Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will give thumbs up for all correct answers!! Score: 0 of 1 pt 1 3 of 7 (3 complete) HW Score: 28.57%, 20 PC:9-39 (similar

Will give thumbs up for all correct answers!!

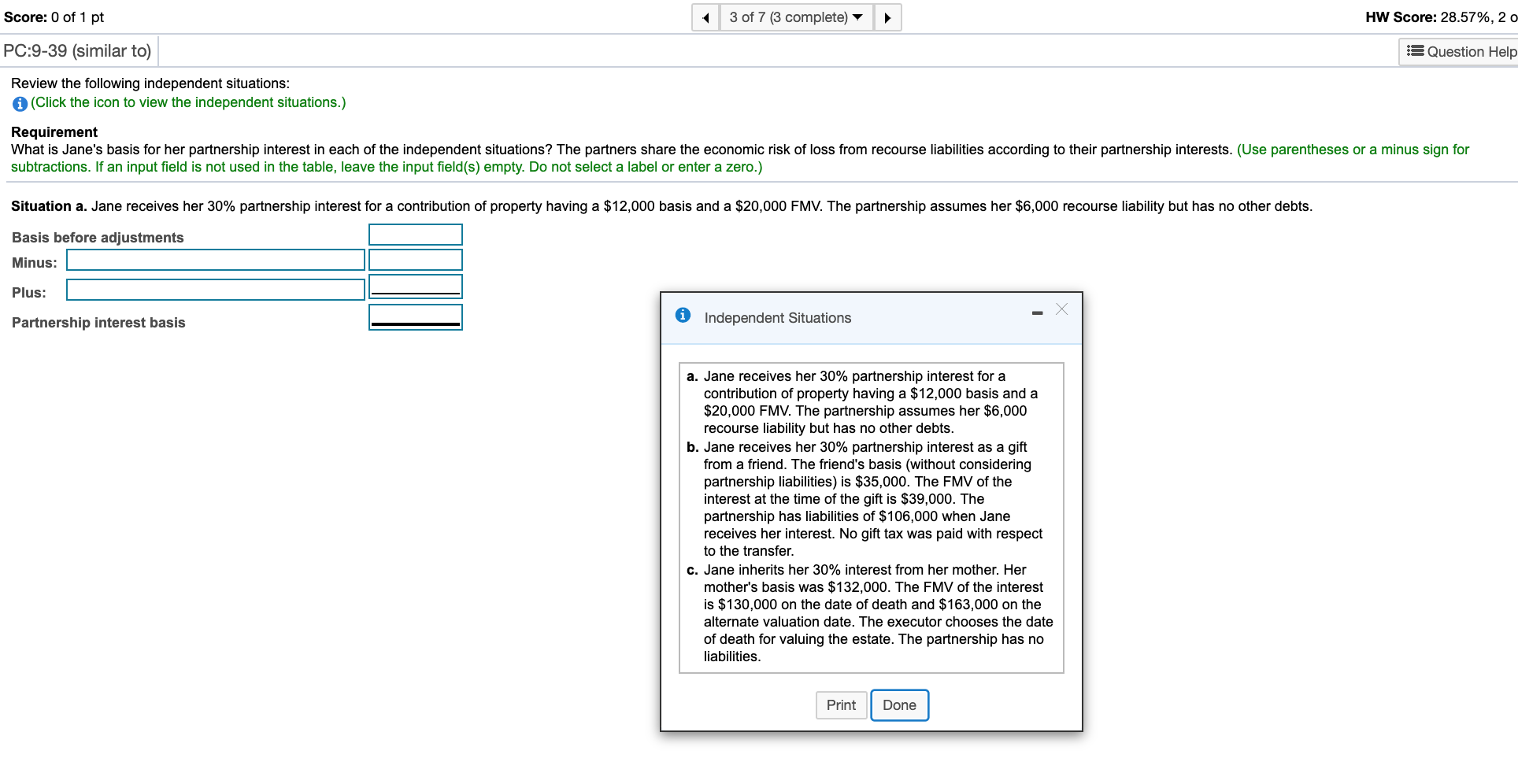

Score: 0 of 1 pt 1 3 of 7 (3 complete) HW Score: 28.57%, 20 PC:9-39 (similar to) 3 Question Help Review the following independent situations: (Click the icon to view the independent situations.) Requirement What is Jane's basis for her partnership interest in each of the independent situations? The partners share the economic risk of loss from recourse liabilities according to their partnership interests. (Use parentheses or a minus sign for subtractions. If an input field is not used in the table, leave the input field(s) empty. Do not select a label or enter a zero.) Situation a. Jane receives her 30% partnership interest for a contribution of property having a $12,000 basis and a $20,000 FMV. The partnership assumes her $6,000 recourse liability but has no other debts. Basis before adjustments Minus: Plus: Partnership interest basis Independent Situations a. Jane receives her 30% partnership interest for a contribution of property having a $12,000 basis and a $20,000 FMV. The partnership assumes her $6,000 recourse liability but has no other debts. b. Jane receives her 30% partnership interest as a gift from a friend. The friend's basis (without considering partnership liabilities) is $35,000. The FMV of the interest at the time of the gift is $39,000. The partnership has liabilities of $106,000 when Jane receives her interest. No gift tax was paid with respect to the transfer. c. Jane inherits her 30% interest from her mother. Her mother's basis was $132,000. The FMV of the interest is $130,000 on the date of death and $163,000 on the alternate valuation date. The executor chooses the date of death for valuing the estate. The partnership has no liabilities. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started