Answered step by step

Verified Expert Solution

Question

1 Approved Answer

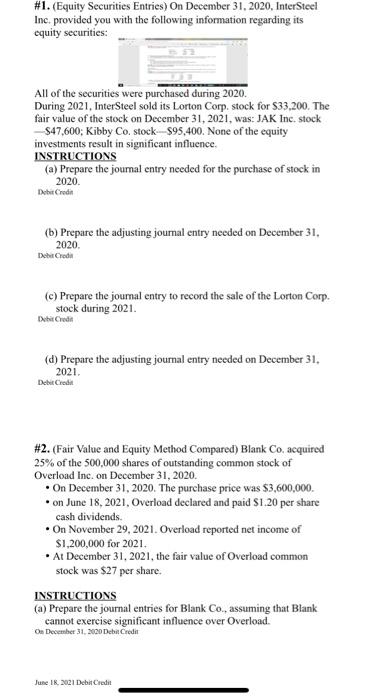

will leave a good review, thanks! #1. (Equity Securities Entries) On December 31, 2020, Inter Steel Inc provided you with the following information regarding its

will leave a good review, thanks!

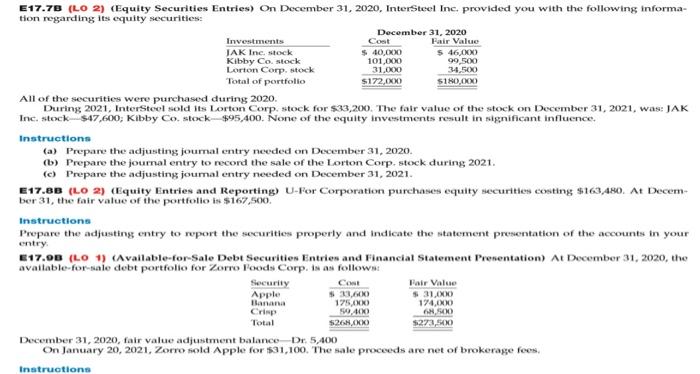

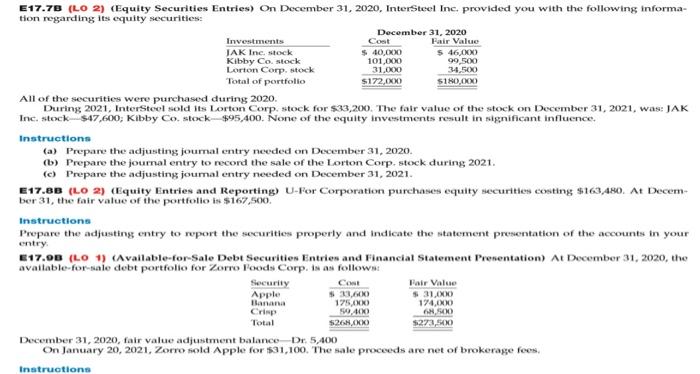

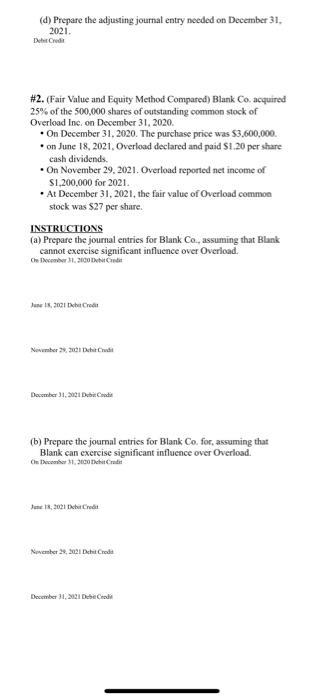

#1. (Equity Securities Entries) On December 31, 2020, Inter Steel Inc provided you with the following information regarding its equity securities: All of the securities were purchased during 2020. During 2021, InterSteel sold its Lorton Corp. stock for $33.200. The fair value of the stock on December 31, 2021, was: JAK Inc. stock S47,600; Kibby Co.stock-$95,400. None of the equity investments result in significant influence. INSTRUCTIONS (a) Prepare the journal entry needed for the purchase of stock in 2020. Debit Credit (b) Prepare the adjusting journal entry needed on December 31, Dobar Credit 2020 (c) Prepare the journal entry to record the sale of the Lorton Corp. stock during 2021. Debit Credi (d) Prepare the adjusting journal entry needed on December 31, 2021. Debit Credit #2. (Fair Value and Equity Method Compared) Blank Co, acquired 25% of the 500,000 shares of outstanding common stock of Overload Inc. on December 31, 2020. On December 31, 2020. The purchase price was $3,600,000 on June 18, 2021, Overload declared and paid $1.20 per share cash dividends. On November 29, 2021. Overload reported net income of $1,200,000 for 2021. At December 31, 2021, the fair value of Overload common stock was $27 per share INSTRUCTIONS (a) Prepare the journal entries for Blank Co., assuming that Blank cannot exercise significant influence over Overload. On December 31, 2020 Debit Credit June 18, 2021 Debt Credit E17.7B (LO 2) (Equity Securities Entries) On December 31, 2020, InterSteel Inc. provided you with the following informa- tion regarding its equity securities: December 31, 2020 Investments Cost Fair Value JAK Inc. stock $ 40,00 $ 46,000 Kibby Co stock 101.000 99,500 Lorton Corp. stock 31.000 34,500 Total of portfolio $172,000 $180,000 All of the securities were purchased during 2020. During 2021, Intersteel sold its Lorton Corp. stock for $33,200. The fair value of the stock on December 31, 2021, was: JAK Inc. stock $47,600, Kibby Co stock-$95,400. None of the equity Investments result in significant influence Instructions (a) Prepare the adjusting journal entry needed on December 31, 2020. (b) Prepare the journal entry to record the sale of the Lorton Corp. stock during 2021. (c) Prepare the adjusting joumal entry needed on December 31, 2021. E17.BB (LO. 2) Equity Entries and Reporting) U-For Corporation purchases equity securities costing $13,480. At Decem- ber 31, the fair value of the portfolio is $167,500. Instructions Prepare the adjusting entry to report the securities properly and indicate the statement presentation of the accounts in your entry E17.00 (LO 1) (Available for Sale Debt Securities Entries and Financial Statement Presentation) At December 31, 2020, the available for sale debt portfolio for Zorro Foods Corp. is as follow Security Cot Pair Value Apple S 31,600 $ 31,00 Banana 175.00 174,000 CHIP 59.400 6,500 Total $268.000 $273,500 December 31, 2020, fair value adjustment balance Dr. 5,400 On January 20, 2021, Zorro sold Apple for $31,100. The sale proceeds are net of brokerage fees, Instructions () Prepare the adjusting journal entry needed on December 31, 2021 Dit Credit #2. (Fair value and Equity Method Compared) Blank Co, acquired 25% of the 500,000 shares of outstanding common stock of Overload Inc. on December 31, 2020. On December 31, 2020. The purchase price was $3,600,000 . on June 18, 2021, Overload declared and paid $1.20 per share cash dividends. On November 29,2021. Overload reported net income of S1,200,000 for 2021 At December 31, 2021, the fair value of Overload common stock was $27 per share INSTRUCTIONS (a) Prepare the journal entries for Blank Co., assuming that Blank cannot exercise significant influence over Overload. Che Icember 200 June 2001 Credit Nombre de December 31, 201 DubeCode (b) Prepare the journal entries for Blank Co. for, assuming that Blank can exercise significant influence over Overload. Cecember 1.200 chitra November 28, 20:21 Dchat Code December 31, 2.21 Derde

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started