will like if you are right

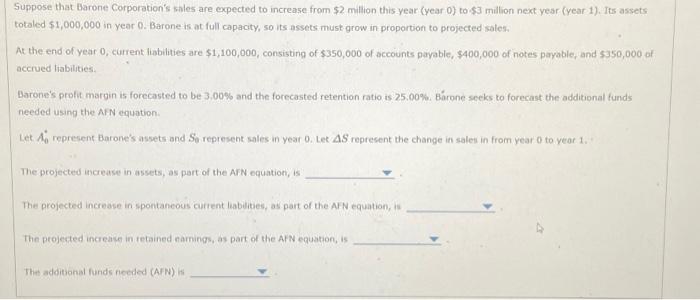

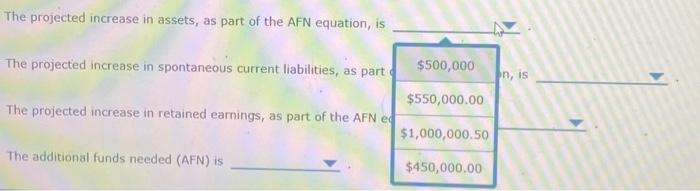

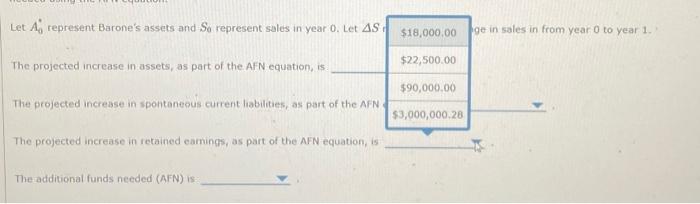

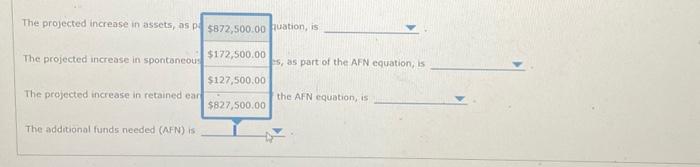

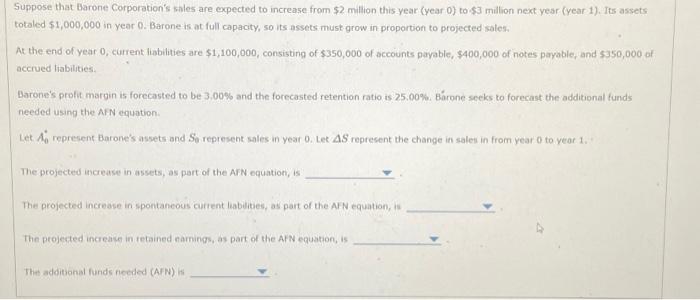

Suppose that Barone Corporation's sales are expected to increase from $2 million this year (year 0 ) to $3 million next year (year 1 ). Its assets totated $1,000,000 in year 0. Barone is at full capacity, so its assets must grow in proportion to projected sales. At the end of year 0 , current liabilities are $1,100,000, consisting of $350,000 of accounts payable, $400,000 of notes payable, and $350,000 of accrued liabilities. Darone's prolit margin is forecasted to be 3,00% and the forecasted retention ratio is 25,00%. Barrone secks to forecast the additional funds needed using the AF N equation. Let A0 represent Barone's assets and S0 represent sales in year 0 . Let S represent the change in sales in from year 0 to year 1. The projected increase in assets, as part of the ArN equation, is The projected increase in spontaneous current labiltes, as part of the ArN equation, is The projected increase in retained namings, as part of the Af N equatoon, is Thet additonal funds neoded (AIN) iti The projected increase in assets, as f zation, is The projected increase in spontaneou 3, as part of the AFN equation, is The projected increase in retained ea the AFN equation, is The additional funds needed (AFN) is The projected increase in assets, as part of the AFN equation, is The projected increase in spontaneous current liabilities, as part The projected increase in retained earnings, as part of the AFN e The additional funds needed (AFN) is Let A0 represent Barone's assets and S0 represent sales in year 0. Let S, The projected increase in assets, as part of the AFN equation, is The projected increase in spontaneous current liabilities, as part of the AFN The projected increase in retained eamings, as part of the AFN equation, is The additional funds needed (AFN) is Suppose that Barone Corporation's sales are expected to increase from $2 million this year (year 0 ) to $3 million next year (year 1 ). totaled $1,000,000 in year 0 . Barone is at full capacity, 50 its assets must grow in proportion to projected sales. At the end of year 0 , current liabilities are $1,100,000, consisting of $350,000 of accounts payable, $400,000 of notes payable, and $3 accrued liabilities. Barone's profit margin is forecasted to be 3,00% und the forecasted retention ratio is 2% is to forecast the additional needed using the AFN equation. Let A0 represent Barone's asscts and S0 represent sales in year 0 . Let S represent th ifrom year 0 to year 1 . The projected increase in assets; as part of the AFN equation, is The projected increase in spontaneous current liabilities, as part of the AFN equation, is The projected increase in retained eamings, as part of the AFN equation, is The additional funds needed (AFN) is