will give a thumbs up if all answers are correct

will give a thumbs up if all answers are correct

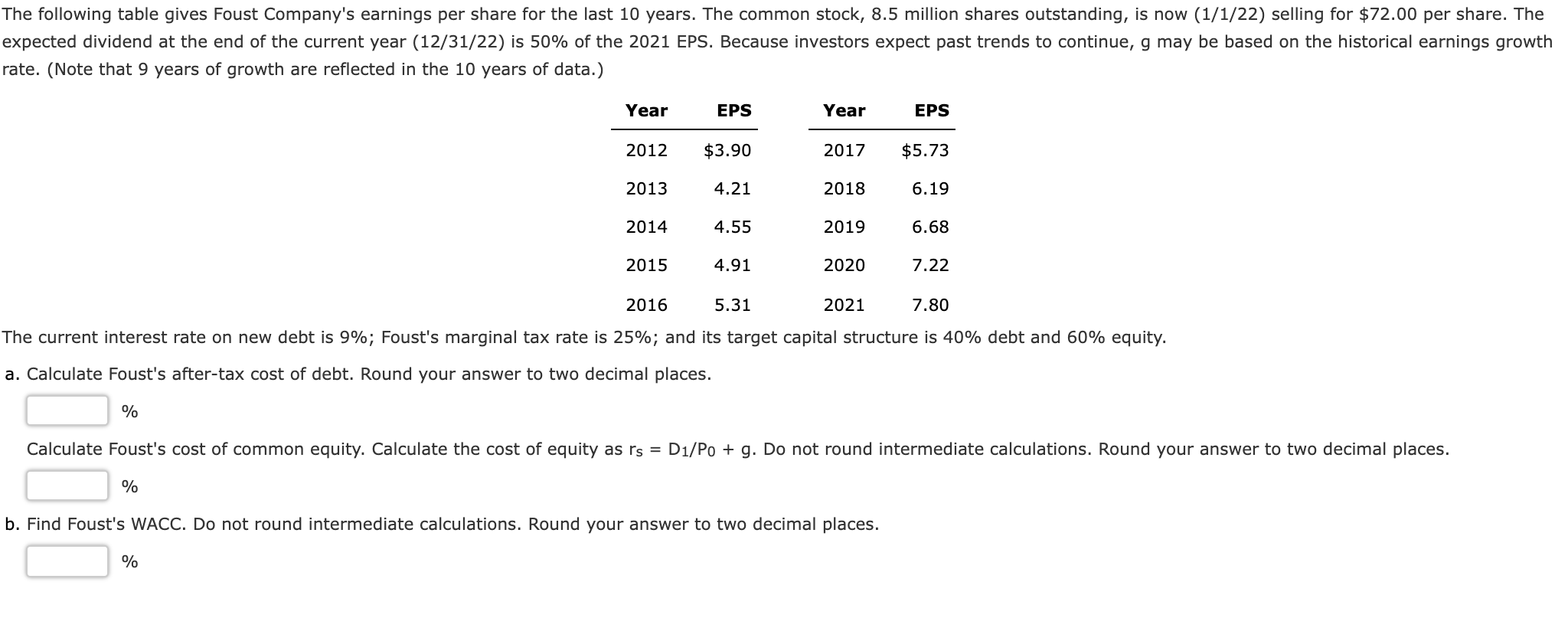

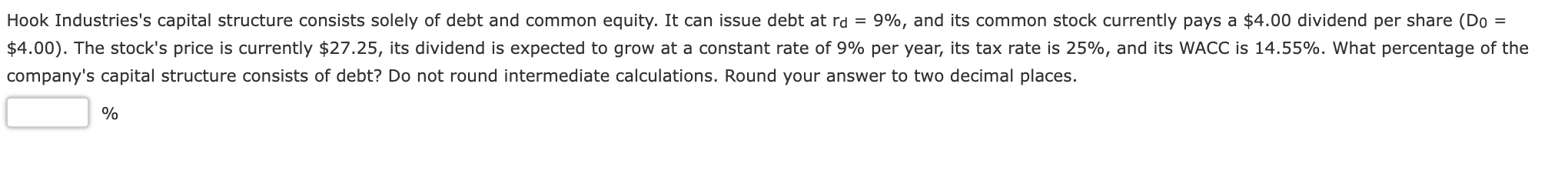

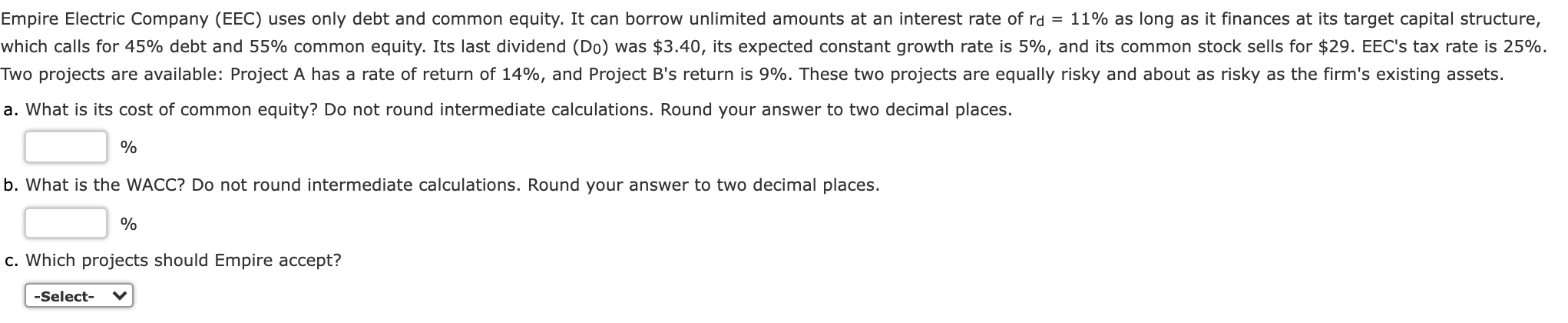

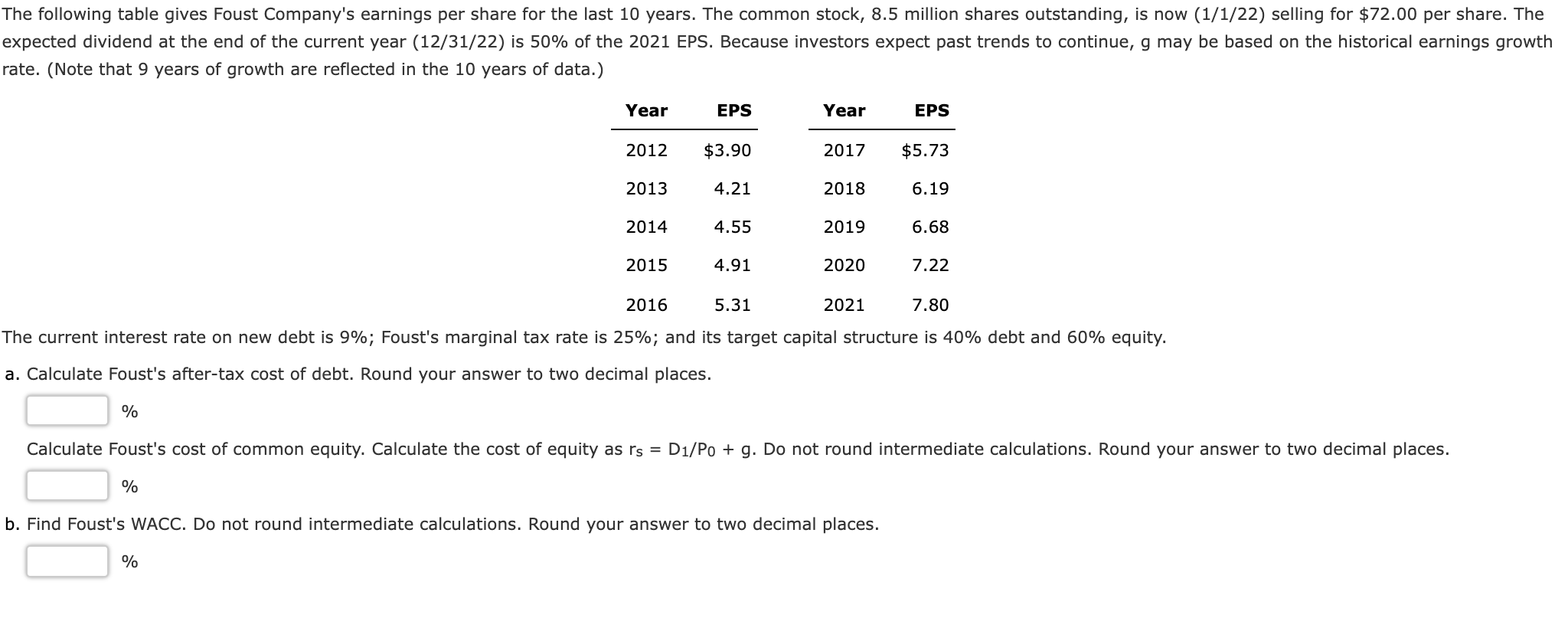

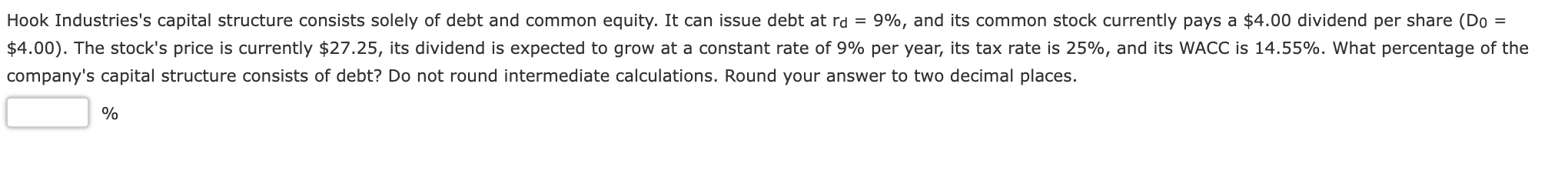

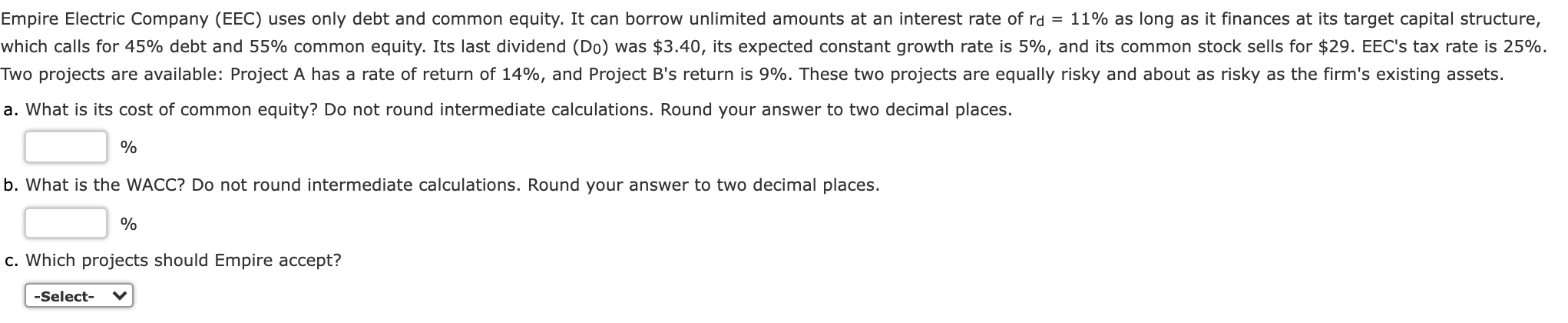

The following table gives Foust Company's earnings per share for the last 10 years. The common stock, 8.5 million shares outstanding, is now (1/1/22) selling for $72.00 per share. The expected dividend at the end of the current year (12/31/22) is 50% of the 2021 EPS. Because investors expect past trends to continue, g may be based on the historical earnings growth rate. (Note that 9 years of growth are reflected in the 10 years of data.) Year EPS Year EPS 2012 $3.90 2017 $5.73 2013 4.21 2018 6.19 2014 4.55 2019 6.68 2015 4.91 2020 7.22 2016 5.31 2021 7.80 The current interest rate on new debt is 9%; Foust's marginal tax rate is 25%; and its target capital structure is 40% debt and 60% equity. a. Calculate Foust's after-tax cost of debt. Round your answer to two decimal places. % Calculate Foust's cost of common equity. Calculate the cost of equity as rs = D1/Po + g. Do not round intermediate calculations. Round your answer to two decimal places. % b. Find Foust's WACC. Do not round intermediate calculations. Round your answer to two decimal places. % Hook Industries's capital structure consists solely of debt and common equity. It can issue debt at rd = 9%, and its common stock currently pays a $4.00 dividend per share (Do = $4.00). The stock's price is currently $27.25, its dividend is expected to grow at a constant rate of 9% per year, its tax rate is 25%, and its WACC is 14.55%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations. Round your answer to two decimal places. % Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of ra = 11% as long as it finances at its target capital structure, which calls for 45% debt and 55% common equity. Its last dividend (Do) was $3.40, its expected constant growth rate is 5%, and its common stock sells for $29. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 14%, and Project B's return is 9%. These two projects are equally risky and about as risky as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. % c. Which projects should Empire accept? -Select

will give a thumbs up if all answers are correct

will give a thumbs up if all answers are correct