will leave thunbs up

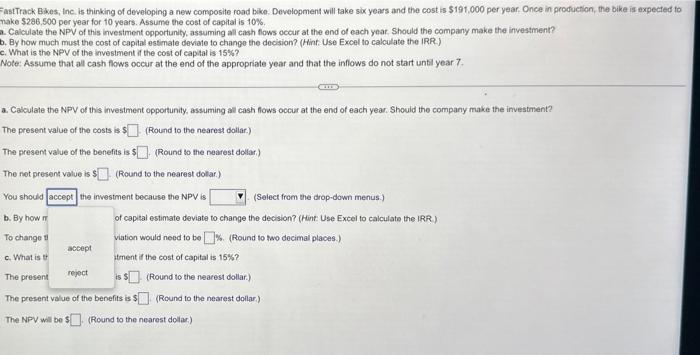

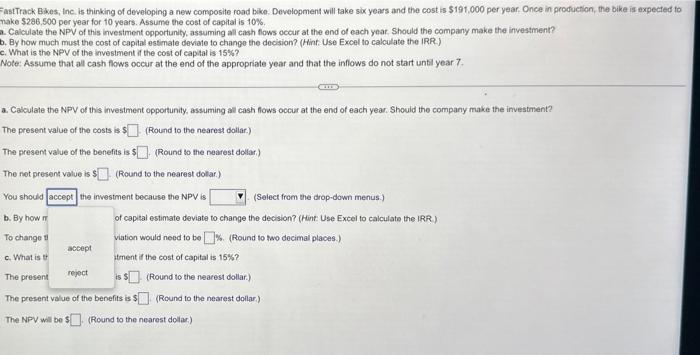

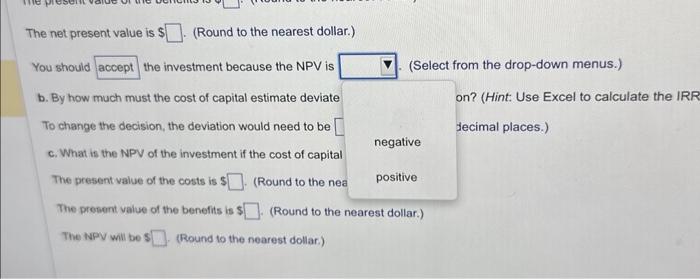

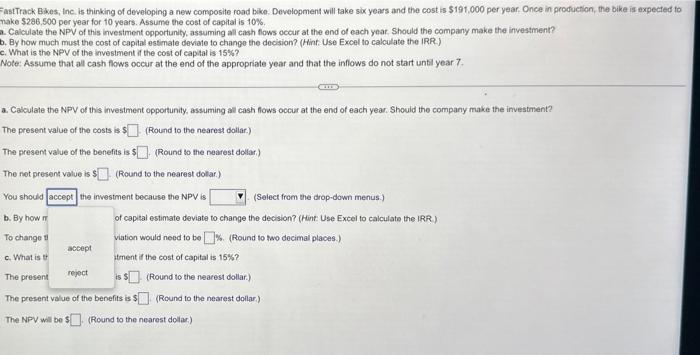

FastTrack Bzes, inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $191,000 per year. Once in production, the bike is expected to nake $286,500 per year for 10 years. Assume the cost of capital is 10%. 2. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? . By how much must the cost of capital estmate deviate to change the decision? (Hint: Use Excel to calculate the IRR) c. What is the NPV of the investment if the cost of capital is 15% ? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7. a. Cabculate the NPV of this investment opportunity, assuming all cash fows occur at the end of each year. Should the company make the investment? The present value of the costs is $ (Round to the nearest dollar.) The present value of the benefits is $ (Round to the nearest dollar.) The net present value is s (Round to the nearest dolar.) You should the investment becacse the NPV is (Select from the drop-down menus.) b. By hown of captal estimate deviate to change the decision? (Hint Use Excel to calculate the IRR) To change t viation would need to be \%. (Round to two decimal places.) c. What is f tenent if the cost of capital is 15% ? The presen is $ (Round to the nearest dollar.) The present value of the benefits is ? (Round to the nearest dollar.) The NPV will be 5 (Round to the nearest doliar.) The net present value is $ (Round to the nearest dollar.) You should the investment because the NPV is (Select from the drop-down menus.) b. By how much must the cost of capital estimate deviate on? (Hint: Use Excel to calculate the IRF To change the decision, the deviation would need to be decimal places.) c. What is the NPV of the investment if the cost of capital negative (Round to the nea positive The present value of the costs is 5 (Round to the nearest dollar.) The presert value of the benefits is $ (Round to the nearest dollar.) The NPV will be (Round to the nearest dollar.)