Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will Rate! Please answer all 3. Futures contracts A. are traded on the OTC markets b. are customizable c. have daily settlements d. none of

Will Rate!

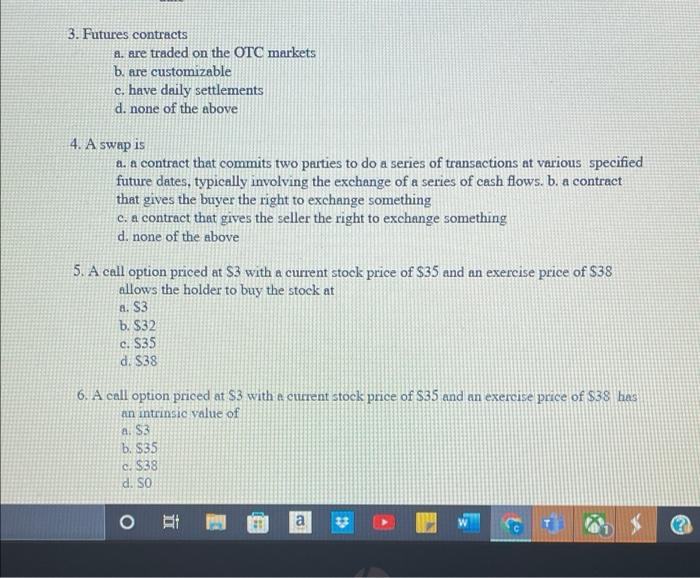

3. Futures contracts A. are traded on the OTC markets b. are customizable c. have daily settlements d. none of the above 4. A swap is d. a contract that commits two parties to do a series of transactions at various specified future dates, typically involving the exchange of a series of cash flows. b. a contract that gives the buyer the right to exchange something c. a contract that gives the seller the right to exchange something d. none of the above 5. A call option priced at $3 with a current stock price of $35 and an exercise price of $38 allows the holder to buy the stock at a. S3 b. $32 c. $35 d. $38 6. A call option priced at $3 with e current stock price of $35 and an exercise price of 38 has an intrinsic value of a. S3 b. $35 c. 838 d. SO a 33 Please answer all

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started