Answered step by step

Verified Expert Solution

Question

1 Approved Answer

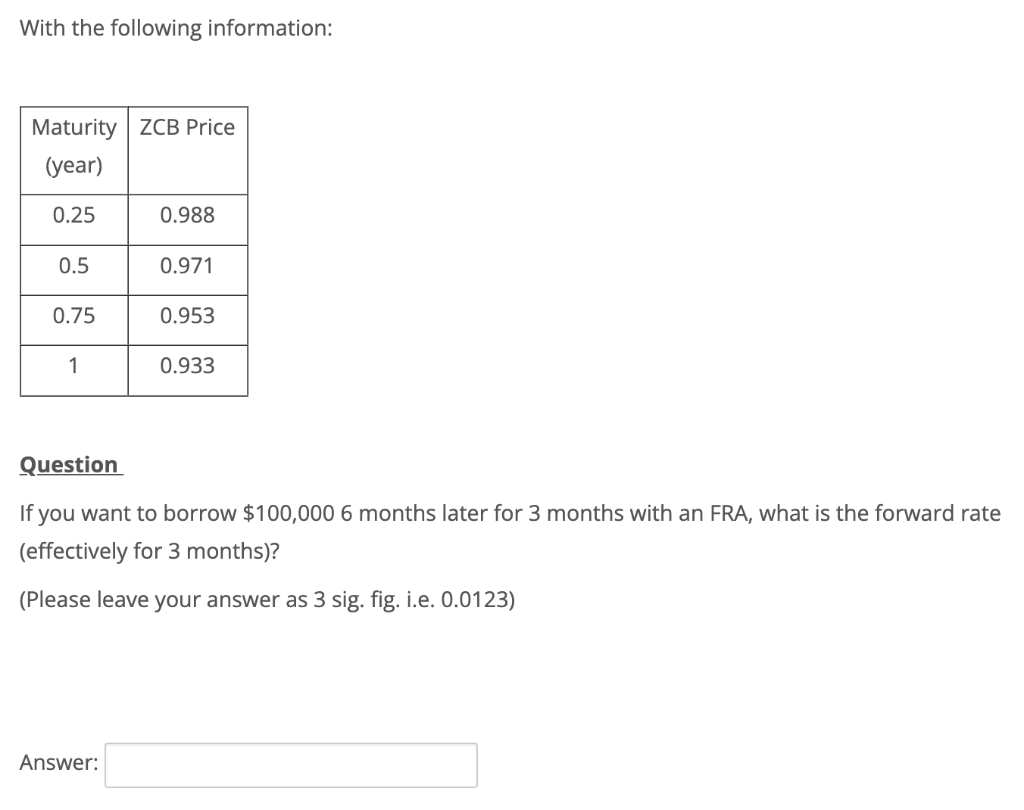

Will give a thumb up if answer all short questions correctly. Thanks! With the following information: Maturity ZCB Price (year) 0.25 0.988 0.5 0.971 0.75

Will give a thumb up if answer all short questions correctly. Thanks!

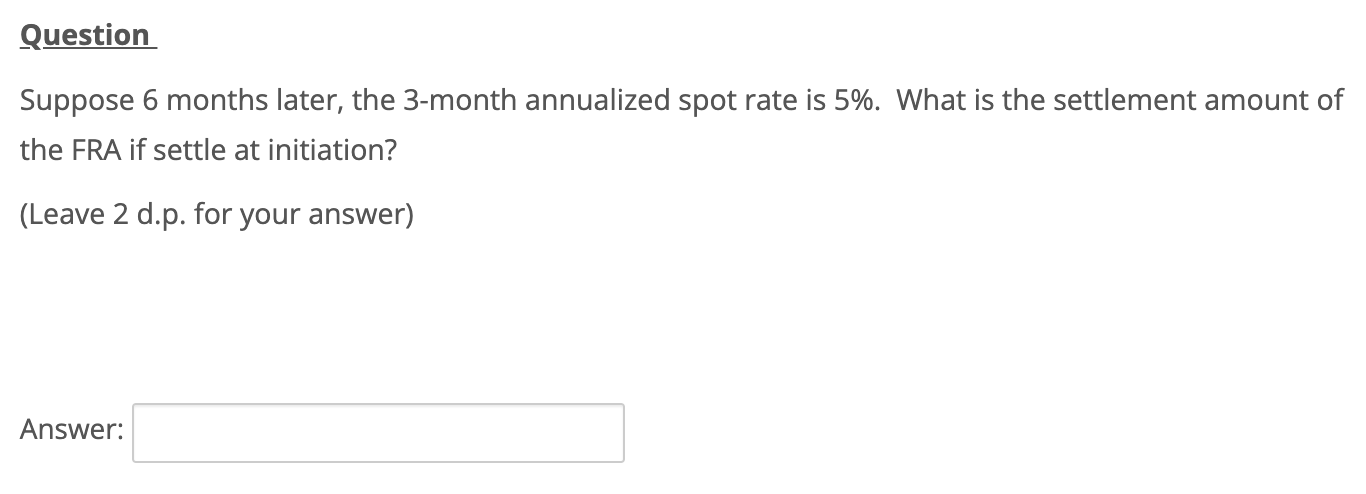

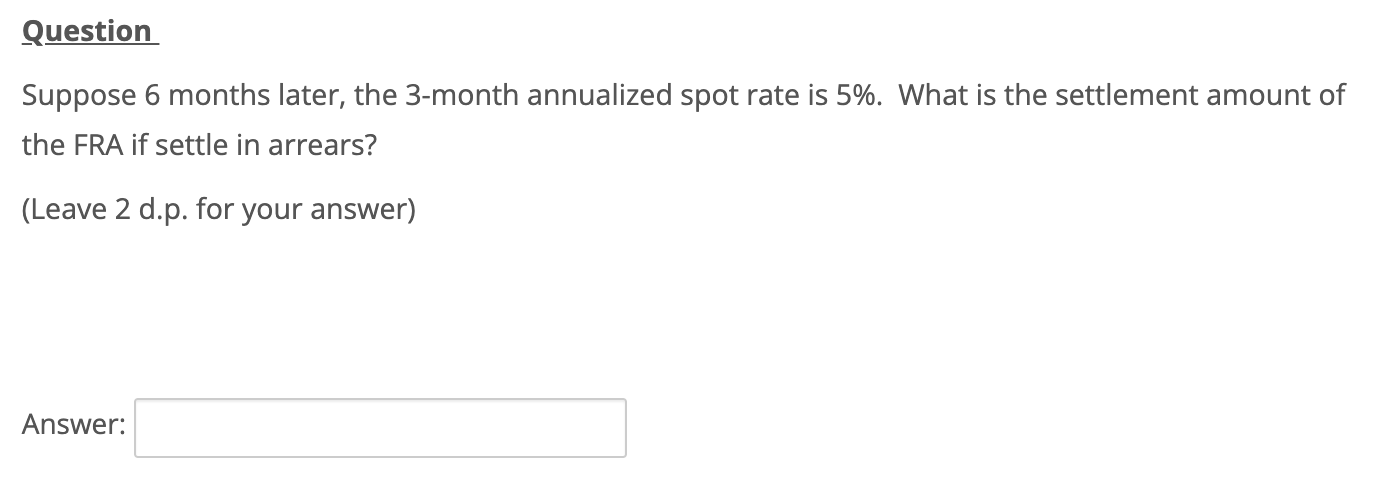

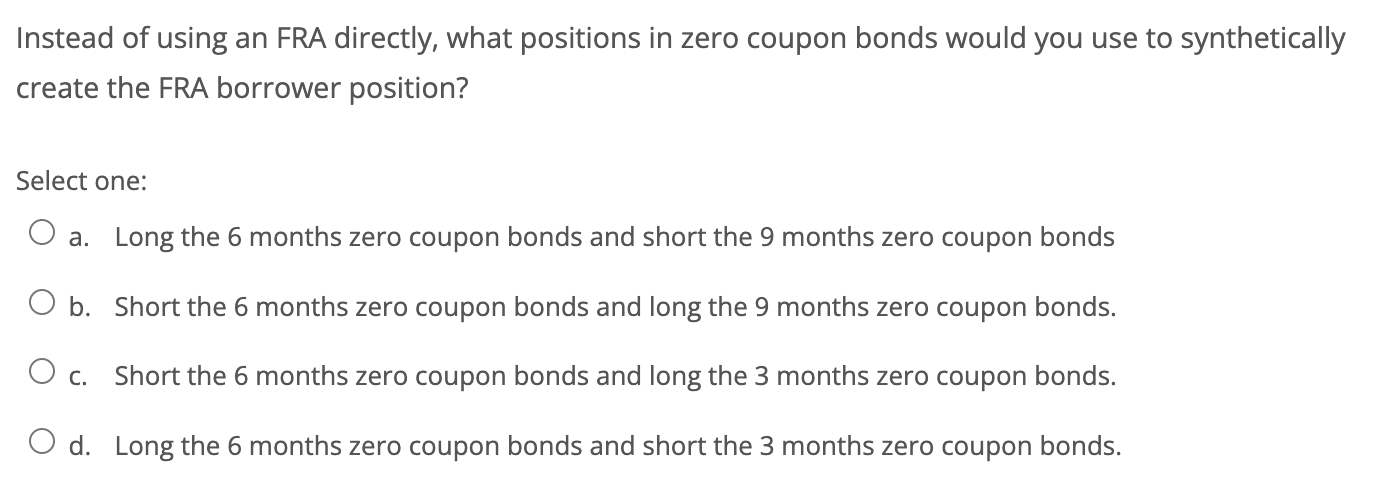

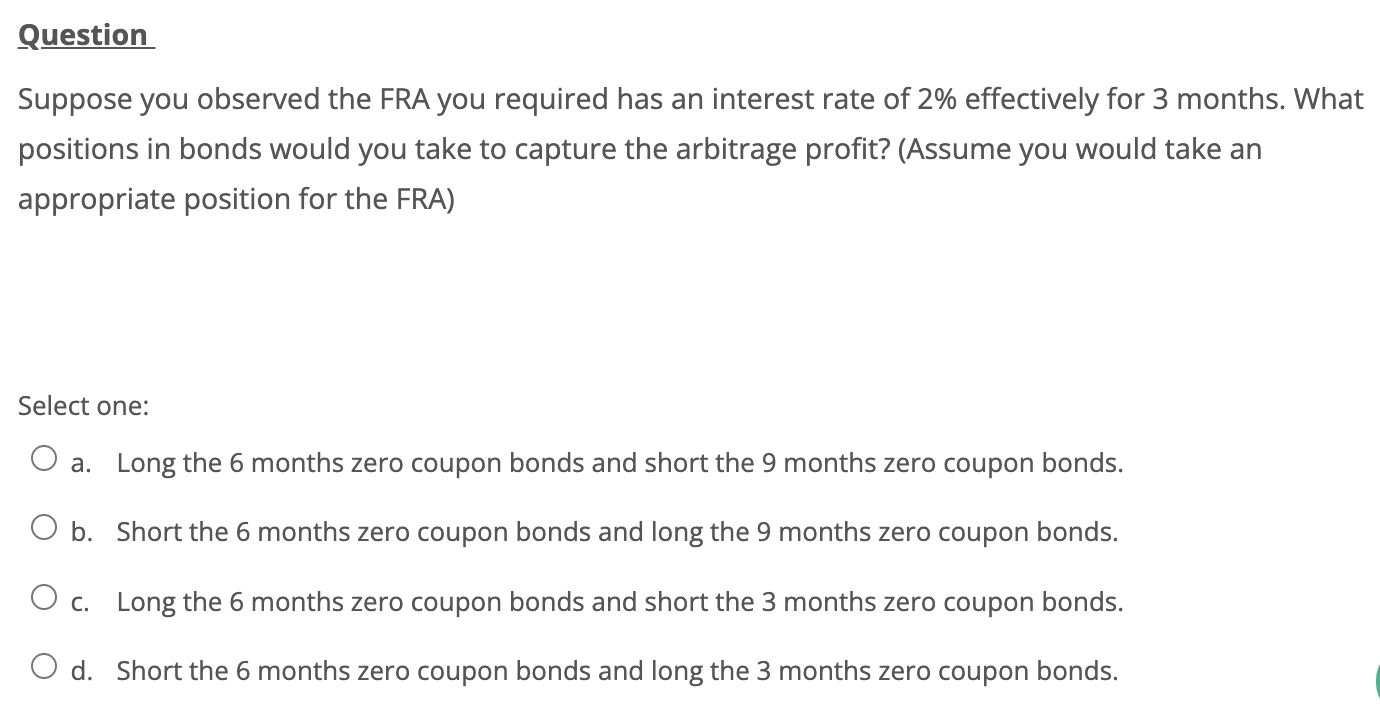

With the following information: Maturity ZCB Price (year) 0.25 0.988 0.5 0.971 0.75 0.953 1 0.933 Question If you want to borrow $100,000 6 months later for 3 months with an FRA, what is the forward rate (effectively for 3 months)? (Please leave your answer as 3 sig. fig. i.e. 0.0123) Answer: Question Suppose 6 months later, the 3-month annualized spot rate is 5%. What is the settlement amount of the FRA if settle at initiation? (Leave 2 d.p. for your answer) Answer: Question Suppose 6 months later, the 3-month annualized spot rate is 5%. What is the settlement amount of the FRA if settle in arrears? (Leave 2 d.p. for your answer) Answer: Instead of using an FRA directly, what positions in zero coupon bonds would you use to synthetically create the FRA borrower position? Select one: a. Long the 6 months zero coupon bonds and short the 9 months zero coupon bonds O b. Short the 6 months zero coupon bonds and long the 9 months zero coupon bonds. O c. Short the 6 months zero coupon bonds and long the 3 months zero coupon bonds. O d. Long the 6 months zero coupon bonds and short the 3 months zero coupon bonds. Question Suppose you observed the FRA you required has an interest rate of 2% effectively for 3 months. What positions in bonds would you take to capture the arbitrage profit? (Assume you would take an appropriate position for the FRA) Select one: O a. Long the 6 months zero coupon bonds and short the 9 months zero coupon bonds. O b. Short the 6 months zero coupon bonds and long the 9 months zero coupon bonds. O c. Long the 6 months zero coupon bonds and short the 3 months zero coupon bonds. O d. Short the 6 months zero coupon bonds and long the 3 months zero coupon bonds. Question What is your arbitrage profit per dollar borrowed/lend on the maturity day? (Please leave your answer as 3 sig. fig. i.e. 0.0123) Answer: With the following information: Maturity ZCB Price (year) 0.25 0.988 0.5 0.971 0.75 0.953 1 0.933 Question If you want to borrow $100,000 6 months later for 3 months with an FRA, what is the forward rate (effectively for 3 months)? (Please leave your answer as 3 sig. fig. i.e. 0.0123) Answer: Question Suppose 6 months later, the 3-month annualized spot rate is 5%. What is the settlement amount of the FRA if settle at initiation? (Leave 2 d.p. for your answer) Answer: Question Suppose 6 months later, the 3-month annualized spot rate is 5%. What is the settlement amount of the FRA if settle in arrears? (Leave 2 d.p. for your answer) Answer: Instead of using an FRA directly, what positions in zero coupon bonds would you use to synthetically create the FRA borrower position? Select one: a. Long the 6 months zero coupon bonds and short the 9 months zero coupon bonds O b. Short the 6 months zero coupon bonds and long the 9 months zero coupon bonds. O c. Short the 6 months zero coupon bonds and long the 3 months zero coupon bonds. O d. Long the 6 months zero coupon bonds and short the 3 months zero coupon bonds. Question Suppose you observed the FRA you required has an interest rate of 2% effectively for 3 months. What positions in bonds would you take to capture the arbitrage profit? (Assume you would take an appropriate position for the FRA) Select one: O a. Long the 6 months zero coupon bonds and short the 9 months zero coupon bonds. O b. Short the 6 months zero coupon bonds and long the 9 months zero coupon bonds. O c. Long the 6 months zero coupon bonds and short the 3 months zero coupon bonds. O d. Short the 6 months zero coupon bonds and long the 3 months zero coupon bonds. Question What is your arbitrage profit per dollar borrowed/lend on the maturity day? (Please leave your answer as 3 sig. fig. i.e. 0.0123)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started