will leave like please explain as best as you can

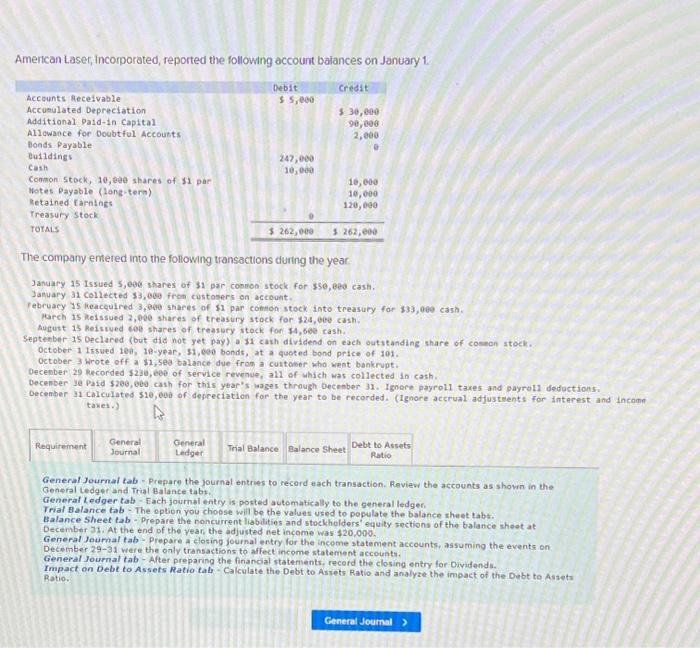

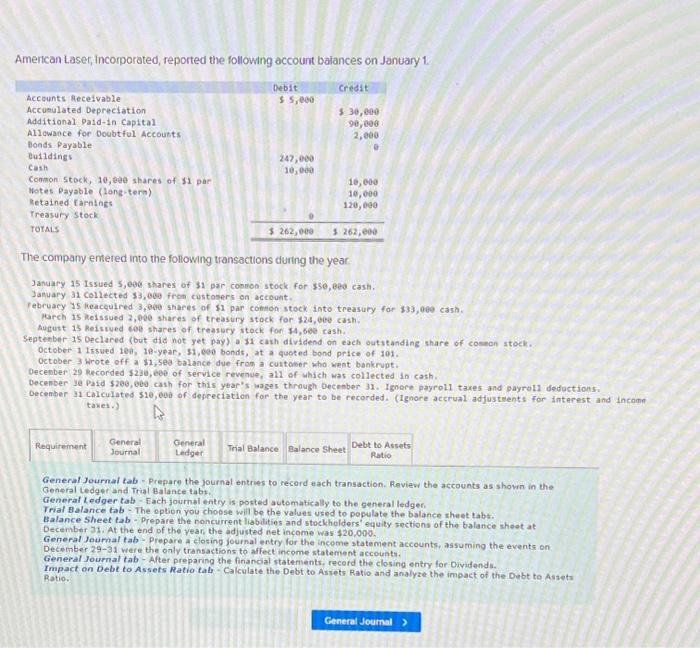

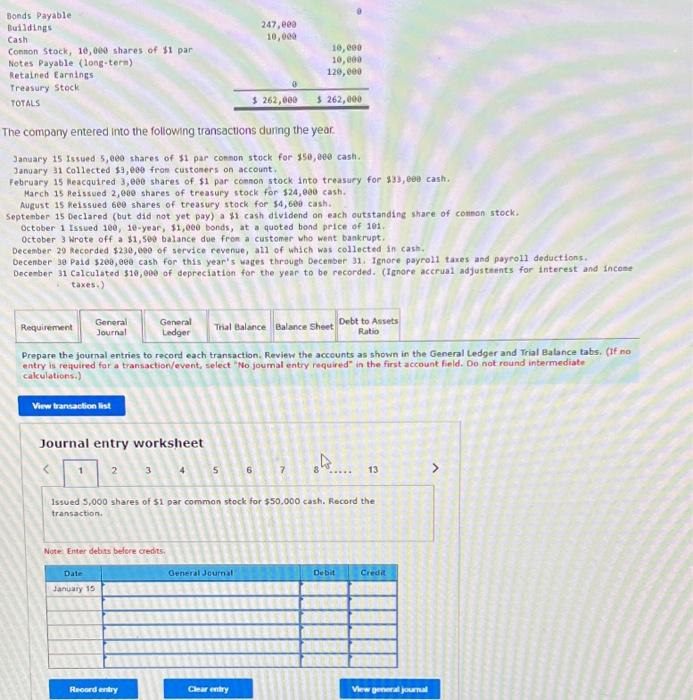

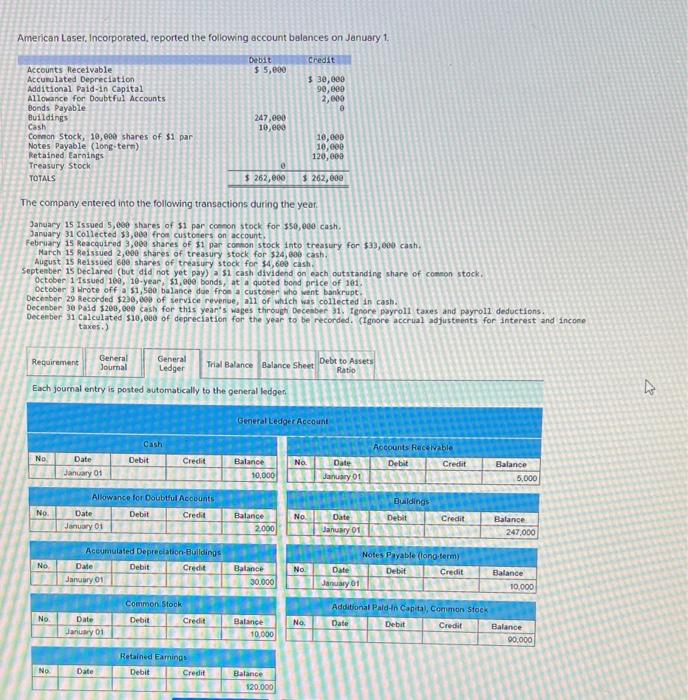

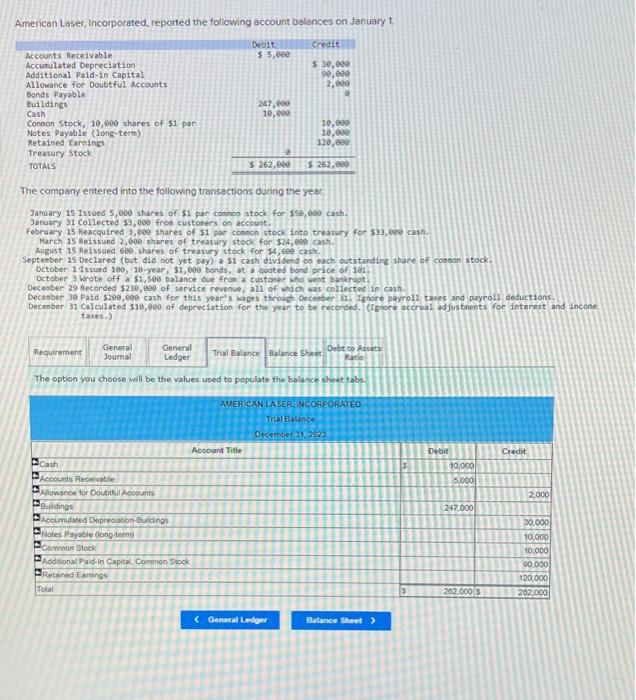

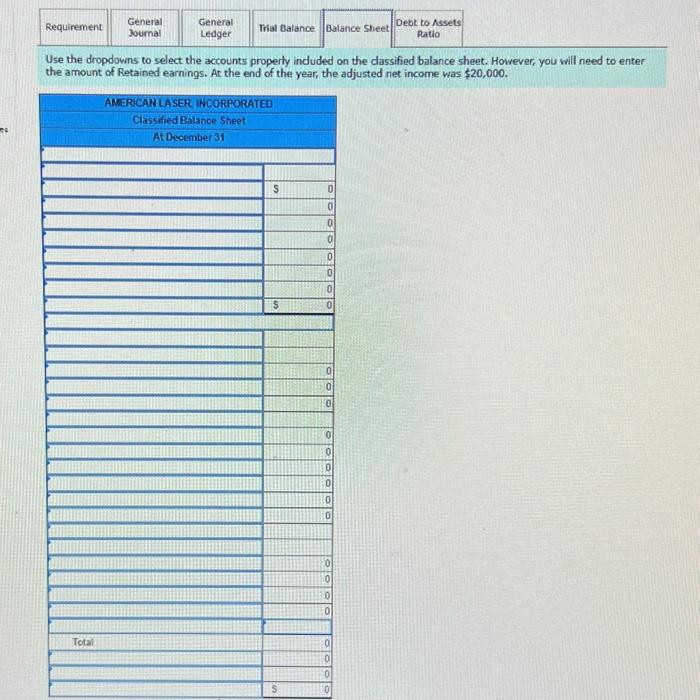

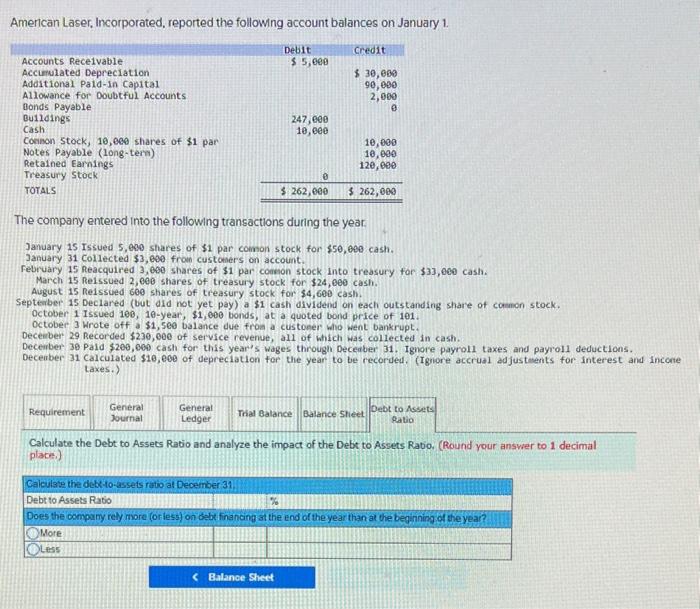

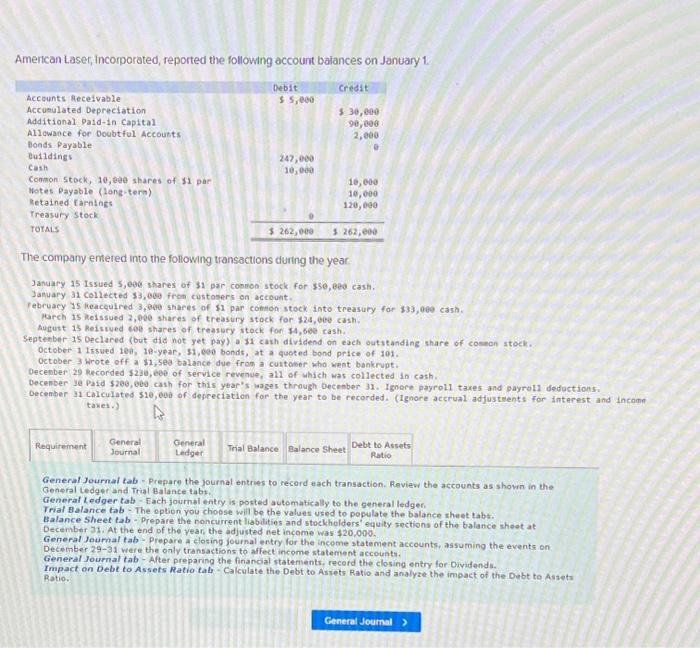

American Laser, incorporated, reported the following account bafances on January 1. The company emtered into the following transactions during the year Jahuary 15 Issued 5 , eae shares of 31 per conmon stock for $50, eed casth. Jasuary 31 collected $3,000 fron custosers on account. Mareh is kelssued 2,020 shares of treasury stock for $24,000 cash. Autust is heisuved bob shares of treasery stock for 54,56e cash. Septenber 15 Declared (but did not yet pay) a 31cash dividend on each outstanding share of conen stock. october 1 tssued 100, 1e-year, 31,000 bondt, at a quoted bond price of 101. October 3 Wrote off a $1, sea balance due from a cuitomer who weat bankrupt. Decenber 29 Recorded $230, eeo of service revenue, all of which was collected in cash. Decenber 31 calculated 510,600 of depreciation for the year to be recorded. (1gnore accrual adjustwents for interest and income taxes.) General Journal tab - Pcepare the journal entries to recerd each transaction. Review the accounts as shown in the General Ledger and Trial Balance tabs. General Ledger tab - Each journal enty is posted automatically to the general ledger. Trial Balance tab The eption you chiopse will be the values used to populate the balance sheet tabs. Balance Sheet tab - Prepare the noncurrent liabilities and stockholders' equity sections of the balance sheet at Gecember 31 . At the end of the year, the edjusted net income was $20,000. General Joumal tab - Prepare a closing journal entry for the income statement accounts, assuming the events on Gecember 2.931 were the only transactions to affect income statement accounts. Impact on Debt to Assets Ratio tab - Calculate the Debt to Asvets Ratio and resing entry for Oividends. Ratio. Ract on Debr to Assers Ratro tab-Calculate the Debt to Assets Ratio and analyze the impact of the Debt to Assets The compary entered into the following transactions during the year. January 15 Issued 5,600 shares of $1 par conton stock for $50,600 cash. January 31 collected $3,009 fron custoners on account. February 15 heacqutred 3 , eee shares of $1 par common stock into treasury for $33,6ea cash. Harch 15 pelssued 2 , eee shares of treasury stock for 324, eee cash. August is heissued 660 shares of treasury stock for $4,600cash. september 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of coninon stock. october 1 tssued 100 , 10-year, $1, eee bonds, at a quoted bond price of 101. october 3 Wrote off a $1,500 balance due fron a customer who went bankrupt. December 29 kecorded $239, eae of service revenue, all of which was collected in cash; Decenber 39 paid $260, eee cash for this year's wages through Decenber 31 . Ignore payroll taxes and payroll deductions. Decenber 31 Calculated $10, e00 of depreclation for the year to be recorded. (Ignore acerual adjustatents for interest and incone taxes.) Prepare the journal entries to record each transaction. Review the accounts as shown in the General Ledger and Irial Ealance tabs. (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Do not round intermediate cakculations.) Journal entry worksheet 2 3 4 5 6 7 8 13 > Issued 5,000 shares of $1 par common stock for $50,000 cash. Fecord the transaction. Note Enter debits before codits. American Laser, Incorporated, reported the following account balances on January 1. The company entered into the following transactions during the yeot. January 15 Issued 5,000 shares of $1 par conmon $ tock for $50,000 cash. January 31 Collected $3,009 froe custoters on account. February is Reacquired 3,000 shares of $1 par conton stock into treasury for $33,000 cash. March 15 Reissued 2,000 shares of treasury stock for $24,eag cash. August is felssued 600 , shares of treasury stock for $4,600 cash. Septenber is beclared (but did not yet pay) $1 eash dividend on each outstanding share of common stock. October 1 Issued 16a, 10-year, $1,000 bonds, at a quoted bond price of 101 . October 3 Hrote off a \$1, 5 eo balance doe froe a customer who vent bankrupt. Decenber 29 Recorded $230, 690 of service reverve, all of which was collected in cash. Decenber 30 Pald $200, eee cash for this year"s wages through Deceaber 31 . Ignore payroll taxes and payroll deductions. Deceeber 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjurstents for interest and inc taxes.) Each joumal entry is posted automatically to the general ledget American Laser, incorporated, reported the following account balances on January 1. The company entered into the following transactions during the year: Janeary 15 Issued 5 , eed shares of $1 par comon stock for 5 sejeder cath. 3anuary 31 Collected $3, a6o fros custoners on account. February 15 Reacquired 3 , e00 shares of $1 par connon stock into treasury for $33, eee cash. March is Reissued 2, 000 shares of treasury stock for $24,600 cash. August 15 reissued 6Be shares of treasury stock for 34,68e cash. Septenber 15 Declared (but did not yet pay) a $1 cash dividend on each outstandirg share of conson stock. October-1 Issued 160 , 10-year, $1,090 bonds, at a quoted bond price of 101 . October 3 Wrote off a $1,500 balance due from a cuistoner who went baverupt. Deceaber 29 flecorded 32le, 60 e of service revenue, all of which was collected in cash. Decenber 31 Calculated 318 , 000 of depreciation for the year to be recerded. (Ignore accrual adjustonents for interest and in taxes.) The option you choose will be the values used to populate the balance sheet tabs: Use the dropdowns to select the accounts property induded on the classified balance sheet. However, you will need to enter the amount of Retained earnings. At the end of the year, the adjusted net income was $20,000. Amencan Laser, Incorporated, reported the following account balances on January 1. The company entered into the following transactions during the year: January 15 Issued 5,000 shares of $1 par comon stock for $50,000 cash. January 31 collected $3,600 froin custoners on account. rebruary 15 Reacquired 3,090 shares of $1 par comon stock Into treasury for $33,000 cash. March 15 Relssued 2,000 shares of treasury stock for $24,000 cash. August 15 Reissued 600 shares of treasury stock for $4,600 cash. September 15 Declared (but ald not yet pay) a $1 cash dividend on each outstanding share of comon stock. October 1 Issued 100, 10-year, $1,000 bonds, at a quoted bond price of 101. October 3 Wrote off a $1, see balance due froa a custoner who went bankrupt. Decenber 29 Recorded $230, 000 of service revenue, all of which was collected in cash. Decenber 30 pald $200,690 cash for this year's wages through Decenber 31 . Ignore payroll taxes and payroll deductions. Decenber 31 Calculated $10,e90 of depreciation for the year to be recorded. (Igrore accrual adjustients for interest and ince taxes.) Calculate the Debt to Assets Ratio and analyze the impact of the Debt to Assets Rabio, (Round your answer to 1 decimal places.)