Answered step by step

Verified Expert Solution

Question

1 Approved Answer

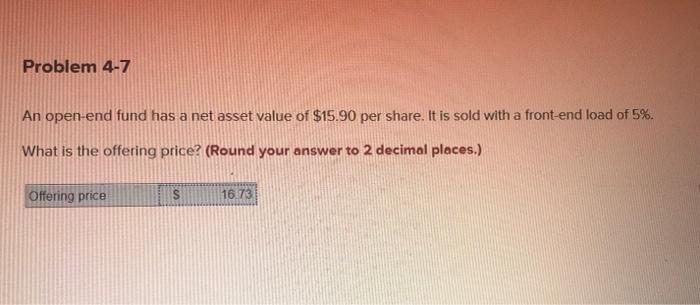

will give positive ratings Problem 4-7 An open-end fund has a net asset value of $15.90 per share. It is sold with a front-end load

will give positive ratings

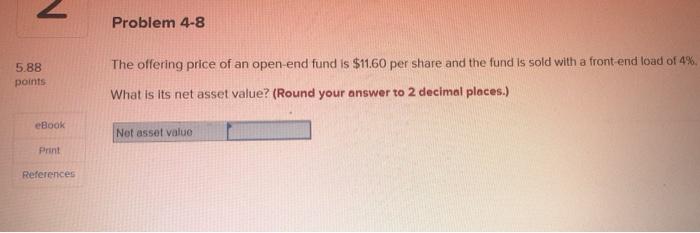

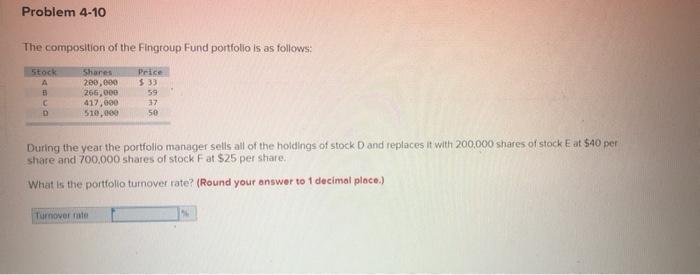

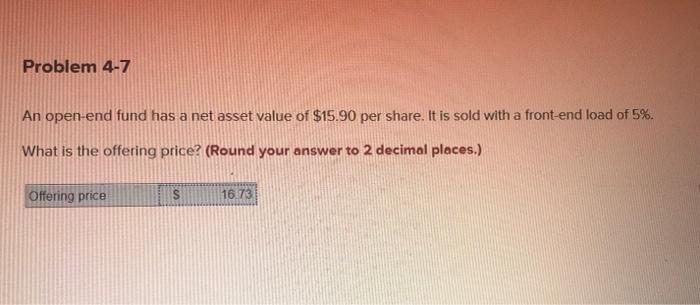

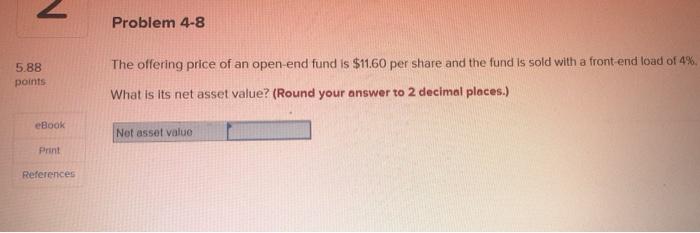

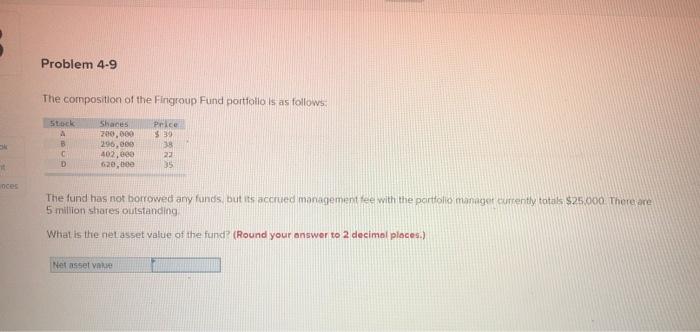

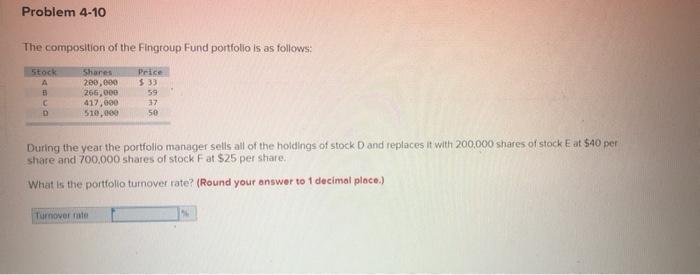

Problem 4-7 An open-end fund has a net asset value of $15.90 per share. It is sold with a front-end load of 5%. What is the offering price? (Round your answer to 2 decimal places.) Offering price S 16.73 N Problem 4-8 The offering price of an open-end fund is $11.60 per share and the fund is sold with a front-end load of 4% 5.88 points What is its net asset value? (Round your answer to 2 decimal places.) eBook Not asset value Print References Problem 4.9 The composition of the Fingroup Fund portfolio is as follows: Stock A C D Shares 200,000 298,000 402,800 620,000 Price $ 39 39 23 35 oces The fund has not borrowed any funds but its accrued management tee with the portfolio Manager currently totals $25.000 There are 5 million shares outstanding What is the net asset value of the fund? (Round your answer to 2 decimal places.) Net asset Problem 4-10 The composition of the Fingroup Fund portfolio is as follows: Stock Shares 200,000 266,000 417,000 510,000 Price $33 59 37 50 D During the year the portfolio manager sells all of the holdings of stock and replaces it with 200,000 shares of stock E at $40 per share and 700.000 shares of stock Fat $25 per share What is the portfolio turnover rate? (Round your answer to 1 decimal place.) Turnover rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started