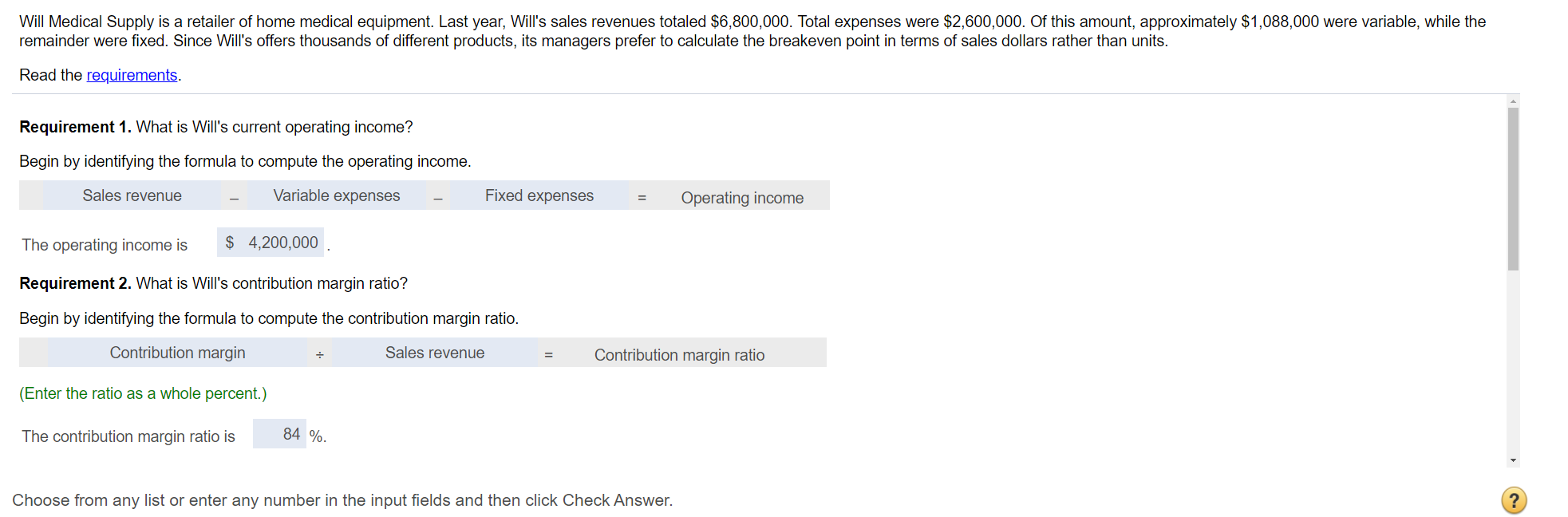

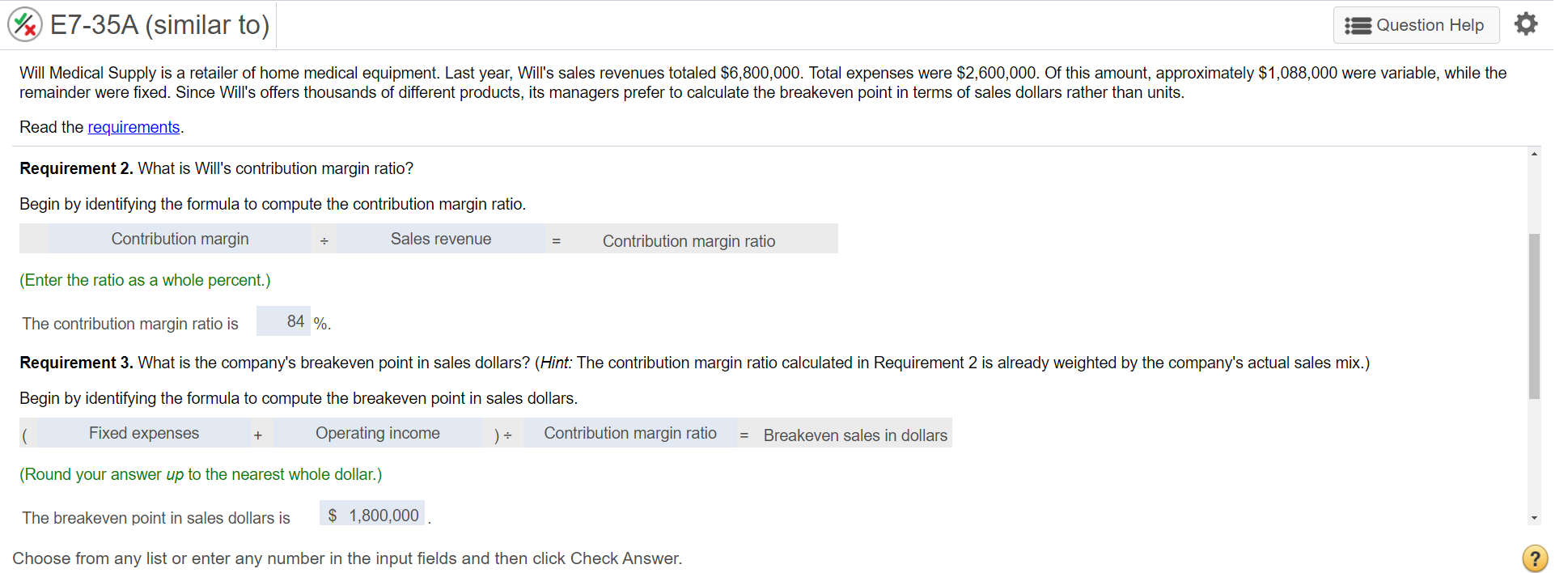

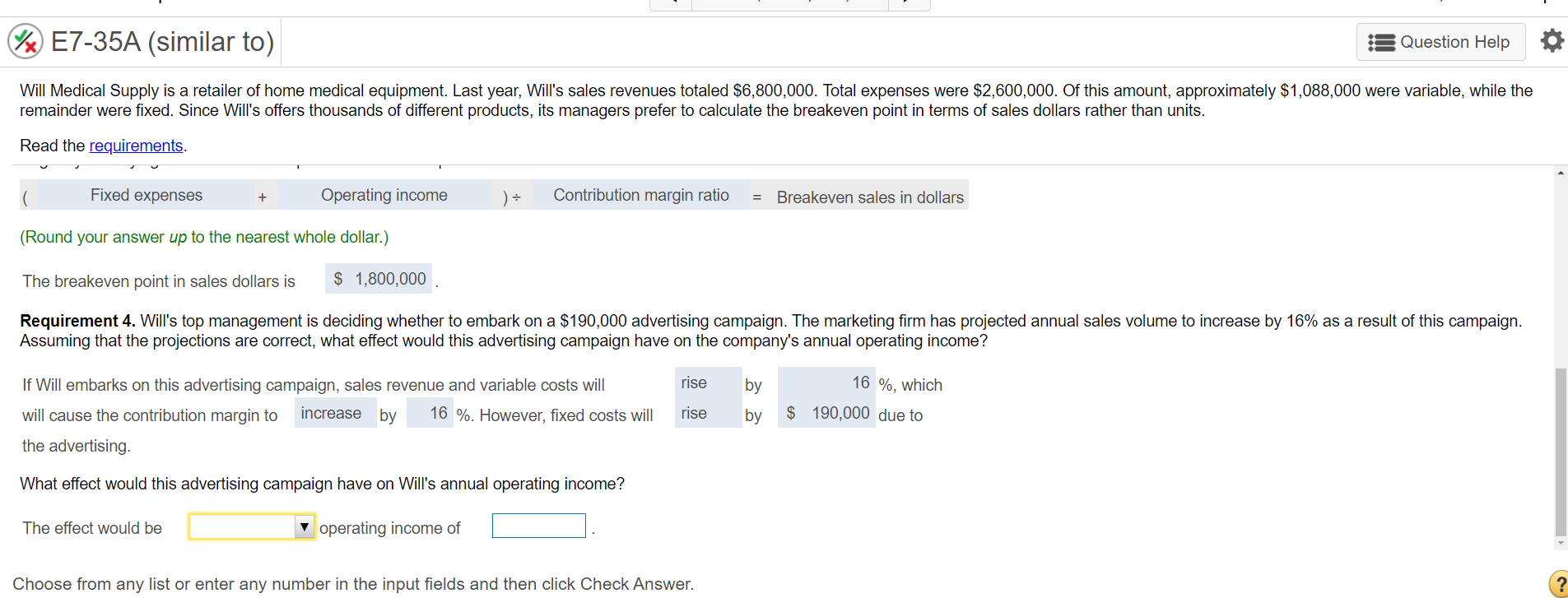

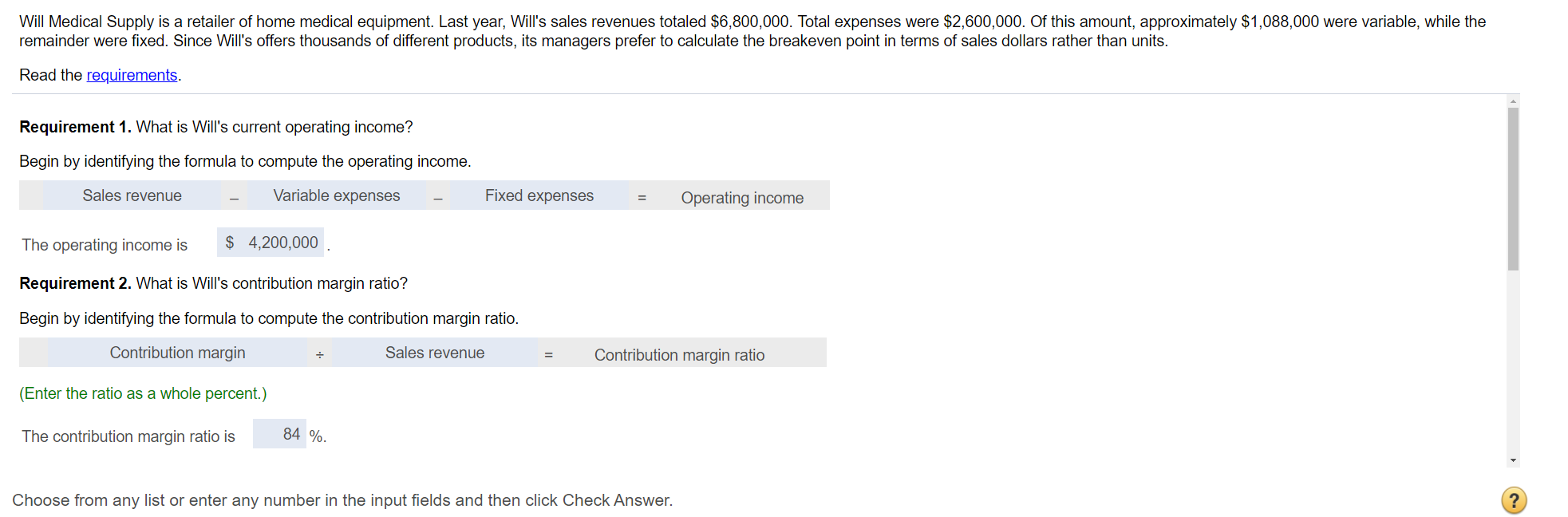

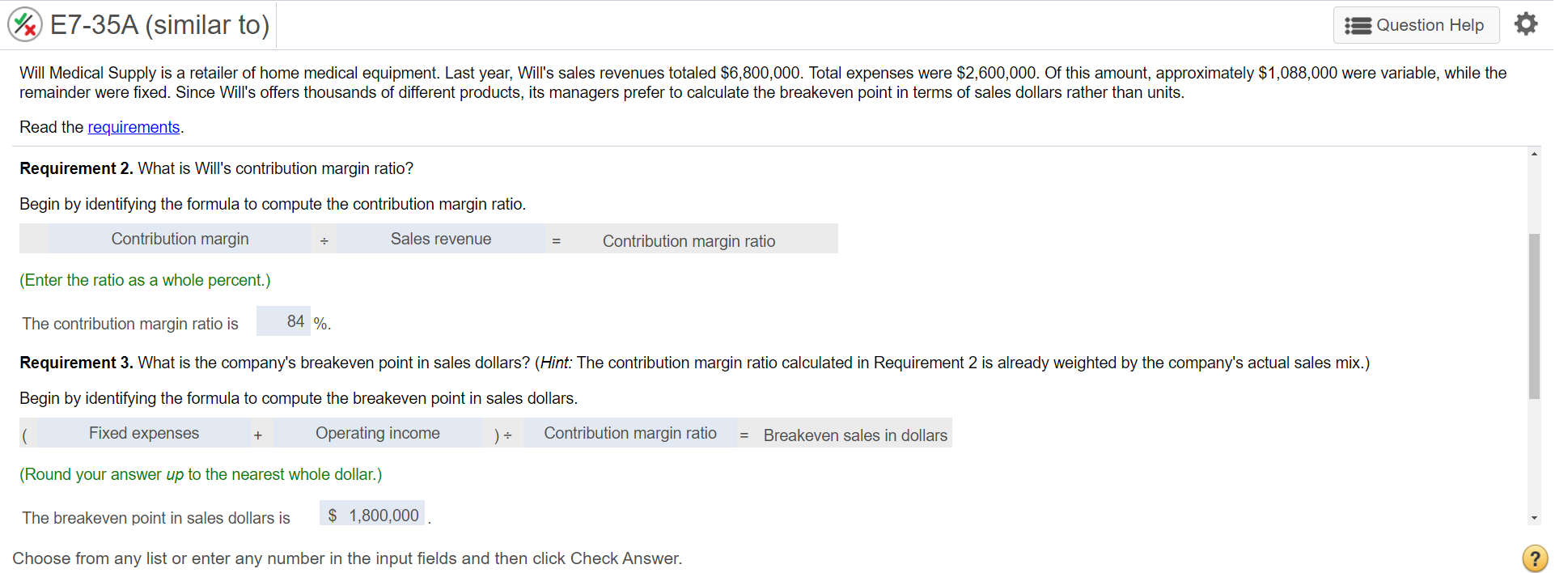

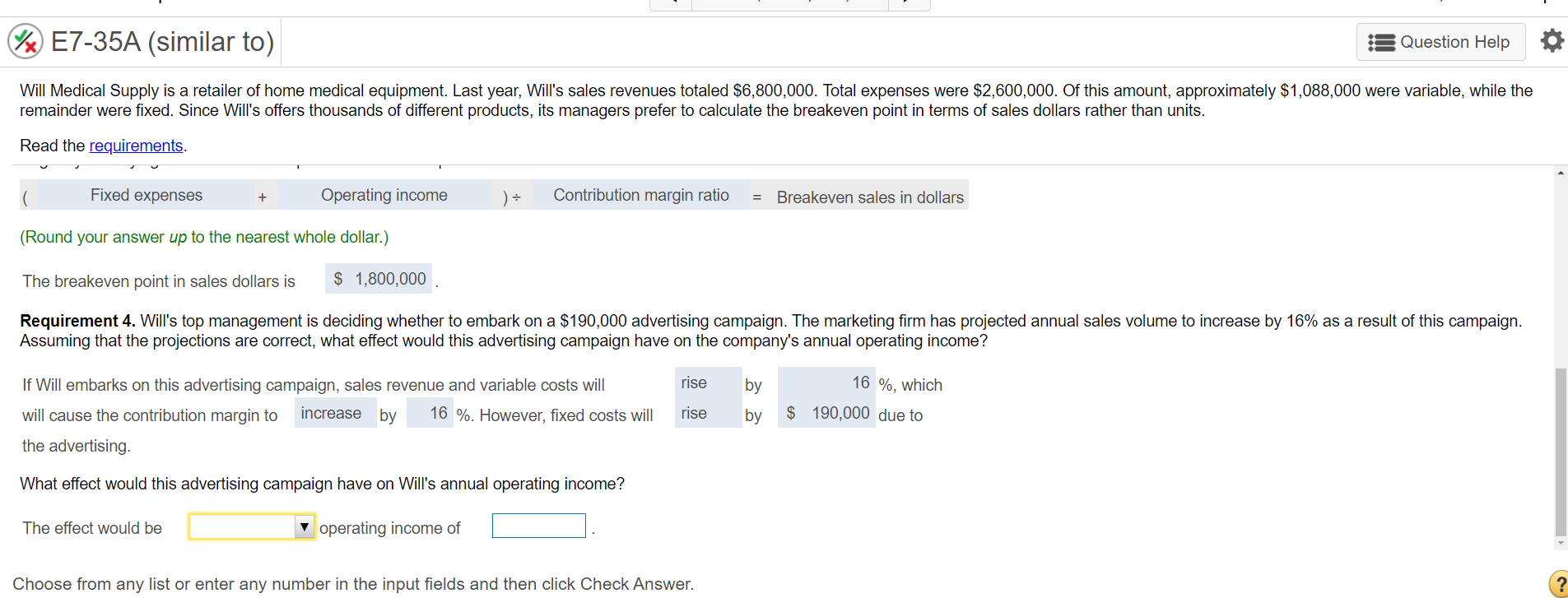

Will Medical Supply is a retailer of home medical equipment. Last year, Will's sales revenues totaled $6,800,000. Total expenses were $2,600,000. Of this amount, approximately $1,088,000 were variable, while the remainder were fixed. Since Will's offers thousands of different products, its managers prefer to calculate the breakeven point in terms of sales dollars rather than units. Read the requirements. Requirement 1. What is Will's current operating income? Begin by identifying the formula to compute the operating income. Sales revenue Variable expenses Fixed expenses Operating income The operating income is $ 4,200,000 Requirement 2. What is Will's contribution margin ratio? Begin by identifying the formula to compute the contribution margin ratio. Contribution margin Sales revenue Contribution margin ratio (Enter the ratio as a whole percent.) The contribution margin ratio is 84 % Choose from any list or enter any number in the input fields and then click Check Answer. %E7-35A (similar to) Question Help Will Medical Supply is a retailer of home medical equipment. Last year, Will's sales revenues totaled $6,800,000. Total expenses were $2,600,000. Of this amount, approximately $1,088,000 were variable, while the remainder were fixed. Since Will's offers thousands of different products, its managers prefer to calculate the breakeven point in terms of sales dollars rather than units. Read the requirements. Requirement 2. What is Will's contribution margin ratio? Begin by identifying the formula to compute the contribution margin ratio. Contribution margin Sales revenue = Contribution margin ratio (Enter the ratio as a whole percent.) The contribution margin ratio is 84 %. Requirement 3. What is the company's breakeven point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by the company's actual sales mix.) Begin by identifying the formula to compute the breakeven point in sales dollars. Fixed expenses + Operating income ) = Contribution margin ratio Breakeven sales in dollars (Round your answer up to the nearest whole dollar.) The breakeven point in sales dollars is $ 1,800,000 Choose from any list or enter any number in the input fields and then click Check Answer. 1x E7-35A (similar to) Question Help Will Medical Supply is a retailer of home medical equipment. Last year, Will's sales revenues totaled $6,800,000. Total expenses were $2,600,000. Of this amount, approximately $1,088,000 were variable, while the remainder were fixed. Since Will's offers thousands of different products, its managers prefer to calculate the breakeven point in terms of sales dollars rather than units. Read the requirements. Fixed expenses + Operating income ) : Contribution margin ratio Breakeven sales in dollars (Round your answer up to the nearest whole dollar.) The breakeven point in sales dollars is $ 1,800,000 Requirement 4. Will's top management is deciding whether to embark on a $190,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 16% as a result of this campaign. Assuming that the projections are correct, what effect would this advertising campaign have on the company's annual operating income? rise by If Will embarks on this advertising campaign, sales revenue and variable costs will will cause the contribution margin to increase by 16 %. However, fixed costs will the advertising. 16 %, which $ 190,000 due to rise by What effect would this advertising campaign have on Will's annual operating income? The effect would be operating income of Choose from any list or enter any number in the input fields and then click Check