT Paragraph Arial ET TT, OP 9 O fx Mashups - 1 HTML CSS 3 (12pt) Words: 0 Pat P Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started