Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will give thumbs up. Thank you in advance Ch. 3: Job Costing - Flow of Costs Names: 4. Calculate the unadjusted cost of goods sold

Will give thumbs up.

Thank you in advance

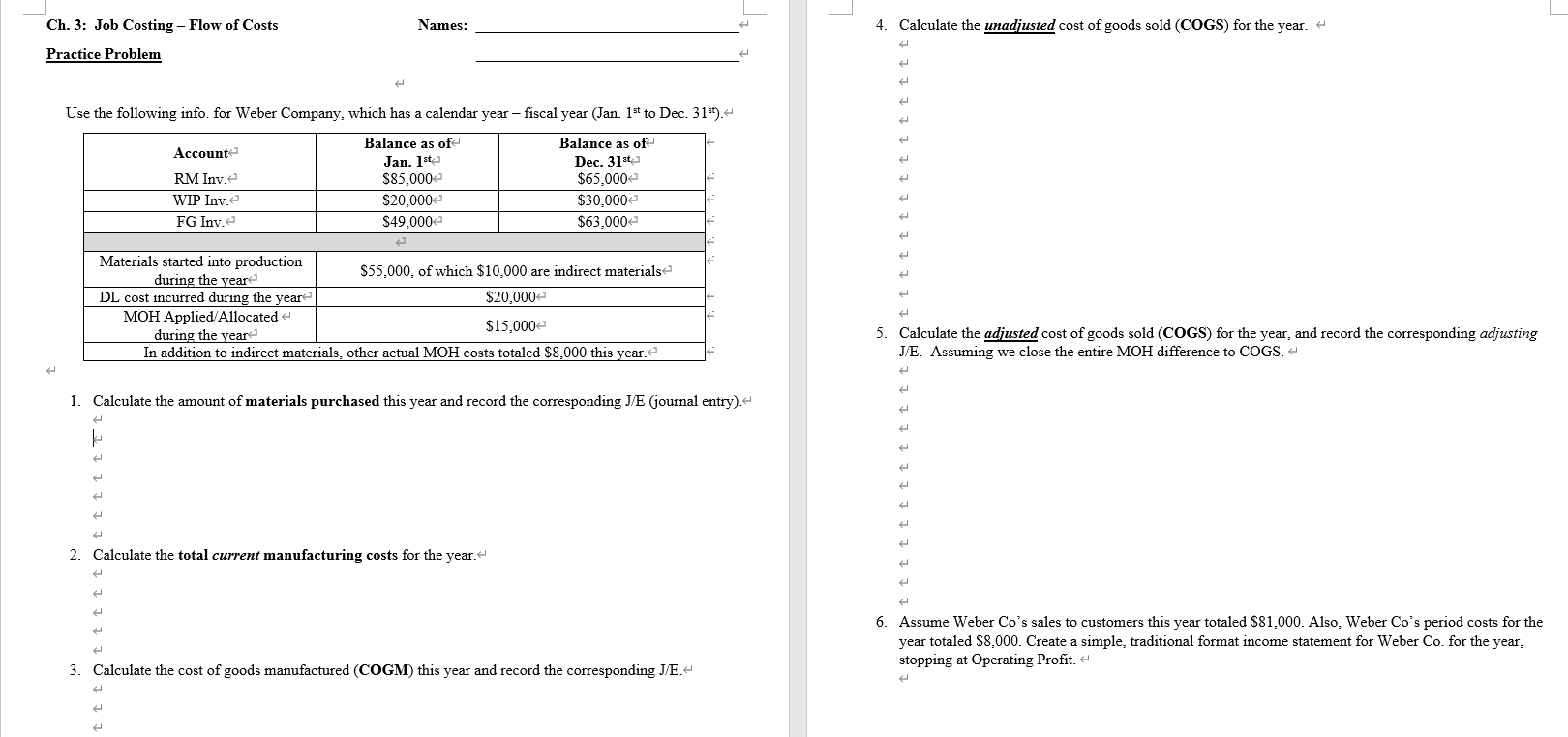

Ch. 3: Job Costing - Flow of Costs Names: 4. Calculate the unadjusted cost of goods sold (COGS) for the year. Practice Problem Use the following info. for Weber Company, which has a calendar year - fiscal year (Jan. 1st to Dec. 31st). Balance as of Balance as of Account Jan. 1st Dec. 31st RM Inv. $85,000 $65,000 WIP Inve $20.000 $30,000 FG Inve $49.000 $63,000 Materials started into production $55,000, of which $10,000 are indirect materials during the year DL cost incurred during the year $20,000 MOH Applied Allocated $15,000 during the year In addition to indirect materials, other actual MOH costs totaled $8,000 this year. 5. Calculate the adjusted cost of goods sold (COGS) for the year, and record the corresponding adjusting J/E. Assuming we close the entire MOH difference to COGS. 1. Calculate the amount of materials purchased this year and record the corresponding J/E Gournal entry). 2. Calculate the total current manufacturing costs for the year. 6. Assume Weber Co's sales to customers this year totaled $81,000. Also, Weber Co's period costs for the year totaled $8.000. Create a simple, traditional format income statement for Weber Co. for the year, stopping at Operating Profit 3. Calculate the cost of goods manufactured (COGM) this year and record the corresponding J/E.- Ch. 3: Job Costing - Flow of Costs Names: 4. Calculate the unadjusted cost of goods sold (COGS) for the year. Practice Problem Use the following info. for Weber Company, which has a calendar year - fiscal year (Jan. 1st to Dec. 31st). Balance as of Balance as of Account Jan. 1st Dec. 31st RM Inv. $85,000 $65,000 WIP Inve $20.000 $30,000 FG Inve $49.000 $63,000 Materials started into production $55,000, of which $10,000 are indirect materials during the year DL cost incurred during the year $20,000 MOH Applied Allocated $15,000 during the year In addition to indirect materials, other actual MOH costs totaled $8,000 this year. 5. Calculate the adjusted cost of goods sold (COGS) for the year, and record the corresponding adjusting J/E. Assuming we close the entire MOH difference to COGS. 1. Calculate the amount of materials purchased this year and record the corresponding J/E Gournal entry). 2. Calculate the total current manufacturing costs for the year. 6. Assume Weber Co's sales to customers this year totaled $81,000. Also, Weber Co's period costs for the year totaled $8.000. Create a simple, traditional format income statement for Weber Co. for the year, stopping at Operating Profit 3. Calculate the cost of goods manufactured (COGM) this year and record the corresponding J/EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started