Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will rate for a correct detailed explanation. Thank you. At time after his contract was marked to market Mr. S Also at time t=1, Mr.

Will rate for a correct detailed explanation. Thank you.

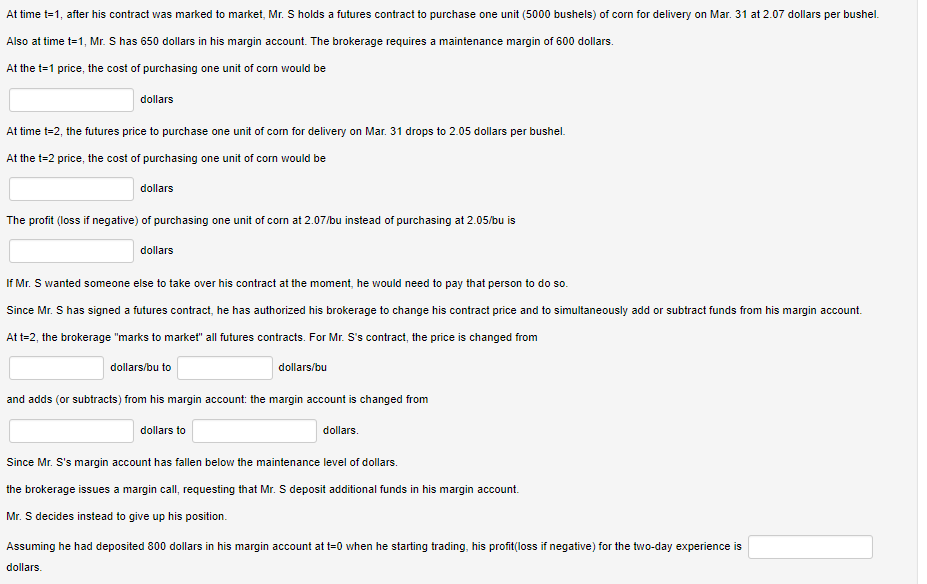

At time after his contract was marked to market Mr. S Also at time t=1, Mr. S has 650 dollars in his margin account. The brokerage requires a maintenance margin of 600 dollars. At the t 1 price, the cost of purchasing one unit of corn would be holds a futures contract to purchase one unit (5000 bushels) of corn for delivery on Mar. 31 at 2.07 dollars per bushel. dollars At time t-2, the futures price to purchase one unit of corn for delivery on Mar. 31 drops to 2.05 dollars per bushel. At the t-2 price, the cost of purchasing one unit of corn would be dollkr The profit (loss if negative) of purchasing one unit of corn at 2.07/bu instead of purchasing at 2.05/bu is dolsn If Mr. S wanted someone else to take over his contract at the moment, he would need to pay that person to do so. Since Mr. S has signed a futures contract, he has authorized his brokerage to change his contract price and to simultaneously add or subtract funds from his margin account. At t-2, the brokerage "marks to market" all futures contracts. For Mr. S's contract, the price is changed from dollars/bu to dollars/bu and adds (or subtracts) from his margin account: the margin account is changed from dollars to dollars. Since Mr. S's margin account has fallen below the maintenance level of dollars. the brokerage issues a margin call, requesting that Mr. S deposit additional funds in his margin account. Mr. S decides instead to give up his position. Assuming he had deposited 800 dollars in his margin account at t 0 when he starting trading, his profit loss if negative) for the two-day experience is dolkrsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started