Answered step by step

Verified Expert Solution

Question

1 Approved Answer

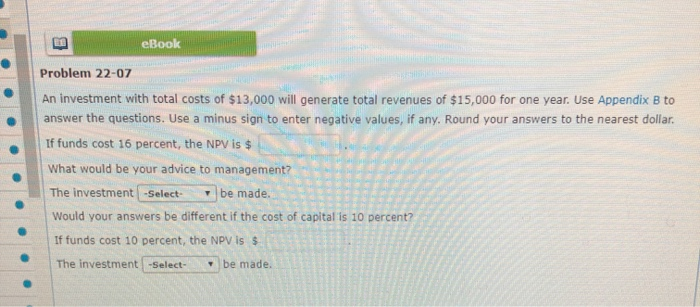

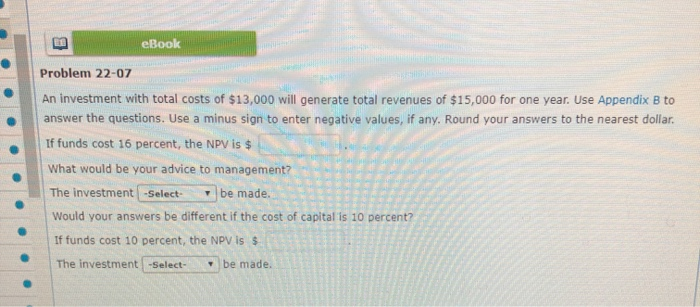

Will like for correct answer. First drop down is should/should not Second drop down is should/should not Also, added the appendix b eBook Problem 22-07

Will like for correct answer.

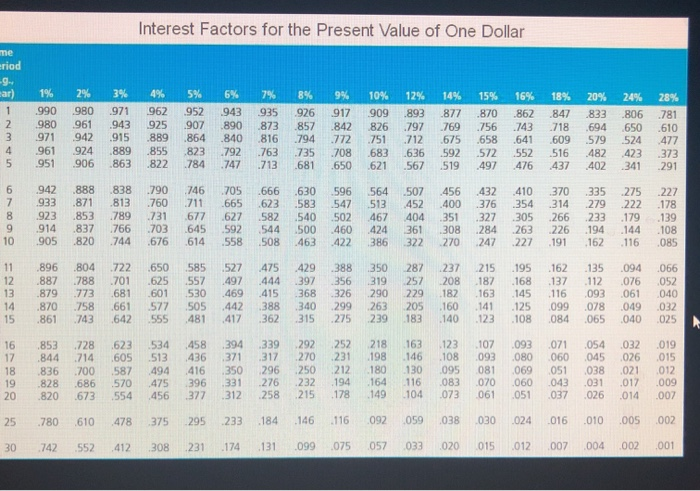

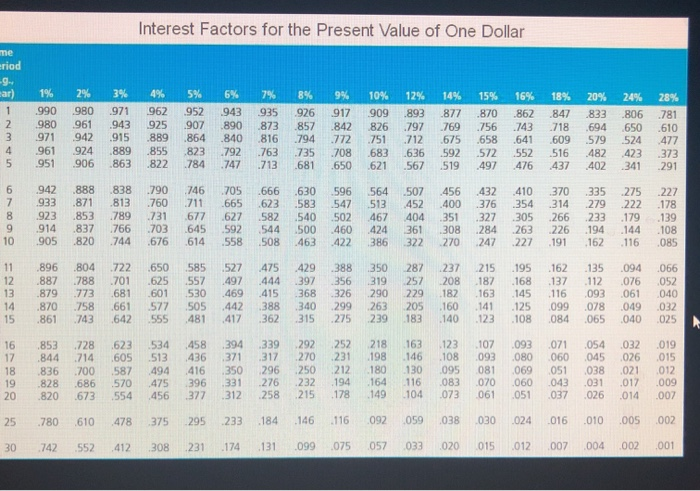

eBook Problem 22-07 An investment with total costs of $13,000 will generate total revenues of $15,000 for one year. Use Appendix B to answer the questions. Use a minus sign to enter negative values, if any. Round your answers to the nearest dollar If funds cost 16 percent, the NPV is $ What would be your advice to management? The investment -Select be made. Would your answers be different if the cost of capital is 10 percent? If funds cost 10 percent, the NPV is $ The investment Select be made. Interest Factors for the Present Value of One Dollar riod ar) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 16% 14% 15% 18% 20% 24% 28% 1 990 980 971 962 952 943 935 926 917 909 893 877 870 862 847 833 806 781 2 .980 .961 .943 .925 .907 .890 .873 .857 .842 .826 .797 .769 .756 .743 .718 .694 .650 .610 3 971 942 915 889 864 840 816 794 72 751 712 675 .658 641 609 579 524 477 4 .961 .924 .889 .855 .823 .792 .763 .735 708 .683 .636 592 ,572 .552 516 .482 .423 .373 5 951 906 863 822 784 747 713 681 650 621 567 519 497 476 437 402 341 291 1 6 .942 .888 .838 .790 746 .705 .666 .630 .596 564 .507 .456 .432 .410 370 .335 .275 227 7 .933 .871 .813 .760 .711 .665 .623 .583 .547 .513 .452 .400 .376 .354 314 279 222 .178 8 .923 .853 .789 .731 .677 .627 .582 .540 .502 467 404 351 .327 305 .266 233 .179 .139 9 914 837 766 703 645 592 544500 460 424 36 308284 263 226 194 144 108 10 905 820 744 .676 614 558 508463 422 386 322 270 247 227 191162 116 085 11 896 804 722 650 585 527 475 429 388 350287 237 215 195 162 135 094 066 12 887 788 701 625 557 47 444 397 356 319 257 208 187 168 137 112 076 052 13 .879 .773 .681 .601 .530 .469 .415 .368 .326 .2g0 .229 .182 .163 .145 .116 .093 .061 .040 14 870 758 661 577 505 442 388 340 299 263 205 160 141 125 099 078049 032 15 861 743 642 555 481 417362 315 275 239 183 140 123 108 084 065 040 025 16 853 728 623 534 458 394 339 292 252 218 163 123 107 093 071 054 032 019 17 844 714605 513 436 371 317 270 231198 146 108 093 080 060 045 026 015 18 .836 .700 .587 .494 .416 .350 296 .250 212 .180 .130 .095 081 .069 .051 .038 .021 .012 19 828 686 570 475 396 331 276 232 194 164 116 083 070 060 043 031 017 0059 20 820 673 554 456 377312 258 215 178 149 104073 061 051 037 .026 014 007 1 25 780 610 478 375 295 233 184 146 116 092 059 038 030 024 016 .010 005 .002 30 742 552 412 308 231 174 131 099 075 057 033 020 015 012 007 004 002 001 First drop down is should/should not

Second drop down is should/should not

Also, added the appendix b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started