Answered step by step

Verified Expert Solution

Question

1 Approved Answer

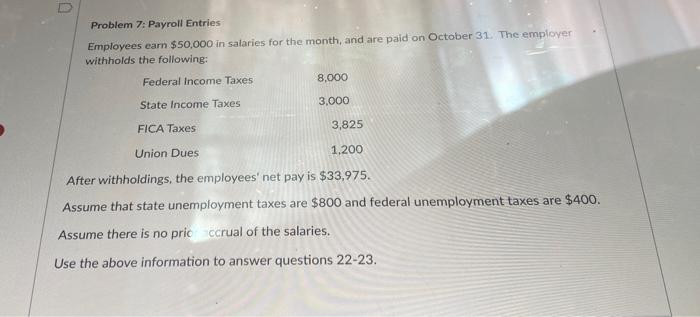

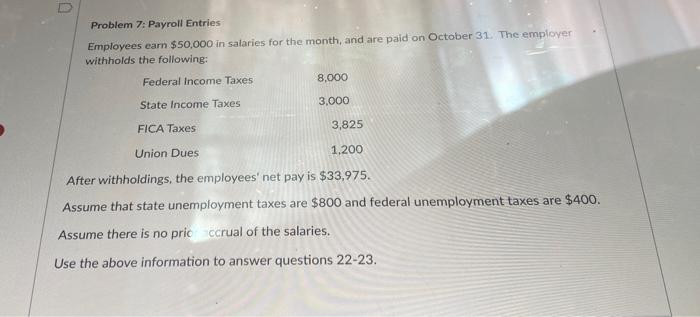

will give thumbs up u Problem 7: Payroll Entries Employees earn $50,000 in salaries for the month, and are paid on October 31. The employer

will give thumbs up

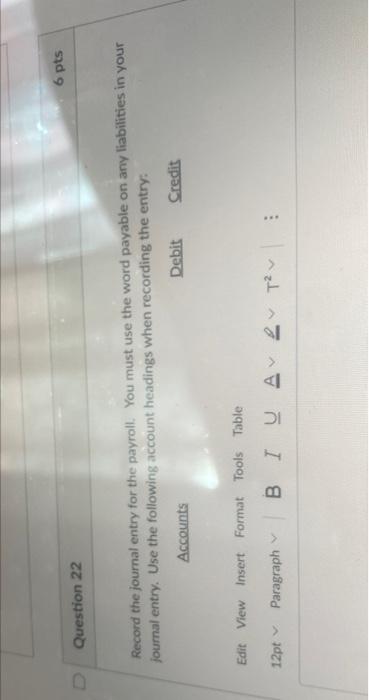

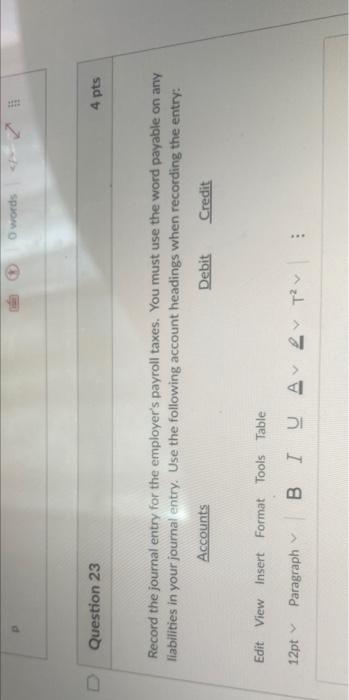

u Problem 7: Payroll Entries Employees earn $50,000 in salaries for the month, and are paid on October 31. The employer withholds the following: Federal Income Taxes 8,000 State Income Taxes 3.000 FICA Taxes 3,825 Union Dues 1.200 After withholdings, the employees' net pay is $33,975. Assume that state unemployment taxes are $800 and federal unemployment taxes are $400. Assume there is no pricccrual of the salaries. Use the above information to answer questions 22-23. 6 pts Question 22 Record the journal entry for the payroll. You must use the word payable on any liabilities in your journal entry. Use the following account headings when recording the entry: Accounts Debit Credit Edit View Insert Format Tools Table 12ptv Paragraph BI U AL Tv : words D Question 23 4 pts Record the journal entry for the employer's payroll taxes. You must use the word payable on any liabilities in your journal entry. Use the following account headings when recording the entry: Accounts Debit Credit Edit View Insert Format Tools Table 12pt Paragraph I o Avev

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started